How To Use the Debt Snowball Method

Those looking to become debt-free will likely find success when adopting a financial strategy or method. The Debt Snowball Method, first popularized by personal finance expert Dave Ramsey, is one of these strategies. Find out if the Debt Snowball Method is the way forward for you.

Read: This Credit Score Mistake Could Be Costing Millions Of Americans

What You Should Know About the Debt Snowball Method

The Debt Snowball Method is a widely-held approach for paying down debt, along with other methods, such as the Debt Avalanche Method and debt consolidation. With the Debt Snowball Method, you categorize and pay debts individually, starting with the smallest and “snowballing” until they are all paid off. This allows you to feel the accomplishment of paying debt and encourages you to continue until you’re debt free.

How long it takes depends on the amount of debt and money you can put into debt repayment. The Debt Snowball Method may take more time than other methods because it prioritizes paying off the smallest debts first, not the ones with the highest interest.

Pros and Cons of the Debt Snowball Method

The Debt Snowball Method may work better for some people than others. Understanding its advantages and disadvantages will help you decide if it’s the right fit.

Pros

Once you feel the satisfaction of paying off your first debt, you’re more likely to be motivated to continue, as people tend to stick to a payment plan if they’re seeing quick results. That is, you’re more likely to follow through on your commitment to becoming debt free when using the Debt Snowball Method.

Cons

Some of your larger debts may have higher interest rates than others, so this method might not be the most efficient. You may end up paying more interest than you would have had you prioritized paying off the debts with the highest interest rates first.

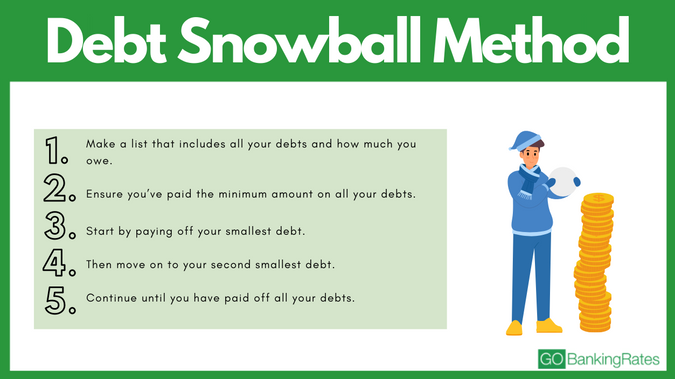

How Do You Apply The Debt Snowball Method?

The Snowball Method is a simple process. Think about how you would apply the following steps to your financial situation.

1. Write Down Your Debts

Record all your debts in order from smallest to largest.

2. Keep Up with Your Minimum Payments

Stay on top of your other debts by paying at least the minimum due.

2. Pay Off Your Smallest Debt

Make only the minimum payments on all debts except the smallest one. Pay as much money as possible on the smallest debt each month until it’s paid off.

3. Start on the Next Debt

Put the money you used for the first debt toward your next smallest debt. This is the “snowball” part. The fewer debts you have, the more you can focus on paying off one debt instead of multiple minimum payments.

5. Repeat the Process Until You Are Debt-Free

Continue paying your debts one by one, from smallest to largest. If you follow this process, you may find that becoming debt free is not as complicated as it may have seemed.

What Should You Do After You Become Debt-Free?

The journey to becoming debt free may seem intimidating, but paying off your debts might be the best investment you can make for your future. Now that you know about the Debt Snowball Method, decide if it’s right for you. Whether you choose this or another debt repayment method, the sooner you take your first steps, the closer you are to becoming financially secure.

Melanie Grafil contributed to the reporting for this article.

This article originally appeared on GOBankingRates.com: How To Use the Debt Snowball Method