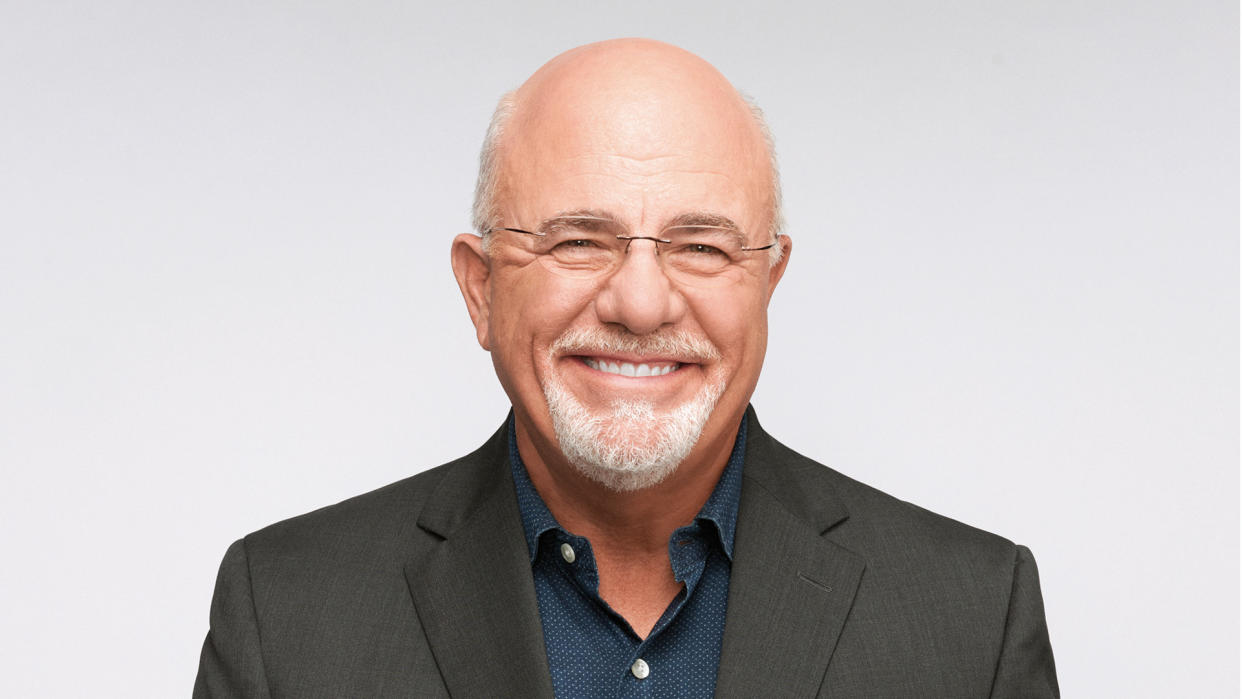

Dave Ramsey: Here’s Why the United States Isn’t Switching To 100% Digital Currency

Dave Ramsey has a popular call-in show where he answers common money questions from everyday Americans. On the Sept. 22, 2023, edition of “The Ramsey Show,” a listener asked what she should do when the United States makes the switch to digital currency, as she only uses cash and not other forms of payment like credit cards. Ramsey had a thorough answer for this caller that began with a suggestion to not believe everything she reads on the internet.

Find Out: I’m a Bank Teller: 3 Times You Should Never Ask For $100 Bills at the Bank

Read More: 6 Unusual Ways To Make Extra Money (That Actually Work)

Here’s Ramsey’s explanation as to why she has nothing to worry about because the U.S. is not going to switch to 100% digital currency any time soon.

The US Is Not Going Completely Digital

In response to the call-in question, Ramsey noted that the vast majority of U.S. financial transactions are already digital, estimating the figure to be about 90% to 95%. This is because nearly all transactions, even those that may not seem to be, are already electronic/digital. This includes debit card transactions, direct deposits and even personal checks. All are simply digits in an electronic ledger, according to Ramsey. This includes wire transfers, which Ramsey noted he used recently to purchase a car. No “real money” ever changed hands, there were simply electronic ledger transfers involved in making the transaction.

Learn More: 7 Things To Know If You Withdraw More Than $10,000 From Your Checking Account

Why Is There Talk of Switching To Digital Currency?

Ramsey directly states that the United States will not get rid of cash money in his lifetime or yours. The reason he told his caller to be cautious about things she sees on the internet is because he attributes this whole idea to fear-mongering.

According to Ramsey, people use fantastic scenarios like the collapse of the U.S. economy to scare you into making purchases of something else. Gold is a common subject of these fear-mongering salespeople, who suggest that Russia’s economy will take over the world when the U.S. collapses, or things like that. Ramsey said that will simply never happen, as the Russian economy is about the same size as that of Texas and that the Russians “can’t even feed their own people.”

Another rumor that Ramsey wants to dispel is that “the U.S. controls all digital transactions and can control your life.” Ramsey said that the U.S. is already in charge of how electronic transfers are processed in the country but it’s not “the mark of the Beast” like some “online fanatics” suggest. In other words, Ramsey said that people should stop worrying about using digital transactions.

What About Using Gold Instead?

Since most of the fear-mongering Ramsey refers to comes from those trying to push gold, he addressed the use of gold with his caller directly. As Ramsey put it, the scenario that’s never going to happen is where the economy completely fails and you are going to run down to Walmart with your gold bars to buy jeans. But this is the type of scenario that’s often propagated by those selling gold. Ramsey calls these scenarios wastes of time that have no connection to reality, pointing out that there hasn’t been an economy in over 400 years that has used gold exclusively as a currency.

So Is It OK To Keep Using Cash Only?

The primary fear that Ramsey’s caller had was that she wouldn’t be able to use cash anymore for her budgeting system. The envelope system, for example, requires you to put actual cash into separate envelopes for each of your expenses. As you can only spend up to the amount that’s in each envelope, you can’t physically overspend in any given category.

Ramsey reassured his caller that it’s perfectly OK to keep using cash for her budgeting system, and that she shouldn’t worry about it going away. He emphasized to his caller that he’s a cash guy also, and he’s not worried that the U.S. will ever completely do away with using paper money. To that end, he even keeps 10 $100 bills in his pocket every day as a portable emergency fund, knowing it will always be accepted.

While nearly all financial transactions in the United States are now conducted electronically, cash will continue to remain a viable form of payment, according to Ramsey. Be wary of any advertisements or sales pitches that try to convince you to exchange your U.S. dollars to gold or Bitcoin or any other type of non-cash currency, as they are simply using fear of unrealistic and highly improbable scenarios to get you to part with your money.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: Here’s Why the United States Isn’t Switching To 100% Digital Currency