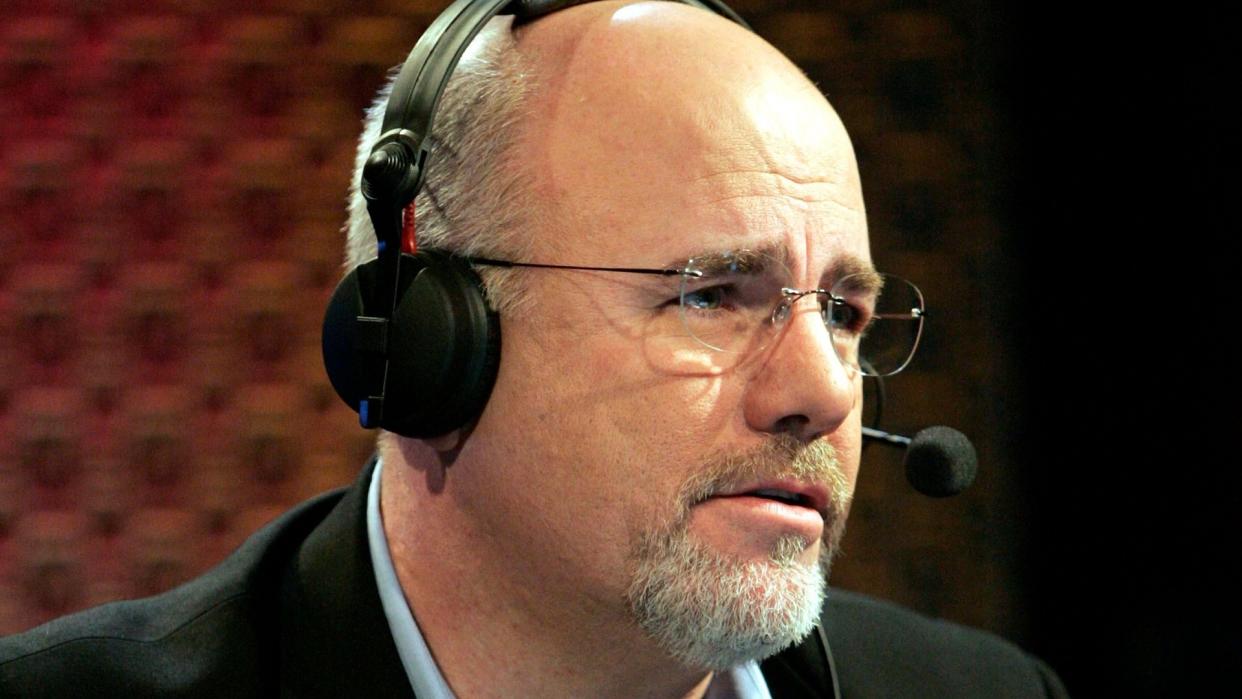

Dave Ramsey Warns Sometimes the ‘Cheapest Route’ Can Cost You — Here’s How

You may be tempted to buy the cheapest car insurance available when money is tight. However, personal finance expert Dave Ramsey says skimping on this essential coverage can ultimately destroy your budget if you’re in an accident.

Learn: The States With the Cheapest Gas Prices

Explore: 3 Signs You’re Serious About Raising Your Credit Score

Typically, the lowest-priced auto insurance provides state minimum coverage, which often only protects the other party in the accident. In that case, you’ll be on the hook for the total cost of repairs to your vehicle.

Plus, these so-called budget-friendly policies often come with low liability limits. So, if the other party sustained damage in excess of your limit, you may get sued for the remaining bill.

Ramsey advised purchasing enough insurance to cover any potential loss. At a minimum, you should carry $500,000 worth of liability coverage.

Ways To Save

Buying sufficient car insurance doesn’t have to break the bank. If you’re strategic, you can pay significantly less than the $1,483 annual national average.

You can raise your deductible, per Ramsey’s suggestion. You may also be eligible for car insurance discounts if you:

Take a defensive driving course

Get good grades

Install an anti-theft device

Set up automatic payments

Pay your premium in larger installments

Drive carefully and responsibly

Remember: When you need to buy a new policy, shopping around is a smart idea. That way, you can rest assured that you’re getting the best rate possible.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey Warns Sometimes the ‘Cheapest Route’ Can Cost You — Here’s How