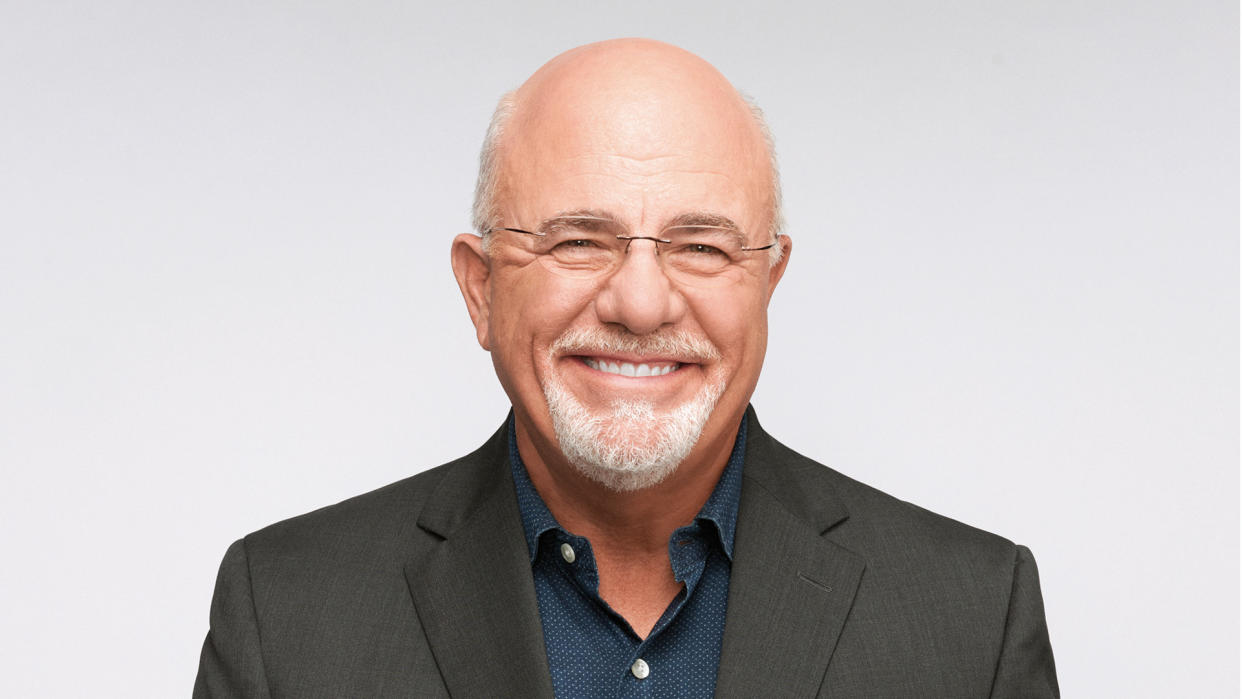

Dave Ramsey’s Top Methods for Paying Off Debt: Experts Debate Which Are Most Effective

There are a lot of ways to pay off debt. According to financial guru Dave Ramsey, some of the best ways include the debt snowball method, making and sticking to a budget, increasing your income, and reducing your expenses.

But is Ramsey right, or are there other — possibly better — ways to get rid of debt?

Check Out: I’m a Self-Made Millionaire: Here’s My Monthly Budget

Try This: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

GOBankingRates spoke with several other financial experts to determine the best steps to pay off debt. While many did agree with Ramsey’s approach to debt relief, some had other ideas. Here’s what they said.

Debt Snowball vs. Debt Avalanche Method

Ramsey’s preferred debt payoff method is the debt snowball method. This strategy entails listing all your debts from the smallest to the largest balance, ignoring interest rates. From there, you’ll pay the minimums due on all but the smallest debt, which you’ll start paying aggressively until it’s gone. Once it is gone, you then move on to the next debt and the next until you’re debt-free.

The thought behind the debt snowball method is that, with each debt eliminated, you’ll have more money to put toward the remaining debts. Also, even small wins — like getting rid of a specific credit card’s balance — can keep you motivated to continue.

While this method can work, Andrew Latham, CFP with SuperMoney, suggested the debt avalanche method instead.

This strategy is opposite the first. With it, you prioritize paying off debts based on their interest rate. The highest rate goes first, followed by the next until they’re all gone.

“As each high-interest debt is eliminated, apply those payments to the next highest interest debt,” Latham said. “This strategy minimizes total interest paid, helping you become debt-free faster and more efficiently.”

Ramsey pointed out that this method tends to take longer, which could lead to some people losing their motivation to keep going. But if it works for you, then go for it.

Trending: Nearly Half of Americans Struggle To Pay Their Utility Bills: 5 Ways To Save

Make a Budget and Increase Your Income

Just like Ramsey, many other financial experts agree that making a budget — and sticking to it — is vital to not only paying off debt but avoiding more debt.

“In today’s economy, inflation and rising interest rates can make it challenging to stay within a budget,” said Michael Hershfield, CEO and founder of Accrue Savings. “Keep track of your income and expenses and create a realistic budget for yourself. Sticking to a budget can help you pinpoint where you can cut unnecessary costs that can go towards paying off your debt.”

Every so often, you should adjust your budget based on your income and needs. If you’re able to increase your income, you can also put more money toward your existing debts.

Know Your Why

Knowing that you want to get out of debt is important, as Ramsey pointed out. It can keep you motivated, especially if you owe a lot of money and feel like the process to become debt-free is taking a long time.

One way to determine your reason for paying off debt is to review your finances and debt situation as a whole.

“Assess the impact of your debt on your financial picture, including total debt amounts and monthly expenses. Gather every receipt and review your bank account transactions to determine how much money you spent and the amount of debt you owe,” said Kristine Batch, senior vice president and senior regional delivery manager at UMB Bank. “Next, make a list of your payment due dates, minimum payment amounts, current interest rates and an ideal timeline of when you would like to have your debt paid off.”

It’s OK to make adjustments to your goals or timelines as you go. The important thing is to have an idea of what you expect and want for your future self.

Destroy Your Credit Cards

Ramsey frequently warns against using credit cards. They’re convenient, but this causes many people to overly rely on them — and to rack up their debt.

If credit cards are part of the issue, cut them up and focus on paying off what you currently owe.

“Work on a plan to pay down your credit card debt,” said Herschfield. “A good way to do this is by creating a daily, weekly, and monthly budget. A great rule of thumb is the 50/30/20 rule.”

You can use the debt snowball or debt avalanche method to pay off your credit cards. Just make sure you’re making your payments on time as this can affect your credit score.

Lower Your Expenses

Overspending is a surefire way to accumulate debt. Ramsey suggested planning your meals, comparing prices of the things you need, and DIY-ing as much as possible to cut down on expenses.

But there are other ways to do this and pay off your debts.

“To recover from your debt in a timely manner, you will need to slow down your spending on items or experiences you do not need right now, such as the latest tech, reoccurring monthly subscriptions, discretionary shopping, eating out and impulse buying,” said Batch.

“These temporary lifestyle changes will allow you to have more money to set aside for savings, while you continue to recover from your past expenses,” he continued. “[They] can help you quickly pay down the new debt and set you up for future financial success.”

Don’t Rely on Loan Forgiveness Programs

While it’s possible to get certain loans discharged or forgiven, like some federal student loans, you’re better off not relying on this. If you expect it to happen but it never does, you’re still responsible for paying back what you owe — potentially with a lot more interest.

Regardless of what types of debts you have, the goal is to get rid of them as soon as you can to lower your interest charges.

“Reducing the total amount of interest paid on your loans leads to a lower overall financial obligation,” said Batch. “While the principal (the amount borrowed) is set in stone, the interest is not. Therefore, it’s important to pay off loans as quickly as possible, as a part of an overall budget.”

Debt Settlement

Debt settlement is what happens when you’re able to convince your creditors to reduce how much you owe — usually by a certain percentage. While this can lower your overall debt burden, it can also have serious consequences on your credit score. It might even have tax implications.

While Ramsey is very much against the idea of debt settlement, there may be a time and place where it makes sense.

“Some people have accumulated so much debt that they can’t afford to pay it down within a reasonable timeframe while keeping up on their other expenses and obligations. In this case, I recommend pursuing debt settlement,” said Leslie H. Tayne, a New York financial attorney and managing director of Tayne Law Group.

“[Debt settlement] can be an effective strategy if you are far behind on payments and it’s clear that the creditor will not be able to recover the full amount owed. Debt settlement can be complex, requiring a lot of time and strong negotiation skills, so it’s a good idea to work with a professional (ideally, an attorney well-versed in this area) who can negotiate on your behalf and ensure that any new agreements make sense for your situation.”

Plan Ahead for Expenses

Another key step in paying off your debt is to plan ahead.

“Plan for the expenses you know will come around again and save for them,” said Batch. “For instance, if you typically travel around the same time each year, purchase gifts for annual holidays or host family gatherings, you can plan for those costs in your budget months ahead of schedule.”

If you do have these types of planned expenses, you can also open a separate savings account, ideally a high-yield one, specifically for them.

More From GOBankingRates

I've Secretly Put Us in Serious Debt: How To Break the News to Your Spouse

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Top Methods for Paying Off Debt: Experts Debate Which Are Most Effective