Dave Ramsey says this indulgent purchase can keep Americans from moving up from middle class. Here's 1 common way people appear wealthy — and how to build real wealth instead

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

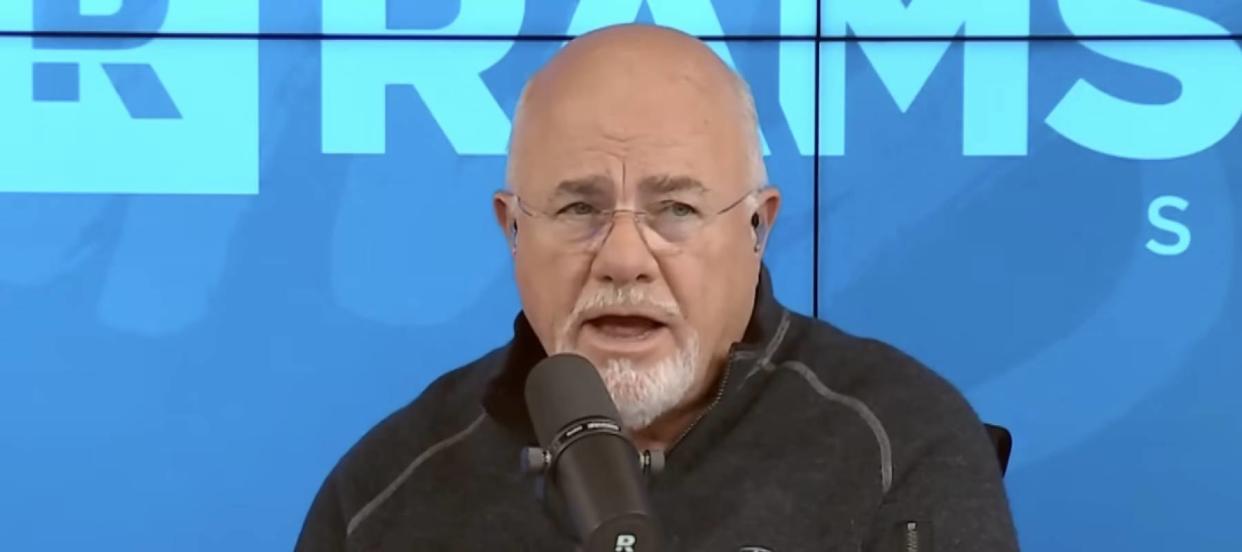

Over the course of his long career, radio personality Dave Ramsey has noticed several indicators of Americans’ financial status.

One of these indicators, he said on an episode of The Ramsey Show, could even possibly predict whether a middle class family could manage to break out of their income bracket and become wealthy.

At least, that is what he told Micah, 24, from Washington, DC, when the military man called in during the episode looking for financial advice regarding a potential car purchase.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

Micah said he earns $80,000 a year. He already owns a car worth $13,000, but is tempted to purchase a new sports car — a Nissan 370Z — for $30,000 in cash. He admitted this is purely an indulgence and that the new car would be for “play.”

However, he called Ramsey to find out if he should invest the money instead of splurging on a vehicle.

Ramsey let him in on a little secret.

Middle class indicator

Ramsey’s advice was simple: say no to the second car. As for his reasoning, the finance guru pointed to something he’s noticed over the years: “The way you know someone is going to stay middle class is when they have two very nice cars — that are obvious [sic] $500, $600, or $700 payments — sitting in front of a middle class house,” he said.

Americans borrow an average of $40,366 for new vehicles and $26,685 for used vehicles, according to the latest data from Experian.

Especially if you are trying to pay off a lot of debt already, you should try to cut down on your car expenses instead of adding a whole other car to your monthly obligations.

Even the Ramsey Show hosts pointed out the obvious: more vehicles means more bills.

To save money on one of those monthly car costs — insurance — try Bestmoney.com.

Bestmoney.com makes it easy to compare car insurance rates with just a few clicks. Just answer a few questions about yourself and your car and Bestmoney.com will show you a list of insurance offers available in your area.

Another reason to not buy that second car is you may already be struggling with your monthly expenses — including your current car loan.

If you’re struggling to stay on top of your car payments while juggling other debts, consider a personal loan through Credible.

Credible is an online marketplace of vetted lenders offering a wide array of loan options. By consolidating your debts onto one loan, you can pay them off faster and easier than if you keep paying multiple loans from different lenders.

Once your debt is out of the way, what can you do to turbocharge your income beyond the bracket of middle class?

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here's how you can save yourself as much as $820 annually in minutes (it's 100% free)

A better way to build wealth

“If you're going to build wealth, you have to keep as small an amount as possible going into things that go down in value,” Ramsey said. According to him, a person trying to build wealth over time should have no more than 50% of their income in depreciating assets such as cars.

So, rather than spending that money on a depreciating asset, you should consider putting that money into investment opportunities that will increase in value, diversify your portfolio and earn you passive income — all factors that can help you build wealth.

Real estate is a great option to do just that. There are many ways to get yourself in the real estate game without taking on the extra cost and responsibility of buying or managing a property yourself.

For instance, Arrived let's you easily invest by purchasing shares of rental properties without having to play landlord.

Backed by world class investors like Jeff Bezos, Arrived makes it easy to fit rental properties into your investment portfolio regardless of your current income bracket by offering a low minimum investment.

Get started by browsing a curated selection of homes, vetted for their appreciation and income potential. Then all you have to do is sign on the dotted line and begin receiving quarterly deposits.

You can also invest in REITs to build up your wealth with passive income. REITs — or real estate investment trusts — are publicly-traded companies that own, operate or finance income producing properties and then distribute their earned rental income to investors. You can buy or sell shares in a REIT, making them one of the most liquid real estate investment options available.

RealtyMogul allows for both accredited and non-accredited investors to add REITs to their portfolio through their Income REIT and their Growth REIT, which have paid a combined $44.5 million in distributions.

RealtyMogul offers an array of other institutional-quality real estate deals — from retail to residential — and their platform makes it easy to research available investment opportunities and their performance before deciding where to put your money.

Splurge on a more valuable asset

While a new car might be fun, you likely won’t get your money’s worth the longer you have it.

And real estate isn’t the only private asset that might be worth investing in over that second car. There are a vast array of private investments available to you, but how do you go about choosing the assets that make sense for your portfolio?

With over two million investors, Fundrise is an accessible investment platform that helps you build a portfolio using a wide range of private assets, from real estate to private debt to venture capital — and more.

To get started, all you have to do is answer a few questions about you finances and investing style and Fundrise will recommend a portfolio aligned with your goals.

What to read next

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Thanks to Jeff Bezos, you can now use $100 to cash in on prime real estate — without the headache of being a landlord. Here's how

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.