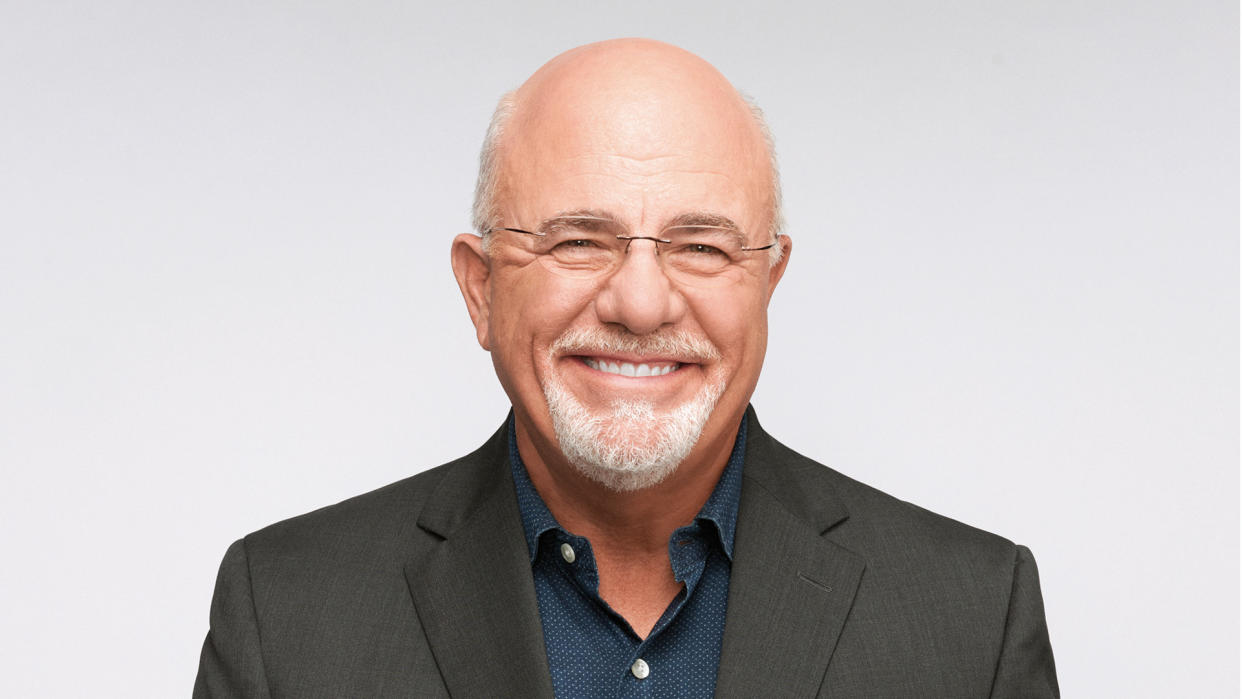

Dave Ramsey: 4 Reasons Getting Rich Quick Can Be a Curse

While the majority of people might view an immense financial windfall as an absolute blessing, others might view it as both a blessing and a curse.

More: How Far a $100,000 Salary Goes in America’s 50 Largest Cities

Discover: 6 Genius Things All Wealthy People Do With Their Money

But Dave Ramsey recently took a completely different view, tweeting that “getting rich quick can be more of a curse than a blessing.” What does Ramsey mean, and what should you do to keep sudden riches from becoming more of a hardship than a help?

How Can Getting Rich Quick Be More of a Curse Than a Blessing?

It’s a hard idea to fathom: becoming wealthy quickly and feeling the opposite of sunshine and roses. But Ramsey warns that fast riches can lead to a path of destruction.

Here’s what Ramsey had to say in his Tweet:

“Getting rich quick can be more of a curse than a blessing. I’m not saying you’re bad or evil to get money quickly. But the Bible warns us, and there’s obviously a ton of social proof all around us, that there are all kinds of problems that can happen when lots of money comes into our lives too quickly.

“Why is that? Well, as most of us are growing our wealth, we’re also emotionally and spiritually maturing. We are growing as individuals as our money grows. In a way, this simultaneous growth protects us. As we gradually build both our wealth and our character at the same time, our wealth never gets so big that it crushes us because our character is strong enough to carry it.”

Basically, Ramsey is saying that if you’ve never had to handle large amounts of wealth and you suddenly find yourself knee-deep in cash, it could be a problem for various reasons, including temptation and poor judgment.

Here are additional reasons why sudden wealth can be dangerous.

Read: A $150K Income Is ‘Lower Middle Class’ In These High-Cost Cities

Lack of Financial Education

“People who have yet to earn their money over time also could not have had the time or discipline to develop strong financial literacy skills to help manage their newfound wealth,” said Noah Schwab, a certified financial planner with Stewardship Concepts Financial Services, LLC, who helps business owners with personal financial planning and investment management. “This could lead to poor investment decisions, overspending and other financial mistakes.”

Unrealistic Expectations

“Sudden wealth might come with unrealistic expectations for either future sums of money or continuous high returns,” said Schwab. “This can lead to overconfidence and impulsive investments with high risks. Another symptom is losing motivation to work hard or pursue their previous passions. Loss of work ethic puts them at risk if they must return to a job because of poor money management.”

Relationship Strain

“If your wealth is public knowledge, people can come out of the woodwork and try to engage in relationships only because of what you can offer them,” Schwab said. “It can be challenging to separate the people who want an authentic connection and those who want something from you.”

Lifestyle Inflation

Shwab also said, “Without proper planning, individuals might quickly inflate their lifestyle, overspending on luxuries and wants. It’s much easier to adapt to a much more expensive lifestyle when there is sudden wealth. It’s better to build healthy habits with spending over time because it’s much more difficult to cut back when wealth is spent.”

Helpful Advice for Becoming Wealthy Quickly

If you find yourself the recipient of sudden wealth, here’s some expert advice for keeping a cool head and effectively dealing with it.

Pause and Educate

“Before making any significant financial decisions, take some time to reflect on your goals and values,” Schwab advised.

“Avoid making impulsive decisions. Invest time learning about personal finance, investment strategies and tax implications. Create a team of professionals who specialize in sudden wealth situations.”

Create a Plan

“Develop a comprehensive financial plan that aligns with your long-term goals,” said Schwab.

“This plan should include budgeting, investment strategies and an estate plan. Avoid putting all your wealth into one investment. Diversify your portfolio to manage risk and increase the likelihood of long-term growth. Understand the tax implications of your newfound wealth. Consult with tax professionals to minimize tax burdens legally.”

More From GOBankingRates

This is One of the Best Ways to Boost Your Retirement Savings in 2024

6 Things You Should Never Do With Your Tax Refund (Do This Instead)

This article originally appeared on GOBankingRates.com: Dave Ramsey: 4 Reasons Getting Rich Quick Can Be a Curse