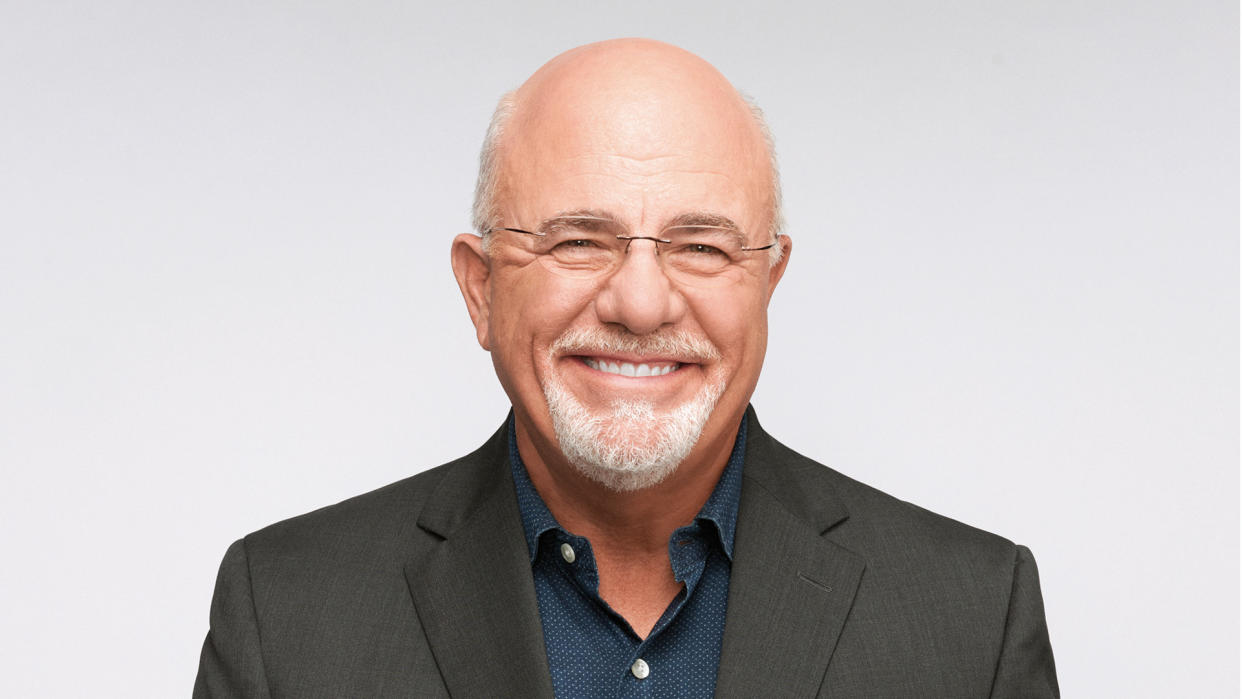

Dave Ramsey Says Don’t Buy a New Car Unless You Have a $1M Net Worth — Do Experts Agree?

Buying a car can be a pricey affair, but for financial expert and host Dave Ramsey you should not buy a new one unless you have a $1 million net worth.

In response to a reader’s question in The Oklahoman, Ramsey said, “I’m all right with buying a new car because, for someone like you, it’s such a small portion of your overall financial picture.”

Yet, he added: “I advise people to always buy good, used cars unless they have a net worth of $1 million or more, and you definitely fall into that category. Still, my advice is to pay cash or don’t do the deal. You’re more than able to do this every few years and not move the needle where your finances are concerned.”

For You: 6 Best Used Cars for the Upper Middle Class

Read More: 5 Genius Things All Wealthy People Do With Their Money

This statement is something he has reiterated for years, for instance, he wrote in a Facebook post: “Just because you can make the monthly payments does NOT mean you can afford something!”

Yet, not everyone agrees with Ramsey’s opinion about how to manage money when it comes to buying a car.

No Blanket Advice

Stephen Kates, CFP, principal financial analyst for Annuity.org, said he disagrees with almost any blanket financial advice and certainly disagrees with this advice.

“Dave has a certain audience that he speaks to that appreciates a ‘tough love’ approach to personal financial management,” he said. “In some cases, this group overlaps with the LeanFIRE crowd who believe the best way to achieve financial security is through very restrictive budgetary constraints and a conservative approach to personal finance.”

According to Kates, this idea does not take into account any nuance or financial circumstances that are vital to creating any relevant and appropriate financial recommendation.

“From any professional financial advisor, this blanket advice would be inappropriate,” added Kates.

Yet, he noted that there are many reasons why someone should not buy an expensive car, but expensive cars are not limited to new cars. Indeed, he argued that the cost of the car and the monthly payments on any loan are far more relevant than whether the car is new or not.

“Someone who buys a used car with a long loan term and a high interest rate is potentially making a worse financial decision than someone who buys a car in cash outright regardless of their net worth or the model year of the car,” he noted.

In addition, Kates noted that in some ways, Ramsey is setting a threshold for when people can be deserving of nice things.

“If you haven’t met his financial determinants of success, then you are not worthy, and I disagree with that,” he said, adding that how people spend their discretionary money is entirely up to them.

“If someone has a solid budget, saves and invests enough to meet their future goals, and manages their finances prudently, then what they spend their remaining money on is not important,” added Kates.

Solid Reasoning But With a More Nuanced Approach

Other experts argued that saying that someone shouldn’t purchase a new car unless they have a net worth of one million dollars is somewhat sound advice — except for the cut-off.

“First, someone can have a net worth of many millions of dollars but not be liquid — their wealth could be in land, unsaleable stock, that sort of thing,” said Peter C. Earle, senior economist, American Institute for Economic Research. “But the basic reasoning is solid.”

Earle noted that Ramsey is highlighting a few of the little-considered trade-offs to new car ownership.

For instance, Earle said, new cars lose a substantial portion of their value immediately after purchase, typically depreciating by 20% to 30% in the first year and up to 60% within five years.

In addition, he noted, the expenses associated with new cars, such as monthly payments and higher insurance premiums, can put a strain on personal finances.

“Opting for a reliable used car is usually a more practical and financially sound choice, as these cars have already experienced the most significant depreciation, providing better value for the money spent,” added Earle.

It’s worth mentioning that under the odd circumstances of the pandemic, we saw prices of used cars skyrocket, but that had to do with the effects of policies, said Earle.

“Supply chain problems, lockdowns and stay-at-home orders caused new car production to slow and even stop in some models, which sent demand for used cars skyrocketing,” he said. “But that’s a highly anomalous situation. Let’s hope so, at least.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey Says Don’t Buy a New Car Unless You Have a $1M Net Worth — Do Experts Agree?