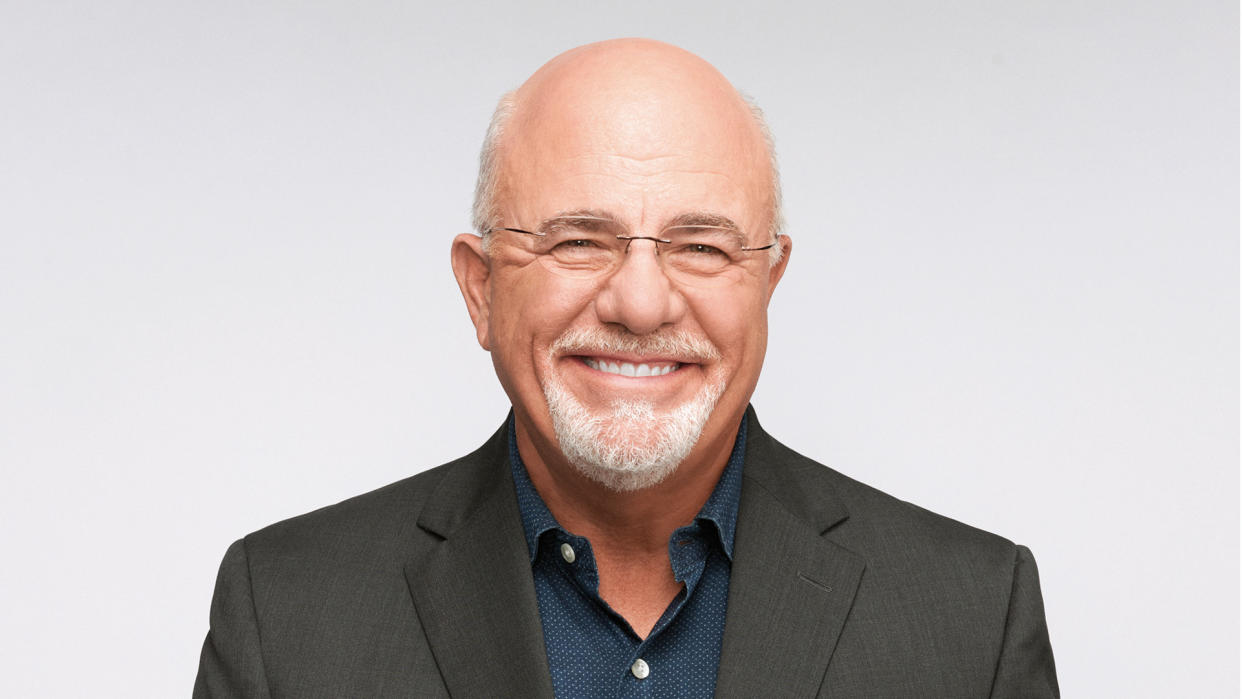

Dave Ramsey’s Debt Snowball Method Has One Key Exception

If you’re not familiar, Dave Ramsey‘s “7 Baby Steps” program is designed to help you take control of your money. Step 2, in particular, is designed to help you pay off all of your debt.

Ramsey says that in order to successfully get out of debt, you have to stop using your credit cards, cut them up and then pay off your debts one at a time using the snowball method.

Read Next: This Is the One Type of Debt That ‘Terrifies’ Dave Ramsey

Try This: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

But what about using rewards credit cards to earn money on your purchases while you’re trying to crush your debt? Could this strategy be beneficial?

Here’s more on why this use of credit cards is the exception to Ramsey’s teachings.

Why Rewards Cards Are the Exception

Andrea Woroch, consumer and money-saving expert at Andrea Woroch, said that even if you’re in debt, a rewards credit card can help your budget as long as you know how to use it wisely.

Here are her suggestions:

Only Charge Recurring Bills

“For one,” Woroch said, “only charge recurring bills you are planning to pay for anyway. This can be your car insurance or video streaming services.”

She explained that by doing this, you can still earn points or cash back, without racking up debt.

Use Your Redeemed Rewards To Pay Off Debt

Even though you can use your credit card rewards for gift cards, merchandise or travel purchases, Woroch pointed out that how you redeem your rewards is equally important to free yourself from debt. “Use your rewards as statement credit to help pay down the debt,” she suggested.

Check Out: I’m a Frugal Shopper: 4 Items I Always Buy Secondhand To Save Money

Apply for a New Rewards Card To Transfer Balances

If you have high-interest credit card debt, consider applying for a rewards card that has a great introductory offer and transferring your balances.

“Many cards that offer balance transfers will give you a year or more to pay down that debt with no additional interest piling up with a few other perks that can help your bottom line,” Woroch explained. “You can find cash-back cards that give you 0% on balance transfer plus a signup bonus that can be used to pay off your balance or new purchases (those that you’re planning to make anyway).

“Again, though, it’s very important that you only use the card for purchases that are planned and accounted for so you don’t keep adding to your debt pile.”

Opt for a Rewards Card That Will Give You Cash Back on Monthly Bills

Woroch said that another option is to look for a rewards card that will give you more cash back on your monthly bills, such as medical bills and car insurance.

“For these types of expenses that you know you have to pay no matter what, you’re better off using a flat-rate cashback card like the Bread Cashback American Express Card that gives you an unlimited 2% back on every purchase, including bill payments,” she said.

Still, another way you can benefit from a cashback rewards card is to use it for your biggest spending category. For example, if you travel for work or have a lengthy commute, use it to fill up your tank. Just make sure to pay it off each month so you won’t get hit with interest charges.

Take Advantage of Extra Rewards

Woroch also suggested looking for other ways to earn rewards in addition to the card reward perks.

“For instance, you can earn rewards by uploading pictures of your purchase receipts using a free cash back app like Fetch, which can help offset future purchases to alleviate your budget and give you more wiggle room to pay down more debt,” she explained.

Additional Tips for Using a Rewards Credit Card Wisely

Woroch gave the following additional suggestions for using your rewards credit card wisely when you’re trying to get out of debt:

Treat it like a debit card and only charge what you can afford to pay off instantly.

Check your statements regularly, or at least once a week to make sure you aren’t charging more than you can pay off. Seeing your balance can help deter unnecessary spending.

Set and follow a budget and use budgeting apps that link your bank account with your various cards to keep you in check. Apps like Rocket Money will alert you when you’re about to overspend in a category depending on your preset limits.

Stick with your shopping list and only buy what you need.

Look for bonus reward offerings, but log in to your account to activate. Just don’t chase those rewards. Only buy if it was something you were planning to [purchase] in the first place.

Review your reward card perks and take full advantage of them. This could be free checked bags, free travel insurance, free rental car collision, free Uber credits, free hotel stay annually, etc.

Jennifer Calonia contributed to the reporting for this article.

More From GOBankingRates

Don't Buy a House in These 3 Cities Facing a 'Climate Change Real Estate Bubble'

This is One of the Best Ways to Boost Your Retirement Savings in 2024

Here's How to Add $200 to Your Wallet -- Just For Banking Like You Normally Would

This article originally appeared on GOBankingRates.com: Dave Ramsey’s Debt Snowball Method Has One Key Exception