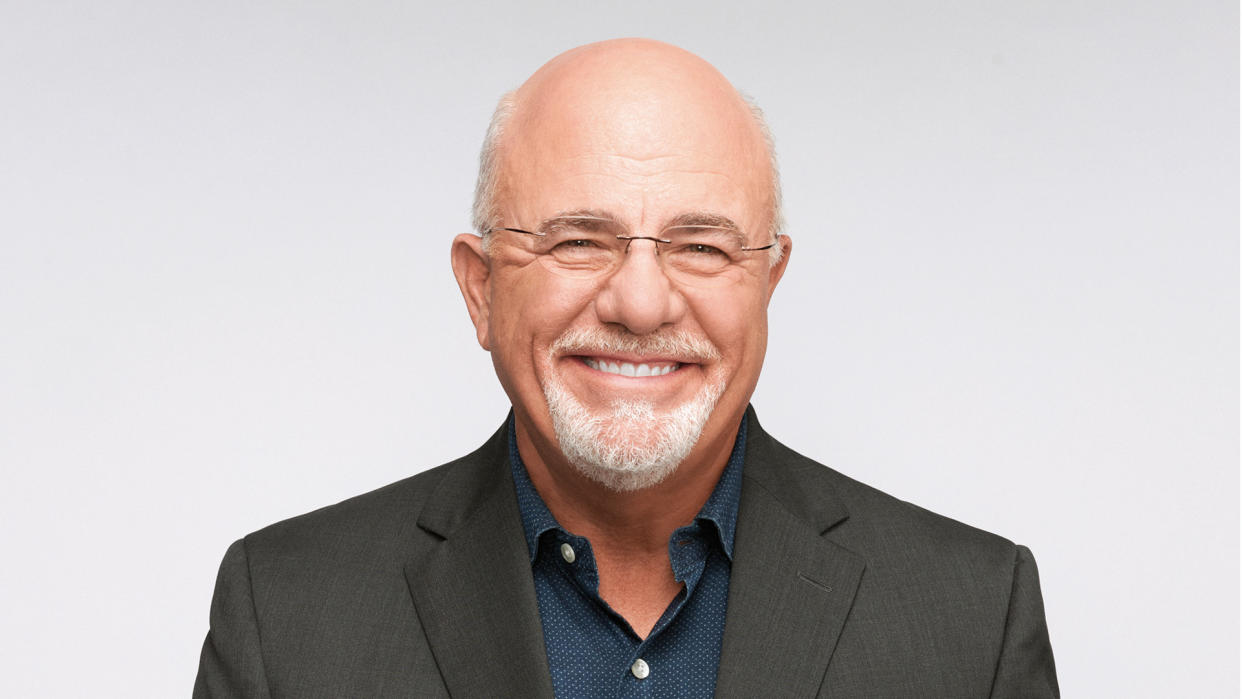

Dave Ramsey: ‘You Need a Better Plan’ Than Refinancing Student Loans

When it comes to student loans, personal finance expert Dave Ramsey doesn’t want anyone to keep this type of debt around forever.

KTAR News 92.3 FM posted a letter to Ramsey from a reader named Austin. In the letter, Austin wrote about graduating from college six years ago with a business degree. Austin works in data analytics making $40,000 a year but has $155,000 in student loans and wants recommendations for refinancing these student loans and reducing interest rates and monthly payments.

Here’s what Dave Ramsey wrote back and his tips for properly paying back student loans.

O Canada! These 30 Famous Canadians Are Richer Than You Think

P Diddy’s Bad Boy Reunion Concert: Notorious B.I.G. Net Worth, Faith Evans Net Worth and More

‘You Need a Better Plan’

There are several moves Austin needs to make to pay off $155,000 in student loans. Ramsey wrote back that a better plan was necessary beyond refinancing loans.

“There’s nothing inherently wrong with refinancing to get a lower interest rate or lower payments, if you do it the right way,” Ramsey said. “But in most cases that [refinancing] translates into keeping the debt around forever.”

Austin’s main goal should be to pay off the loans as fast as possible. This means putting big chunks of money towards the principal. Ramsey recommended Austin pick up an extra job, since Austin had a “shovel-to-hole ratio problem.”

“The hole you’re in is a big one — a $155,000 one. And you’re working with a $40,000 shovel. You need a bigger shovel, and a lot of extra work, instead of trying to keep these loans around like they’re pets,” wrote Ramsey.

For Austin’s extra job, Ramsey recommended searching for a gig that would make the most money in a short time span. He also recommended looking for a higher paid position with a different company to increase Austin’s full-time income.

Discover: All of the States That Will Pay Off Your Student Loans

More Tips for Paying off Student Loans

Aside from getting a side hustle and only using refinancing if it makes sense, what else can borrowers with substantial student loan debt do to pay off their loans in full? Ramsey Solutions offers additional tips for paying off student loans.

Pay more than the minimum payment. According to a Ramsey Solutions blog post, you can use a Student Loan Payoff Calculator — provided by Ramsey Solutions — to determine how quickly you can pay off your loans with extra payments.

Budget and cut back on certain lifestyle choices. “A zero-based monthly budget will show you exactly where your money is going and where you can cut back,” a post on Ramsey Solutions reads. Once you see certain expenses you don’t need, like four monthly streaming service subscriptions, you can unsubscribe and cut these from your budget. The money you would have spent can be allocated towards paying off your student loans.

Use debt snowball to pay off your loans. Borrowers who use debt snowball pay off all loans with the smallest balances in full while contributing minimum payments towards any other outstanding loans. Once the smallest balance has been paid off, the borrower moves on to the loan with the next highest balance and pays it off. They repeat this process, or snowball, until all the small debt is paid off and the only debt left to pay off has the biggest balance. Working the debt snowball, according to the Ramsey Solutions blog post, gives borrowers a sense of progress as each of their loans disappear and helps them stay motivated to crush the biggest loans.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey: ‘You Need a Better Plan’ Than Refinancing Student Loans