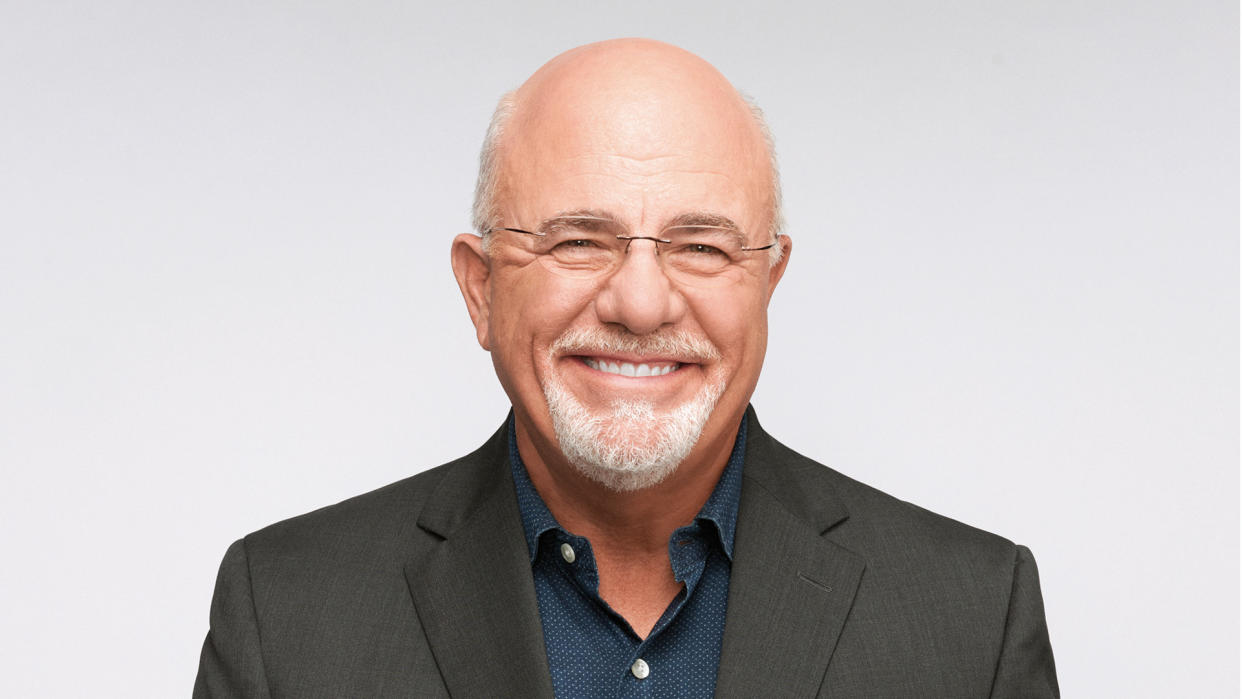

Dave Ramsey Believes Renters Insurance Is Dirt Cheap — Here’s Why You Should Buy Coverage

With housing costs increasing, you might be looking for ways to cut your monthly expenses. But if you’re a renter, the financial expert Dave Ramsey warns against sacrificing one important type of coverage and potentially ending up with high, unexpected expenses later.

I’m a Real Estate Agent: Don’t Rent an Apartment If It Has Any of These 10 Problems

Discover: 3 Things You Must Do When Your Savings Reach $50,000

In an August post on the X platform, formerly known as Twitter, he wrote, “Renter’s insurance coverage is dirt cheap. If you’re currently renting, take care of this today! There’s no excuse for not having this in place before you go to bed tonight!”

Here are five reasons why Ramsey advises that you buy this coverage.

1. Your Personal Belongings Will Be Protected

The main benefit of having rental insurance coverage is that your possessions will be protected in case there’s a fire, robbery or some other disaster at your apartment or home. Depending on your policy, you may receive the replacement cost or actual cash value for your damaged items, up to the coverage limit set. The protection usually extends to when you’re traveling with personal items, too.

Unfortunately, some people believe their landlord is responsible for paying for replacing lost items. However, their coverage is usually just for the building itself. This surprise can lead to severe financial hardship.

In his post, Ramsey recounted when he rented a property to a family and the property burned down. Lacking rental insurance, the family asked when they’d receive an insurance check from him for their destroyed items. He explained, “Telling them that my landlord’s policy didn’t cover any of their belongings was one of the worst conversations of my life.”

2. It Can Help in a Lawsuit

In a YouTube video, Ramsey noted that rental insurance policies usually provide some level of personal liability coverage. This is important in case someone visits your home, has an accident and then tries to sue you. It can also provide protection in case someone in your household damages another person’s property or your pet bites a neighbor.

You can shop around for a renters insurance policy with high personal liability limit options. It might save you significantly if you end up in legal trouble. Just make sure to review the policy’s exclusions, which often include things like intentional incidents or damage to business property.

3. It Can Cover Relocation-Related Costs

If your rental gets destroyed, you’ll need to find somewhere else to live until the property is restored. Not only is this inconvenient, but the costs can add up quickly.

A post on the Ramsey Solutions site highlighted how rental insurance could cover relocation costs, including your temporary housing and even meals at restaurants. It can also cover a storage unit for your items and required paid parking expenses.

4. It Probably Won’t Break Your Budget

As Ramsey emphasized before, the cost of renters insurance is so low that it’s simply worth having. He estimated that the average policy would cost under $300 per year. However, your location, coverage options, claims history and credit all play a role in the premiums.

Since the insurance is widely available, you can easily get quotes from multiple providers and find the best deal. Don’t forget to look into cost-saving options such as bundling with your car insurance, picking a higher deductible and taking advantage of loyalty discounts.

Find: 15 Cheapest, Safest Places To Live in the US

5. You May Have No Choice

Even if you don’t mind forgoing the financial protection, avoiding rental insurance may not be an option. Potential landlords might refuse to approve your lease application unless you show proof of the coverage. That’s usually because they want to limit their liability.

For example, an uninsured tenant might try to sue them for lost personal property, or the landlord might have to file a claim against their own policy in some cases. Some landlords may also simply prefer renting to those with coverage because it shows financial responsibility.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Dave Ramsey Believes Renters Insurance Is Dirt Cheap — Here’s Why You Should Buy Coverage