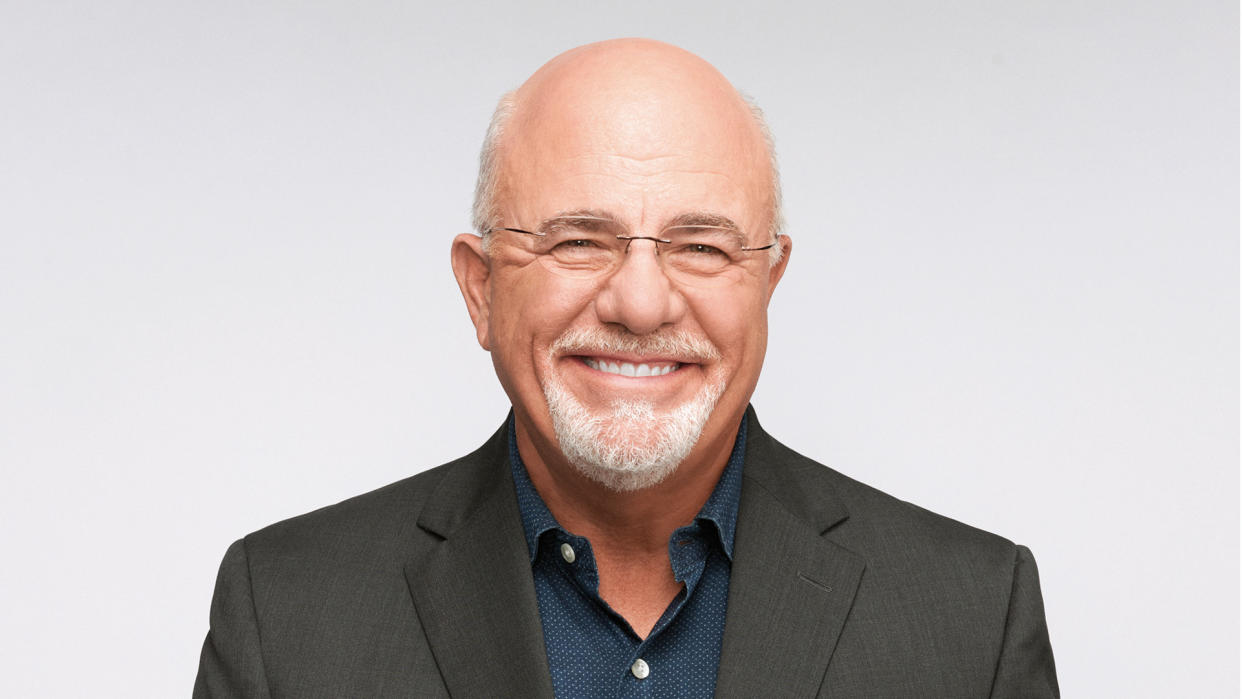

Dave Ramsey: 5 Things To Do To Win With Money 100% of the Time

If there is one topic that Dave Ramsey knows about, it’s money. He’s written books on the subject, hosted podcasts regarding personal finance, and delivered numerous lectures on the ways that you can make and increase your wealth.

Learn More: 16 Tips To Live Well on a Low Salary, According to Dave Ramsey

Find Out: 4 Genius Things All Wealthy People Do With Their Money

GOBankingRates breaks down a video and post on X from Ramsey on the five things he says you need to do to win with money 100% of the time.

Stick to a Written Plan

Also known as a budget. It seems simple, almost too easy. But how many of us are actually sitting down and taking the time to draw out a budget?

If you map out your expenses month to month, calculate your earnings and account for emergencies, as well as savings, you have a budget. Now that you have put it out into the world, the next step is keeping to the parameters. That means no excessive spending, going over your allotted budget and, in some cases, scaling back on what you normally might splurge on.

Read Next: Warren Buffett: 10 Rules for Young People Who Want to Get Rich

Get Out of Debt

Easier said than done, though critical to making money work for you. The problem with debt is that it’s an ongoing cycle, taking from one bucket of money to pay off another bucket of money — and if you do not have the funds on hand, resorting to credit cards or loans.

Forget robbing Peter to pay Paul — it doesn’t work! What will actually keep money in your pocket and add to your personal wealth is paying off the debt you already have. That means not just throwing dollars at the interest every month, but the monthly minimum and whatever else is on top. You’d be surprised how quickly you start seeing your money in the black, once you get out of the red.

Live on Less Than You Make

Who doesn’t enjoy the finer things in life? In all honesty, people who are smart with their money. While they might be making a six figure salary, they are refining their cost of living expenses so that they can live on less than what their earned income would have you believe.

Poor people tend to stay poor, because they try to live rich. On the other hand, rich people stay rich, because they tend to live poor. This doesn’t mean not having any luxuries in life, but cutting back on unnecessary spending, downsizing your overall cost of living and, in general, not spending every penny you make just to live.

Save and Invest Money

While it might sound like common sense, many people do not put the cents and dollars behind saving and investing their money. “A penny saved is a penny earned,” as the old adage goes, but in today’s modern world of money, you need to find ways to have your money work for you.

Try automating a portion of your paycheck to go directly into your savings each time you get paid. You determine the amount, so it’s never a surprise, and you do not have to think about it after you set up a direct deposit system with your bank account.

Investing comes with a similar strategy: take time to research stocks, property, business opportunities and new ventures that you can put your money towards. By the time it comes back, you’ll see your return on investment that has added up over time.

Be Outrageously Generous

This could sound counterproductive, but the notion of money is not to hoard it. Money, in fact, is meant to be spent out in the world. One way to make your money win for you is by being outrageously generous and giving in a way that fits your personal finances.

Sharing the wealth with family, friends, colleagues and your community builds up good relationships and an exchange of goodwill, as well as financial gain, that continues throughout life.

Beyond just spending on those you love and care about, try donating a portion of your income to causes and organizations that you believe in — especially ones that could use the financial support. Nonprofits, 501(c)3s and other organizations usually can offer a tax write off form to any donation made to them. This means you not only are helping to support something you believe in by putting your money where your mouth is, but you can see some of that money come back to you when you file your taxes.

More From GOBankingRates

I Earn Over $30K a Week in Semi-Passive Income on Amazon - Here's How

This is One of the Best Ways to Boost Your Retirement Savings in 2024

Here's How to Add $200 to Your Wallet -- Just For Banking Like You Normally Would

This article originally appeared on GOBankingRates.com: Dave Ramsey: 5 Things To Do To Win With Money 100% of the Time