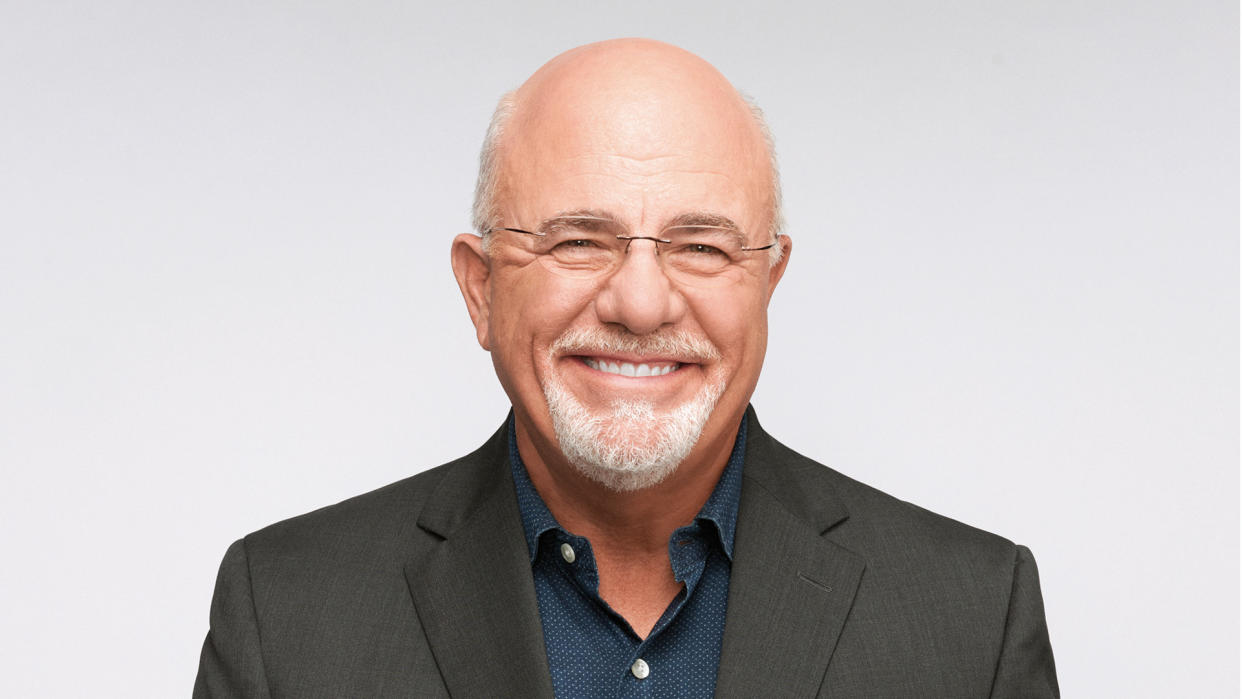

Dave Ramsey: Follow These 5 Steps If You’re Running Out of Money

Living paycheck to paycheck is no fun — worrying about how to pay your light bill while eating the same ramen noodles each night is rough, to say the least.

Waiting for your next paycheck can feel like eternity when you’re struggling to stay afloat, but according to finance expert Dave Ramsey, you shouldn’t despair.

Learn More: 6 Frugal Habits of the Super Rich and Famous

Learn More: 4 Genius Things All Wealthy People Do With Their Money

“You might think all you need to do is make more money to solve this problem,” he wrote on his Ramsey Solutions site. “But here’s the truth: It’ll never matter how big your paycheck is if you’re always spending it on your past (aka debt) — or if you have no plan for your spending. Don’t put a temporary bandage of more cash on the problem. Find a true solution.“

Below are different steps he recommends you take when you’re running out of money.

Start Tracking Your Spending

The first step Ramsey suggests is taking stock of where your money is going. “Go ahead and log in to your bank account, pull up your transactions and look at your expenses, big and small. Where is your money actually going each month? Do you see patterns in your spending?”

When analyzing, he said to be thoughtful of each purchase and ask yourself whether something is a need or want. For example, your car payment is an absolute need, whereas going to the movies every Friday night is a want.

“Remember,” he said, “you’re running out of money — so you can’t keep spending like you have been. But as you make these changes, you’ll start feeling something you haven’t felt in a long time. Peace of mind.”

Check Out: I’m a Bank Teller: Here Are 10 Mistakes You Are Making With Your Banking

Set Up a Budget

Once you’ve taken inventory of where your money is going, Ramsey said it’s crucial to map out a plan. And this involves creating a zero-based budget — which is when your income minus expenses equals zero.

“This type of budget puts you back in the driver’s seat as you tell every single dollar where to go,” he explained. “This is one of the few times in life where seeing that zero is actually a good thing.”

Pay Your Most Urgent Bills

“When you’re running out of money and you’ve got more bills than you know what to do with, you have to play favorites,” Ramsey wrote.

When it comes to deciding which bills to pay, he suggests a simple rule: cover the Four Walls — your basic necessities of food, shelter, utilities and transportation. This doesn’t include those pesky credit card bills — no matter how intimidating they seem. Those can come later, once you have your basic needs met.

If you’re struggling to even pay your most urgent bills, Ramsey said to take a deep breath first. “Remember: No matter what that creditor might say, don’t let them bully you into believing that paying their bill is more important than putting food on the table.”

Get Creative About Cutting Your Spending

Here is where having tracked your expenses will come in handy.

“Whether it was your daily drive-thru coffee fix, extras at the grocery store or those little Amazon purchases, it’s time to press pause on these spending habits until you can get ahead with your income again,” Ramsey urged.

He suggests three top ways to be more intentional about saving money.

To begin with, he said to eat all your meals at home. “Hey, eating out is easy — and tasty — but if you can’t pay your bills, the only time you should see the inside of a restaurant is if you’re working there.”

Secondly, he said to clip coupons and shop clearance aisles. “Since paper coupons are harder to come by these days, you could try out a few money-saving apps like Ibotta, Honey or RetailMeNot.”

Lastly, he said to review any subscriptions — they can easily add up each month. “When you were reviewing your wants and your needs, hopefully you noticed if there were a bunch of extra subscription services you can cut. Use the free versions for now. Endure those ads!”

Make It a Point To Make Extra Money

Once you’ve gone through the other steps, the money guru said it’s time to work on this one: “Okay, we said making extra money isn’t the only solution here, but it is a solution.”

Fortunately, there are many ways to increase your income. Some of these include working as a driver for a food delivery app like Uber Eats, becoming a grocery shopper for Instacart, dog walking and even selling things online, like on Facebook Marketplace.

More than anything, Ramsey said the point is to put yourself out there and start getting creative with solutions. “Hey — there’s no shortage of ways to make extra money when you’re in a pinch. You just have to be willing to put in the work.”

More From GOBankingRates

5 Places in America To Retire That Are Just as Cheap as Mexico, Portugal and Costa Rica

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: Dave Ramsey: Follow These 5 Steps If You’re Running Out of Money