Crypto exchange Binance.US valued at $4.5 billion after inaugural funding

Binance.US, the American subsidiary of the largest cryptocurrency exchange by volume, has closed its first funding round for a $4.5 billion pre-money valuation.

Led by RRE Ventures, Foundation Capital, VanEck and others, the $200 million seed round makes the firm the latest of several that have reached unicorn status as U.S. regulators consider further regulations on the sector’s exchanges.

“This funding and valuation validate the strength of Binance.US’s business today, as well as our long-term growth prospects, and will enable us to continue to make our spot trading platform the best it can be while rolling out an ambitious product roadmap,” said Brian Shroder, the firm’s current chief operating officer in a release.

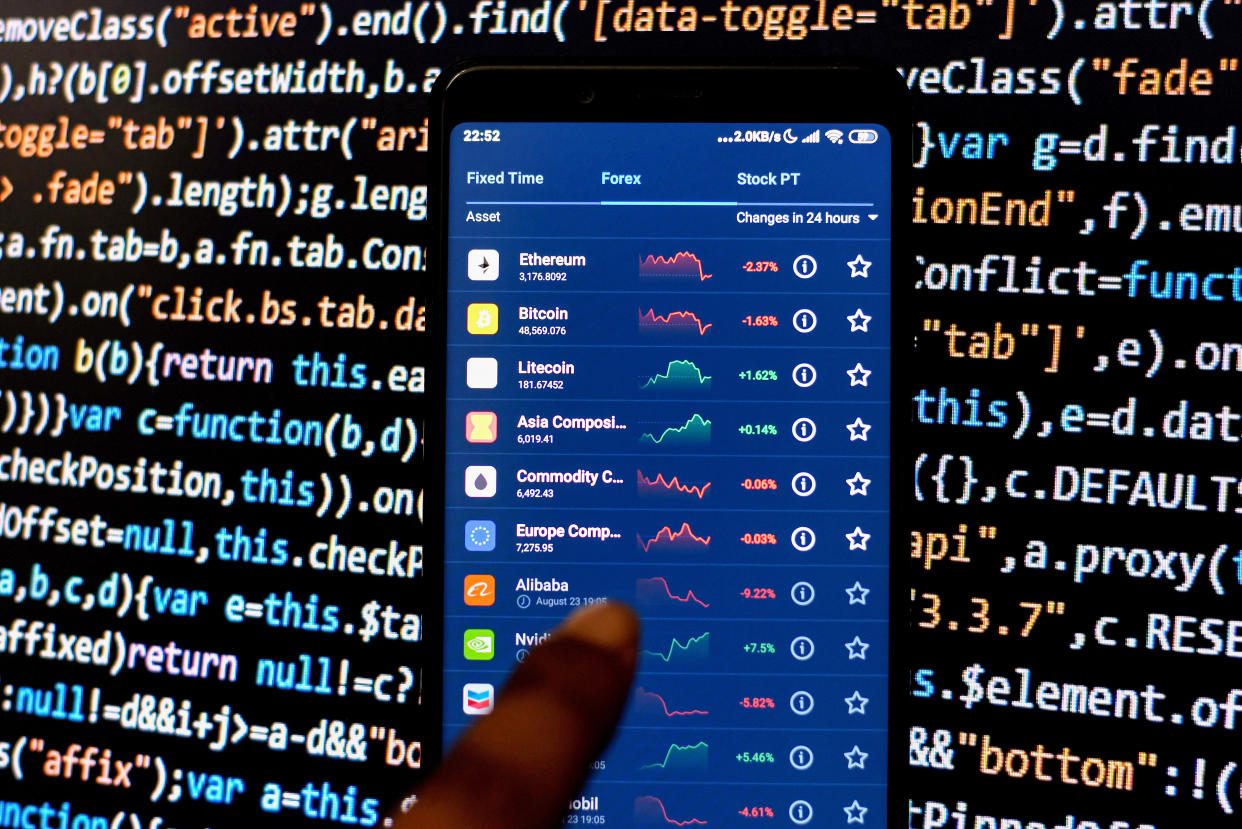

Binance.US said it offers the most competitively low trading fees (0.1%) of crypto exchanges available to U.S. investors. The platform’s native stablecoin, BNB, can also be used by traders to lower transaction costs. In addition to buying and selling at market prices, the platform also enables more sophisticated trading orders as well as over-the-counter (OTC) trading.

In June 2019, the firm’s parent company, Binance, announced a partnership with a lesser known California-based company, BAM Trading Services, to launch a U.S. compliant version of its crypto trading platform led by Ripple executive, Catherine Coley.

Over 2021, the firm saw a revolving door of three different CEOs. Coley was replaced in April by the former acting head of the U.S. Office of the Comptroller of the Currency, Brian Brooks, who left only after a few months on the job, citing "differences over strategic direction.”

In mid-February, a Wall Street Journal report revealed that the the Securities and Exchange Commission (SEC) has been examining the relationship between Binance.US and two trading firms — Sigma Chain AG and Merit Peak Ltd. — linked to its parent company founder and chief operating officer, Changpeng Zhao “CZ.”

Both Sigma Chain and Merit Peak serve as market makers for Binance.US. Citing people familiar with the investigation, the report said one area of focus in the probe revolved around whether the U.S. crypto exchange offered sufficient disclosures to customers about its links to the trading firms.

A market maker or liquidity provider is a large trading entity that enables cryptocurrency exchanges to meet their customer’s buying and selling requests. Unlike a traditional investor or trader, market makers profit from the price spread difference between buyers and sellers in a given market.

On Monday, SEC Chair Gary Gensler confirmed to an audience at a University of Pennsylvania Law event that he has asked staff to consider whether cryptocurrency exchanges should be segregated from market-making functions.

“Unlike traditional securities exchanges, crypto trading platforms also may act as market makers and thus as principals trading on their own platforms for their own accounts on the other side of their customers,” Gensler wrote in his prepared remarks.

During a Tuesday interview, Sam Bankman-Fried, founder and CEO of crypto exchange FTX — which also has a U.S. arm (FTX US) — told Yahoo Finance that if U.S.-regulated cryptocurrency firms were not allowed market-making functions, such as taking the other side of a customer’s trade, most cryptocurrency firms would be fine.

“I don’t think I’m sort of a radical on this or a purist,” Bankman-Fried said.

David Hollerith covers cryptocurrency for Yahoo Finance. Follow him @dshollers.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn