Conagra Brands CFO: ‘There’s a lot of trade down’ to frozen food

Frozen food sales are heating up as consumers look to save on their trips to the grocery store.

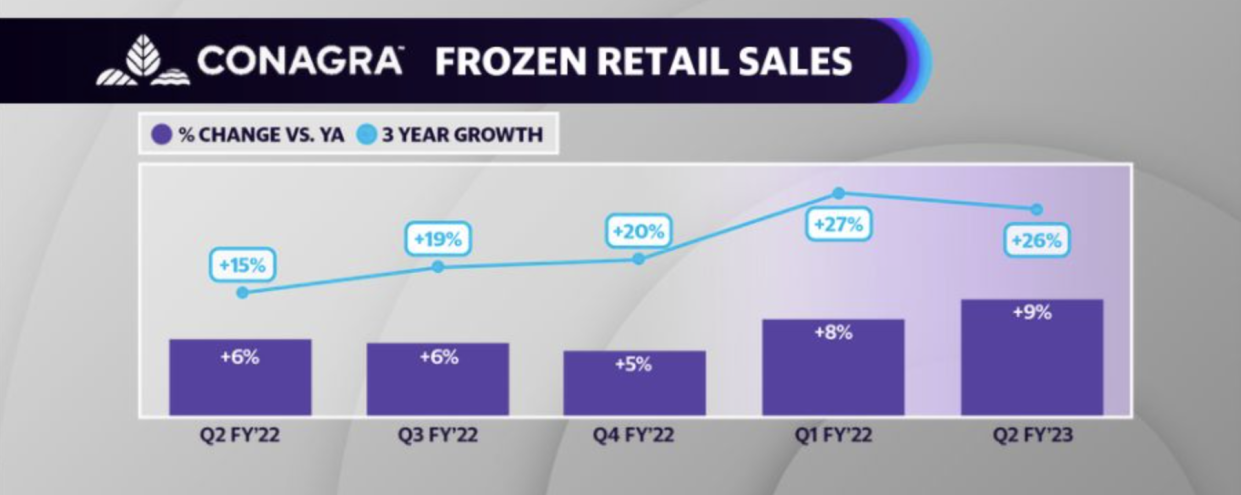

Conagra Brands, known for frozen foods brands like Bird's Eye, Celeste Pizza, Marie Callender's, and Healthy Choice, among others, reported that net sales for its refrigerated and frozen food segment jumped 10.5% in its fiscal second quarter, which ended November 27th, 2022, to $1.4 billion.

CFO Dave Marberger told Yahoo Finance that consumers haven't changed their COVID-19 eat-at-home habits.

"When COVID started, we had a lot of people that were obviously at home, and we converted a lot of new users to the brand, and that hasn't changed...all those businesses are up double digits, and consumers are enjoying it."

Now, with inflation top of mind, consumers are keeping tabs on the cost of food.

"There's a lot of trade down from eating away from home to eating at home, and frozen food is benefiting from that."

The report specifically noted it gained market share in the frozen single serve meals, plant-based protein, and frozen breakfast categories, moving past the perception that "frozen food is bad" with its flash freeze method, Marberger said in the interview.

Inflation impact on the cost for consumers

Prices are still higher year-over-year for frozen options though.

Per November's Consumer Price Index (CPI) from the Bureau of Labor Statistics, the price of frozen fruits and vegetables is up 14.9%, while frozen and freeze dried prepared foods are up 14.0%.

Conagra Brands is not immune to that impact. "If you look at our portfolio, our basket of goods, we got hit early with inflation" in its fiscal fourth quarter back at the end of May 2022.

Marberger said two-thirds of Conagra's cost of goods sold are materials, such as packaging and ingredients, leaving them with no choice but to increase prices.

"We were almost at 9%. Fiscal '22, our inflation was 16% to 17%, so this year in fiscal '23, we're guiding to 10% inflation," Marberger said. "But that's off of a 16% in the prior year and a 5% in the year before that, so on a three year basis, our inflation is about 30%, when that happens, your costs go up, you have to take price increases."

He said there is a lag time between when the costs hit the company's P&L (profit and loss), but Conagra Brands, "finally caught up with our price increases to our customers from the cost increases we've been incurring."

In the recent quarterly report, the company posted a slight beat both its top and bottom line with revenue of $3.31 billion and adjusted earnings per share of $0.81, compared to Wall Street estimates of $3.28 billion and $0.66, per Bloomberg. Net sales also increased 8.3% in the second quarter.

—

Brooke DiPalma is a reporter for Yahoo Finance. Follow her on Twitter at @BrookeDiPalma or email her at bdipalma@yahoofinance.com.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube