A historic and clubby group in London could face billions in claims from the Baltimore bridge collapse

Claims from the container ship Dali's crash into Baltimore's Key Bridge could cost insurers a lot.

Analysts estimate the bridge is worth $1.2 billion, with even more in potential liabilities.

Several firms from the venerable Lloyd's of London exchange will share the risk.

A journalist said in 1859 that "not a breeze can blow in any latitude" without being recorded in the books at Lloyd's of London, the oldest insurance exchange in the world.

With the crash of the container ship Dali into the Francis Scott Key Bridge in Baltimore on Tuesday, insurance underwriters are updating those books as a picture of the true cost of damages emerges.

Barclays analysts estimate insurance claims from the bridge itself could total $1.2 billion, with as much as $700 million in claims for wrongful deaths, plus additional costs from business interruptions related to the port closure and bridge reconstruction, Bloomberg reported.

Economists told Business Insider the port closure itself will cost $15 million a day in lost economic activity, with other disruptions pushing the total into the tens of millions a day.

Baltimore is a key import and export point for cars, construction and farm equipment, and coal — much of which is on hold while salvage crews clear the shipping lane.

All told, Barclays said insurance companies could be looking at claims as high as $3 billion as a result of the crash, Bloomberg reported.

"While the incident still has to be investigated, we believe it has potential to become a significant insurance claim, particularly in the marine market," the analysts wrote, according to the outlet.

Marcos Álvarez, Morningstar's managing director for global insurance ratings, put the figure between $2 billion and $4 billion, "depending on the length of the blockage and the nature of the business interruption coverage for the Port of Baltimore," Reuters reported.

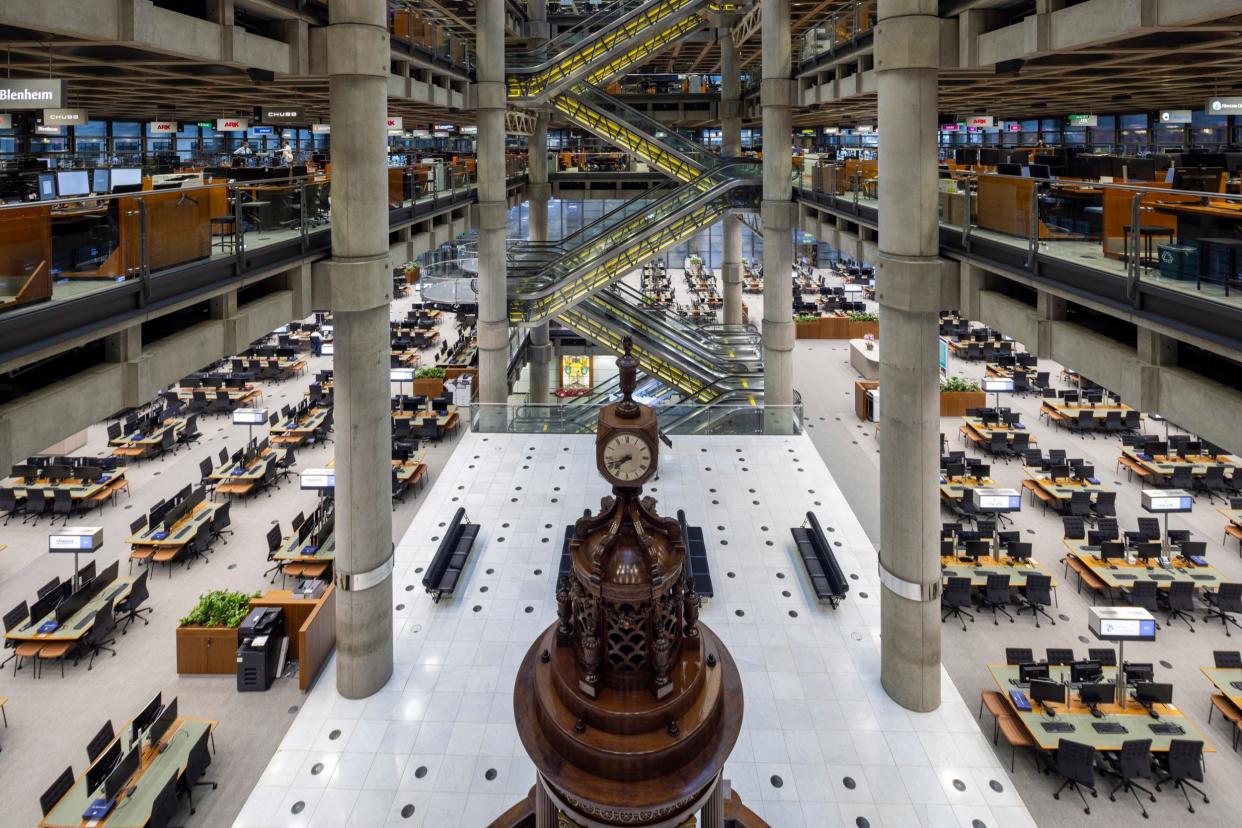

The lead insurer and the major reinsurers for the Dali are underwriters with Lloyd's, in whose storied "Room" underwriters will calculate the financial price of this catastrophe.

In the late 17th century, ship captains and businessmen met at Edward Lloyd's London coffee shop to work out the first insurance policies, and the shop soon grew into a marketplace where the risks of maritime trade could spread across many firms.

While cargo owners are responsible for insuring the property aboard their ships, the shipping industry covers protection for the vessel itself and the damages it causes to third parties.

"Protection and indemnity clubs," groups of shipping companies that pool liabilities together so that an extreme loss doesn't put a member out of business, cover the vast majority of shipping.

Those clubs, in turn, have insurance and reinsurance policies in which multiple firms protect losses over certain thresholds, further distributing the risk.

The Dali is a vessel in the Britannia P&I Club, the oldest such insurance group in the world.

Lloyd's says its firms insure risks representing more than $58 billion in premiums a year, covering everything from ships to satellites.

The Underwriting Room is no stranger to tragedy or complexity, either: Its underwriters have sorted out claims on disasters from the sinking of the Titanic to the 9/11 terrorist attacks.

Still, the collapse of the Key Bridge could lead to "one of the largest claims ever to hit the marine (re)insurance market," John Miklus, the president of the American Institute of Marine Underwriters, told Insurance Business.

Read the original article on Business Insider