Child Tax Credit: ‘Significant Weaknesses’ Cited by Nonpartisan Report for Romney’s $4,200 Proposal

A U.S. Senate proposal to provide child tax credit payments of up to $4,200 a year has gotten mixed reviews from at least one public policy group, which called the plan “a welcome development” but also said it “has significant weaknesses.”

See: These States Are Adding Child Tax Credit Stimulus – Is Yours One?

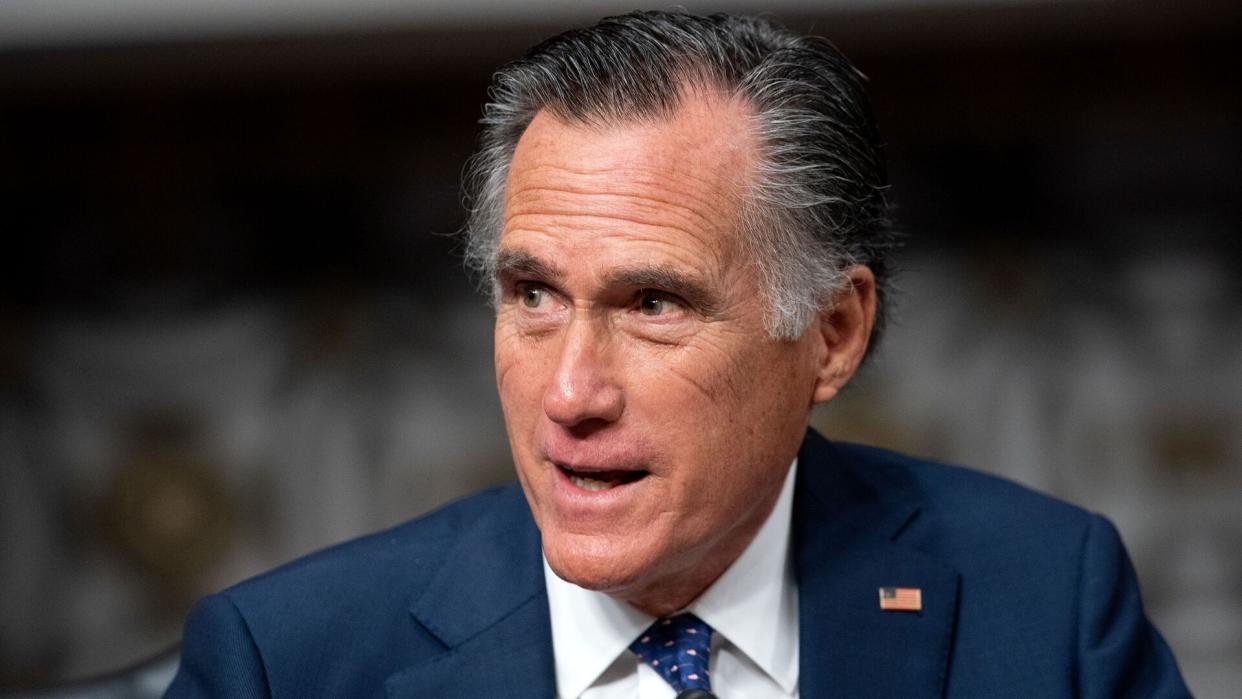

Find: Mitt Romney Wants To Send Parents $350 To Soften Inflation’s Financial Blow

The proposal, called the Family Security Act 2.0, was introduced last month by Sen. Mitt Romney (R-Utah) and co-sponsored by Sens. Richard Burr (R-N.C.) and Steve Daines (R-Mont.). Its goal is to create a sustainable monthly child tax credit similar to the expanded CTC that was sent to millions of Americans as part of the American Rescue Plan.

As previously reported by GOBankingRates, the Family Security Act 2.0 builds on an earlier Romney proposal by encouraging work and supporting pregnancy. It would provide parents with $350 per month for each child ages five and under ($4,200 annually) and $250 per month for children ages six to 17 ($3,000 annually).

Additionally, expectant parents would be eligible to earn $700 a month for the last four months of their pregnancy, for a total of $2,800.

Benefits would be limited to up to six children each year, and families would need to earn $10,000 in the previous year to qualify for full benefits, The Hill reported. Those who earn less than $10,000 a year would receive benefits proportional to their earnings. For example, a household earning $5,000 a year would get half of the maximum child tax credit.

The earnings requirement has drawn criticism in some quarters, including from the Center on Budget and Policy Priorities (CBPP), a nonpartisan research and policy institute.

In a report filed last week, the CBPP said that Romney’s proposal would increase the credit for most children in the lowest-income families. However, children in families without any earnings in a year “would get no credit at all, while millions of other children in families with very low earnings would get only a partial credit.”

Moreover, low- and moderate-income families “would have to pay for much of its cost through a large cut in the Earned Income Tax Credit (EITC) and other offsets, leaving millions of children worse off than they would be without the Romney plan,” the CBPP report said.

The CBPP added that the Family Security Act 2.0 “falls short of the Rescue Plan expansion — and a prior version of Senator Romney’s Family Security Act released last year — by not making the full credit available to families with little or no income. Instead, it includes an earnings requirement and phases in the credit as earnings rise.”

The CBPP estimates that roughly 7 million families earning less than $50,000 would be worse off under the proposed plan than under the current law and impact about 10 million children. Because of the cuts to the EITC and the head of household tax filing status, if the proposed plan were to be approved, the average family could lose more than $800, The Hill noted.

See: Don’t Qualify for SNAP? The Commodity Supplemental Food Program Could Help Seniors Get Food

Food Stamps: Do Unused SNAP Benefits Roll Over Each Month?

Those criticisms aside, the CBPP did concede that the proposal “includes some important improvements to the Child Tax Credit compared to current law and may help create an opening for enacting a meaningful expansion this year.”

More From GOBankingRates

States Whose Economies Are Failing vs. States Whose Economies Are Thriving

Looking To Diversify in a Bear Market? Consider These Alternative Investments

This article originally appeared on GOBankingRates.com: Child Tax Credit: ‘Significant Weaknesses’ Cited by Nonpartisan Report for Romney’s $4,200 Proposal