Your child is required to learn about personal finance thanks to this De Pere teacher

DE PERE — For two decades, Kerri Herrild has wanted Wisconsin students to learn about personal finance. It's a social justice issue, she said.

Starting with the class of 2028, every high schooler will have to take a personal finance course in order to graduate after Gov. Tony Evers signed the requirement into law in December.

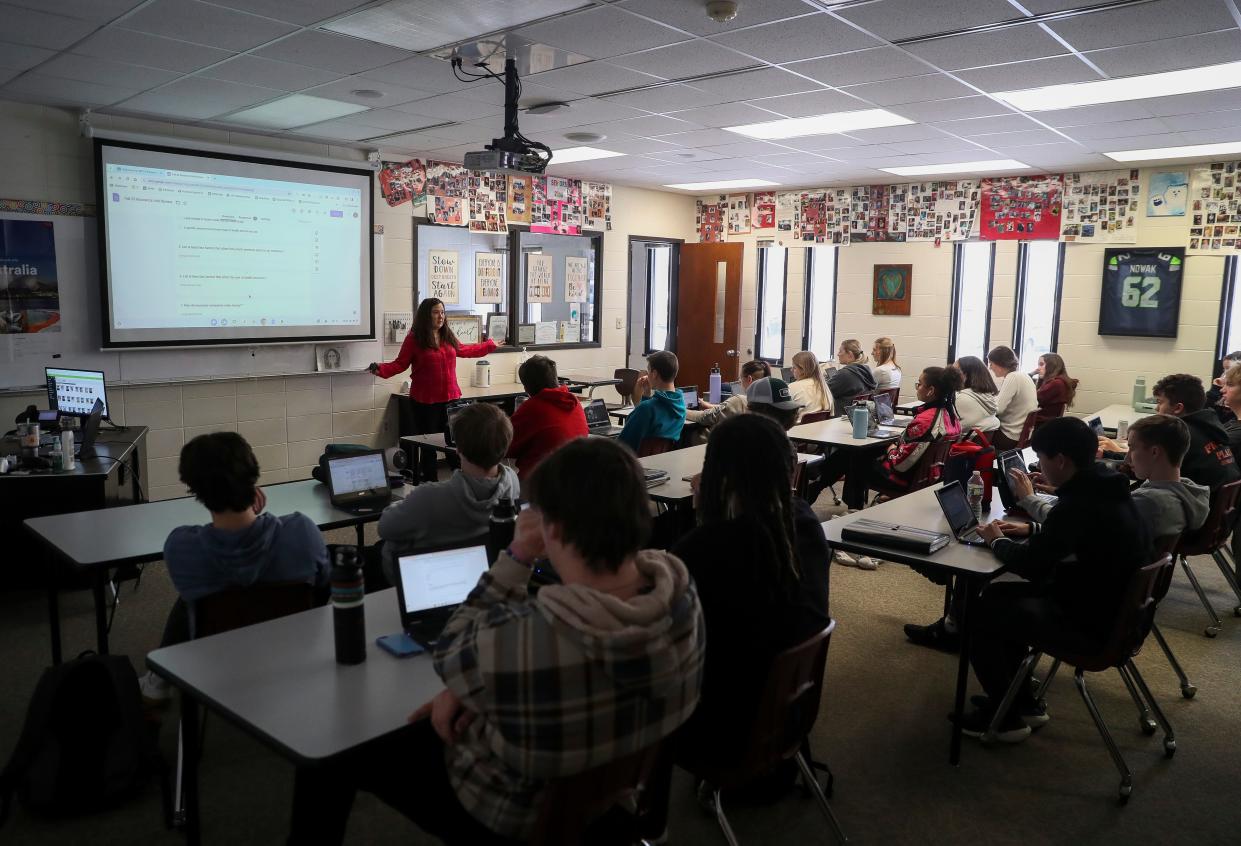

Most teenagers don't know how credit card debt works or how to start investing in the stock market, but it's something they can easily learn in school. Herrild has been teaching an elective personal finance course at De Pere High School for 18 years.

The course covers topics ranging from paying for college to banking, and throughout the semester, Herrild sees students have those "ah-ha" light-bulb moments.

"One that just sticks out in my mind that I really remember — it was from spring last year — a girl had been in class for three days," she said. "And after three days, she came up and she's like, 'Can I just tell you that I have learned more useful knowledge in three days than I think I did in like a year and a half of math.'"

Kids are excited to learn about finances, Herrild said, because everyone at some point has to deal with money.

Wisconsin had personal finance instruction, but didn't require a course

Wisconsin previously required that schools teach about personal finance but left it up to each district to determine how they teach it. For example, some could dedicate a whole course to the subject, while others might have just a few lessons in a business or economics class.

About 35% of school districts in the state already required students to take a standalone personal finance course to graduate, including Milwaukee Public Schools and the Green Bay School District, according to Next Gen Personal Finance, an organization that advocates for teaching financial literacy in schools.

But Herrild wanted all high school students to be required to take a full course on personal finance, so they could learn about doing their taxes, saving for retirement and how to understand a pay stub.

"If I grow up only seeing my family not trust banks and rely on payday lenders ... if that's all that I ever see and all that I ever know, then that's what I'm going to continue doing," Herrild said. "When you are given the chance to know better, you have the chance to do better."

"I just feel so strongly that this is such a social justice issue, and kids deserve this," she continued.

Learn who's running for school board: 15 school board seats are up for election in the Green Bay area. Here's who's running

For most of her teaching career, Herrild has worked to make that a reality. She wasn't successful in getting a requirement implemented locally at her district, so she teamed up with Next Gen Personal Finance. The organization has a goal of getting every state to require a personal finance course by 2030.

In 2022, Herrild headed to the state capitol in Madison with other educators from across the state to testify in support of such a requirement — something she never thought she'd do.

Trying to change legislators' minds

Despite having prepared written testimony, Herrild threw it aside and improvised her whole speech in front of the Assembly Committee on Education back in 2022.

"We, as Wisconsin, need this. We can't afford to have citizens who carry that much debt, and this is for the good of all of us," she recalled saying.

Several of the representatives on the committee said they'd come into the hearing opposed to requiring a personal finance course, Herrild said. But then they said her testimony and that of other educators and students changed their minds.

Despite that, the bill died in committee, which was a crushing, according to Herrild.

"It felt like, oh, my gosh, politics really does suck."

But in March, another bill was introduced, and Herrild went back to the state Legislature to testify again, this time with her daughter Katelynn.

Katelynn, who was a freshman at the time, gave her own testimony to the Senate Committee on Education on why having a personal finance course requirement is important.

"I will never ever forget (that) — I mean, I can't even describe the level of pride I have as a mom, much less as a teacher," Herrild said.

Instead of sitting in committee, the bill advanced through both chambers and made its way to the governor's desk.

In December, Gov. Tony Evers signed a requirement into law that all Wisconsin high school students must take half a credit of personal finance to graduate.

More on De Pere schools: De Pere School Board doesn't ban flags but increases how often books are reviewed

Wisconsin is the 24th state to pass such a requirement, according to Next Gen Personal Finance. The organization lobbied to get the requirement passed in the state. Wisconsin joined the ranks of West Virginia, Indiana, Minnesota, Connecticut, Louisiana and Oregon, all of which passed similar requirements last year.

Herrild was able to attend the bill's signing, the final step in her two-decade-long journey to get the requirement in place.

"The fact that we can believe in something, to stand up for it and persist, and make a difference is so huge," she said.

Danielle DuClos is a Report for America corps member who covers K-12 education for the Green Bay Press-Gazette. Contact her at dduclos@gannett.com. Follow on Twitter @danielle_duclos. You can directly support her work with a tax-deductible donation at GreenBayPressGazette.com/RFA or by check made out to The GroundTruth Project with subject line Report for America Green Bay Press Gazette Campaign. Address: The GroundTruth Project, Lockbox Services, 9450 SW Gemini Drive, PMB 46837, Beaverton, Oregon 97008-7105.

This article originally appeared on Green Bay Press-Gazette: Thanks to this De Pere teacher all students must take personal finance