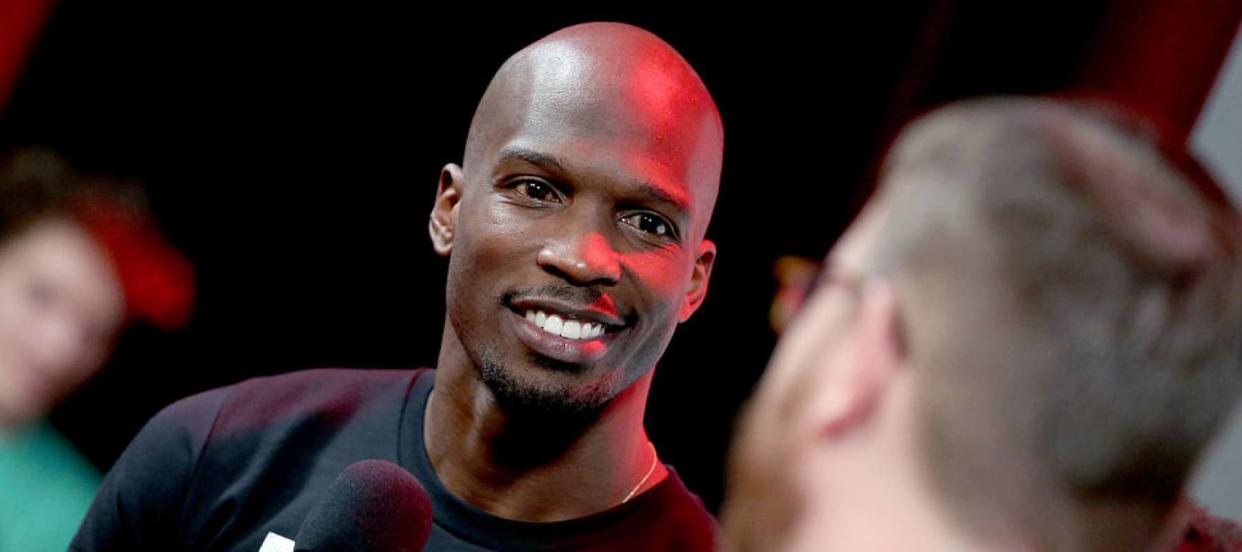

Chad ‘Ochocinco’ saved 83% of his NFL salary by buying fake jewelry and sleeping in the stadium — here are 5 ways to preserve your wealth at an all-star level

Disclaimer: We adhere to strict standards of editorial integrity to help you make decisions with confidence. All links marked with an asterisk ( * ) are paid links.

There’s nothing money can buy that’s bigger than your name — at least that’s what retired NFL star Chad Johnson — nicknamed ‘Ochocinco’— told Fox Sports host Shannon Sharpe when explaining his frugal spending habits.

The former wide receiver for the Cincinnati Bengals and the New England Patriots made close to $49 million over 11 NFL seasons, according to Spotrac — and using his unique money mindset, he claims to have saved 83% of that astonishing total.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Inflation is still white-hot — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

What makes Johnson’s money management extra impressive? Many iconic NFL stars have gone broke after falling prey to the League’s extravagant spending culture and other financial challenges like divorce or suffering a career-ending injury.

Ochocinco wore fake jewelry from Claire’s, only ever leased his exotic cars and flew on budget airlines to save money. He even admitted to living in the Bengals’ stadium for two years so he didn’t have to rent or buy a house.

While your career earnings may pale in comparison to Ochocinco’s cool $49 million, here are five ways to preserve and build your wealth at an all-star level.

Save like Ochocinco

According to Mike Olivia — a registered financial advisor with the NFL — the optimum savings rate is 20%. Still, most people struggle to save even 5% due to ongoing expenses like mortgages, insurance, and paying off loans.

One of the easiest ways to reap some major savings is by shopping around for better home insurance rates.

With SmartFinancial’s* free online platform you can explore the best home insurance rates in your area by simply answering a few questions about yourself.

SmartFinancial does the taxing legwork of exploring insurance options for you by instantly sorting through over 200 insurers* and compiling a list of the best quotes available in your area within minutes.

Put your money to work

How do rich people get rich — beyond inheriting money or landing a cash windfall like freshly-drafted NFL players?

“It's business ownership, it's having some interest in a business (whether it's your own or another) such as stock options, RSUs, or some other ownership of stock,” said Olivia, “Or it's likely to be real estate, or some passive income vehicle.”

While you may not consider yourself rich, it’s still worth accumulating assets (if you can) to help you reach your long-term financial ambitions.

First National Realty Partners* lets accredited investors own a share of institutional-quality properties leased by national brands like Whole Foods, CVS, Kroger and Walmart — and collect stable grocery store-anchored incomeon a quarterly basis.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Play defense

With NFL stars, a career-ending injury is common, said Olivia, which is why he advises players to buy disability insurance.

“Their income, bonuses, performance-based compensation — all of those things can be insured, but a lot of these athletes don’t have the time [to think about personal risk management],” he said.

You can perform your own personal risk management amidst rising inflation by cushioning your finances with inflation-hedging assets, such as precious metals. Opening a Gold IRA with Gold Gate Capital* might be the place to start.

By opening a Gold IRA*, you’re looking out for your future self and cushioning your retirement. Opting for a Gold IRA gives you the opportunity to diversify your portfolio and stabilize your finances.

Get advice from a coach

Spur-of-the-moment financial decisions driven by FOMO — fear of missing out — do not always end well.

Olivia said it’s better to take a step back and calculate the risks, perhaps with the help of a mentor or a financial professional.

WiserAdvisor’s* free platform connects you with experienced financial advisors. It’s a great tool to use to get financial guidance that is suited to your unique needs.

Whether it be tips on safeguarding your savings, making the right investments or even spending your money strategically, WiserAdvisor’s vetted professionals have got you covered.

Just answer a few questions* and within minutes WiserAdvisor will pair you with a list of financial advisors to choose from.

What to read next

Here's how you can invest in rental properties without the responsibility of being a landlord

'The biggest crash in history': Robert Kiyosaki warns that millions of 401(k)s and IRAs will be 'toast' — here's what he likes for protection

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.