Certified Check vs. Cashier’s Check: Here Are the Differences

When you buy a big-ticket item like a car or make a large payment, such as a down payment on a house, you may be asked to pay with a cashier’s check or certified check. These checks are less likely to bounce than standard personal checks and are safer than carrying cash.

While they seem very similar, a key difference is that the funds from a certified check come directly from the account holder’s bank account, whereas the funds from a cashier’s check are drawn from the bank’s own account. Keep reading to learn about other differences between these two types of checks.

See: How To Guard Your Wealth From a Potential Banking Crisis With Gold

What Is a Certified Check?

A certified check is a personal check with a notation from the bank indicating that the signature is legitimate and the funds are available in the account. The notation is typically the institution’s stamp or the signature of an employee. When the check clears, the money is removed from your account just like other checks you write.

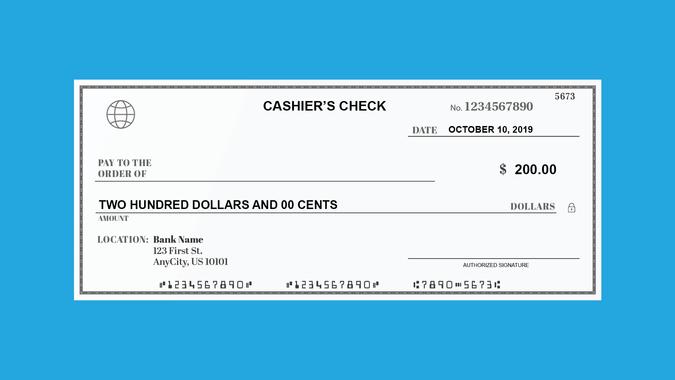

What Is a Cashier’s Check?

A cashier’s check is a check issued by a bank or credit union and drawn from its own account instead of the depositor’s account. To get a cashier’s check, you must visit a bank branch or request one through the bank’s website. The bank will move the money for the check from your account to the bank’s account. Then it issues the check from its account.

What Is the Difference Between a Certified Check, a Cashier’s Check and a Money Order?

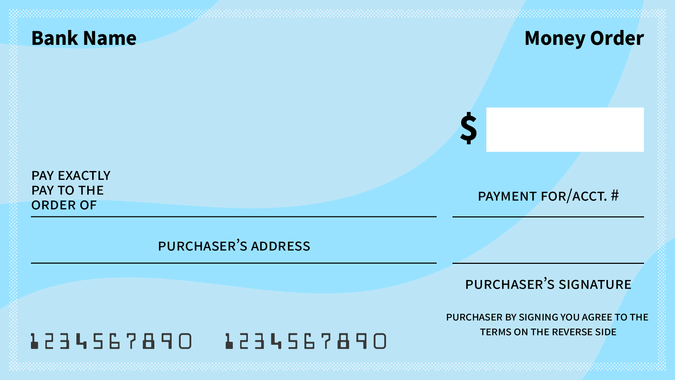

Certified checks, cashier’s checks and money orders accomplish the same goal of providing guaranteed funds to a recipient. But there are some differences between the three. Here’s a look at how these forms of payment compare.

Funding Source

When you get a cashier’s check, you give the bank the amount the check will be made out for. The bank then deposits the funds into its account and writes the check. In essence, this ensures the check will go through because you’ve already provided the cash to cover the value of the check.

The funds from a certified check come directly from your bank account when the receiver cashes or deposits it. Your bank will place a hold on your account for the amount of the certified check.

The funding source for a money order is cash. When you purchase a money order, you typically bring cash to the financial institution, agency or retailer that issues the money order. It’s also possible to pay for a money order with a debit card, and that money comes out of your account immediately.

Signature on the Check

Since a cashier’s check is a check that comes from the bank, the bank’s signature goes on the check. On the other hand, the account holder signs a certified check just like the other personal checks they sign. The person buying a money order signs it after they pay for it.

Availability of Funds

The Electronic Code of Federal Regulations requires banks to make funds for certain types of deposits available the day after putting the money into an account. Both cashier’s and certified checks as well as money orders fall under this requirement. Although a cashier’s check and certified check will not clear immediately, the funds should be available the following business day.

If you deposit a cashier’s check, money order or certified check on Wednesday, you should have access to the funds on Thursday in most cases. However, the bank may delay access to the funds under certain conditions, such as repeatedly overdrawn accounts and checks written for sums greater than $5,000.

Why Would You Need a Certified Check or Cashier’s Check?

You may need to provide a cashier’s check or certified check to make large purchases and when the payee wants to be sure the funds will be available. These situations include:

Making a rental housing security deposit

Handling real estate purchase transactions

Buying an automobile

Paying court fines and traffic citations

Security Deposit Example

If you rent an apartment for $2,000 per month, the landlord might ask for a two-month security deposit in guaranteed funds. You can walk into a bank, give the teller $4,000 — plus the cashier’s check fee — and the teller will issue you a check made out to your landlord for $4,000. The bank is the issuer, and the bank’s funds fully back the cashier’s check.

How To Avoid Check Scams and Fraud

Cashier’s checks and certified checks may be safer than personal checks, but scammers also use them. Knowing what to expect can help you protect yourself against scammers. According to the Federal Trade Commission and the American Bankers Association, the following scams are common:

You’re told that you won a prize and receive an advance on the winnings. You later find out that you need to pay for taxes, shipping and handling or processing fees or that you received an excess amount of money that needs to be returned. Not only will you be out the “prize” money, but you’ll also lose out on the fees you sent.

Someone pays for an item or service with a fake certified or cashier’s check and will overpay. When you discover that the check amount is too high, the fraudster will ask you to return the excess funds.

You get hired as a mystery shopper and are paid with a counterfeit bank check. The person who hired you then sends you another check to cash against your account and tells you to wire the funds using a money transfer business to evaluate its services.

In all of these cases, the scammers hope that your bank won’t discover the check is fraudulent until after your funds clear the scammer’s account. The FTC warns that if you deposit a fraudulent check into your account, the bank can come after you for the money when it sees it doesn’t clear.

Precautions Against Check Fraud

Here are some precautions you can take to avoid being the subject of a fake check scam:

Make sure the bank listed on the check is real. If you’re unsure, you can use the FDIC’s BankFind Suite to verify its legitimacy.

Call the bank to ensure the check is legitimate. But get the bank’s phone number from its website — don’t use the number on the check in case it’s fake.

If you weren’t expecting to receive the money, be on high alert and automatically assume the check is counterfeit.

When the amount on a check is higher than expected, don’t refund any money without first verifying the check’s validity.

Look for signs that the check may be fraudulent, including smeared colors, spelling errors in the name or address, or an MICR number that doesn’t match the check number.

Certified Check vs. Cashier’s Check: Which Is Better?

If a situation requires an official bank check, either a cashier’s check or a certified check will likely be acceptable. Unless the recipient specifically requests a specific payment method, you can choose the one that is most convenient for you. For many people, the answer is cashier’s checks.

You may find it easier to get a cashier’s check from your local bank since they tend to be the more common offering. If you bank with an online bank, a cashier’s check is your only choice.

Cost is another consideration. Some banks and credit unions provide cashier’s checks or certified checks as a complimentary benefit for customers, while others charge a fee. The fee for a cashier’s check usually ranges from $10 to $20, depending on the bank and delivery method. If a fee applies for a certified check, it generally can be as high as about $15.

Valerie Smith contributed to the reporting for this article.

This article has been updated with additional reporting since its original publication.

This article originally appeared on GOBankingRates.com: Certified Check vs. Cashier’s Check: Here Are the Differences