What Is a Cashier’s Check? Definition, Fees and How To Buy

When you’re making large purchases or exchanging significant sums of money, you’ll typically want to use a cashier’s check for the transaction. From renting a new apartment to purchasing a high-ticket item, many businesses and individuals require a cashier’s check for an added layer of security and to ensure they’ll receive the promised funds.

But what is a cashier’s check, and where can you get one when you need it? Keep reading for a look at exactly what a cashier’s check is, why it’s used and the steps involved in getting one.

What Is the Purpose of a Cashier’s Check?

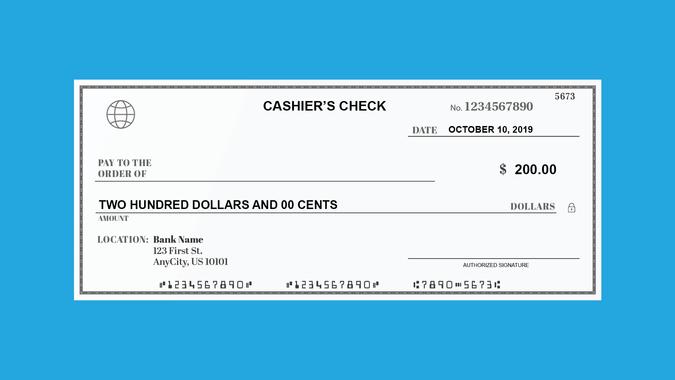

Unlike a personal check, a cashier’s check is a form of payment directly drawn on a bank’s funds. It doesn’t depend on your personal account to cover the amount. Cashier’s checks are, in a sense, “pre-paid” by the person who gets the check.

After receiving the funds to cover the amount of the check and any additional fees, the bank will then write a check out of its own money with a specified designated payee. It’s then guaranteed directly by the bank or credit union. This makes it a safe bet for the recipient, as they know the funds are guaranteed by a financial institution and the check won’t bounce.

Some common situations that require a cashier’s check include:

Putting a down payment toward a new vehicle or boat.

Providing a security deposit for an apartment rental.

Making a real estate purchase.

Other companies require a cashier’s check if they need funds to settle quickly. This is common when working with brokerage firms.

How To Get a Cashier’s Check: 5 Steps

Though you likely won’t find yourself needing a cashier’s check often, knowing how to handle the process ahead of time can make whatever large purchase or commitment you’re funding that much easier to navigate. Here’s a look at five essential steps to getting (and using) a cashier’s check.

Plan a visit to your bank or credit union. The easiest way to get a cashier’s check is to visit a bank where you already have deposit accounts, such as your bank or credit union. Many banks require you to be an account holder, so be sure you bring all necessary proof of ID with you.

Prepare the information necessary for the check. Your bank or credit union will require some important details from you. You’ll need the name of the payee (the person or business who will cash the check) and the exact amount you need the check for. It’s important to get these details right, as a cashier’s check can’t be altered once it’s drafted.

Fund the check and cover any fees. The bank or credit union will either handle a cashier’s check like a window transaction or, in some cases, may deduct the check’s amount from your account. They’ll also likely charge a service fee, which varies from one institution to another and isn’t included in the amount of the check, so be sure you bring enough money to cover both.

Verify and receive the check. After double-checking all of the information to be sure it’s correct, the bank or credit union will issue a check for the total amount drawn on its own funds. The cashier’s check is then a legal and valid form of payment.

Securely store your check until you plan to use it. Once your cashier’s check is in your hands, treat it like cash. If it gets lost or stolen, it can be complicated and difficult to replace. Always ask for a receipt, which may be helpful if any issues arise later on, such as the check going missing or being altered in some way.

Limits and Restrictions of a Cashier’s Check

If you happen to lose a cashier’s check, you might think you can ask the bank that issued it to place a “stop payment” order. Unfortunately, because the check is drawn on the bank that issued the check — not from your account funds — the bank generally must pay the check once it’s presented. However, you still need to notify the issuing bank if you lose a cashier’s check.

Additionally, if you want the bank to issue a new cashier’s check, the bank will require you to purchase an indemnity bond for the same amount as the lost check. This needs to happen before it will issue you a new cashier’s check. An indemnity bond ensures that you will be liable for any losses that occur — instead of the bank — if the original cashier’s check is presented for payment.

Some insurance companies sell indemnity bonds, but they can be difficult to obtain. Plus, after purchasing an indemnity bond, you might still have to wait up to 90 days before the bank will issue a replacement cashier’s check.

How Much Does a Cashier’s Check Cost?

Fees for cashier’s checks differ across financial institutions.

Bank | Fee | Fees Waived? |

|---|---|---|

$10 | Free for Premier Plus, Secure and Sapphire Checking | |

$15 | Fee waived for Preferred Rewards | |

$10 | Fee waived for Citi Priority Account and Citigold® Account | |

$10 | Free for military customers who have a U.S. Bank Smartly Checking Account | |

$5 – $10, depending on state | Fee-free for Performance Select Checking® and Foundation Checking® | |

$8 | Fees are mandatory for all | |

2 free cashier’s checks for members each day; additional checks are $5 each | Fees are mandatory for all | |

$0 | N/A | |

$8 | Fee waived for Beyond Checking, 60 Plus Checking, Signature Savings, Private Tiered Checking and Private Tiered Savings | |

$10 | Fees are mandatory for all |

Is a Cashier’s Check Safe From Fraud?

Whenever money changes hands, there’s an opportunity for fraud, and cashier’s checks aren’t immune. Being aware of a few common cashier’s check scams can help you protect your cash and ensure you’re dealing with the real deal. Here are a few such scams to watch out for:

Work-From-Home Scam

If you’re offered a job as a “check processor” that seems too good to be true, it probably is. This is a relatively common scam where con artists posing as employers recruit unsuspecting people to “work from home” as check processors. The victims are then sent fraudulent cashier’s checks and instructed to deposit them into their own bank accounts.

The fraud kicks in when these well-meaning “employees” are told to forward the money to a third party, often someone posing as a client or a supplier of the fake company. In the meantime, any money you’ve sent to a third party is coming directly out of your pocket.

Once the bank identifies the cashier’s checks as fake, you’re left liable for the funds, leaving you out of pocket and potentially subject to penalties or legal action.

Rental Property Scam

Rental scams are a prevalent form of cashier’s check fraud that prospective landlords or anyone with a property for rent should be aware of. The scam works like this: An alleged renter, usually from out-of-state, contacts you about your property. They’re eager to move, usually due to something like a new job, and they offer to send you a cashier’s check covering the first and last month’s rent, as well as a security deposit.

Once you deposit the check, things get more complicated. Your potential renter calls and will claim that the job fell through or give some other excuse for not being able to move in after all. They’ll “kindly” offer to let you keep the security deposit, but will request the return of the rent money.

If the scam works, you’ll refund the scammer’s “rent” before your bank calls to inform you that the original cashier’s check was a fraud. After you’ve sent the scammer your own money, there’s little chance of recouping your losses. To avoid falling prey to such scams, always wait until your bank clears a cashier’s check fully, which can take a week or more, before giving anyone a refund.

How To Avoid Scams and Fraud

The reason these scams work is that identifying a fraudulent cashier’s check can take weeks. By the time a check is identified as counterfeit or drawn from a bank that doesn’t exist, you may be out a considerable amount of money due to one of the above scams, and your bank will hold you accountable for the funds you’ve sent–and bank transfers are immediate. Here are some tips to avoid getting scammed when using a cashier’s check:

Use caution when accepting a cashier’s check from someone you don’t know.

Contact the financial institution that the cashier’s check was issued from to find out if it’s valid. Do your own research to find contact information; don’t rely on the phone number printed on the check.

Never accept a cashier’s check that’s written for more than the amount you asked for.

Ask your bank when funds from the check will be made available to you and consider not spending any of those funds until the check has fully cleared.

Final Take

Even if a company doesn’t require a cashier’s check, there are times it can still benefit you to use one, like making a rent payment quickly to avoid eviction or late fees. If you need to pay something quickly or just want a more secure method of payment, this may be the way to go.

Brandy Woodfolk, Cynthia Measom and Caitlyn Moorhead contributed to the reporting for this article.

Data is accurate as of Dec. 8, 2023, and is subject to change.

This article originally appeared on GOBankingRates.com: What Is a Cashier’s Check? Definition, Fees and How To Buy