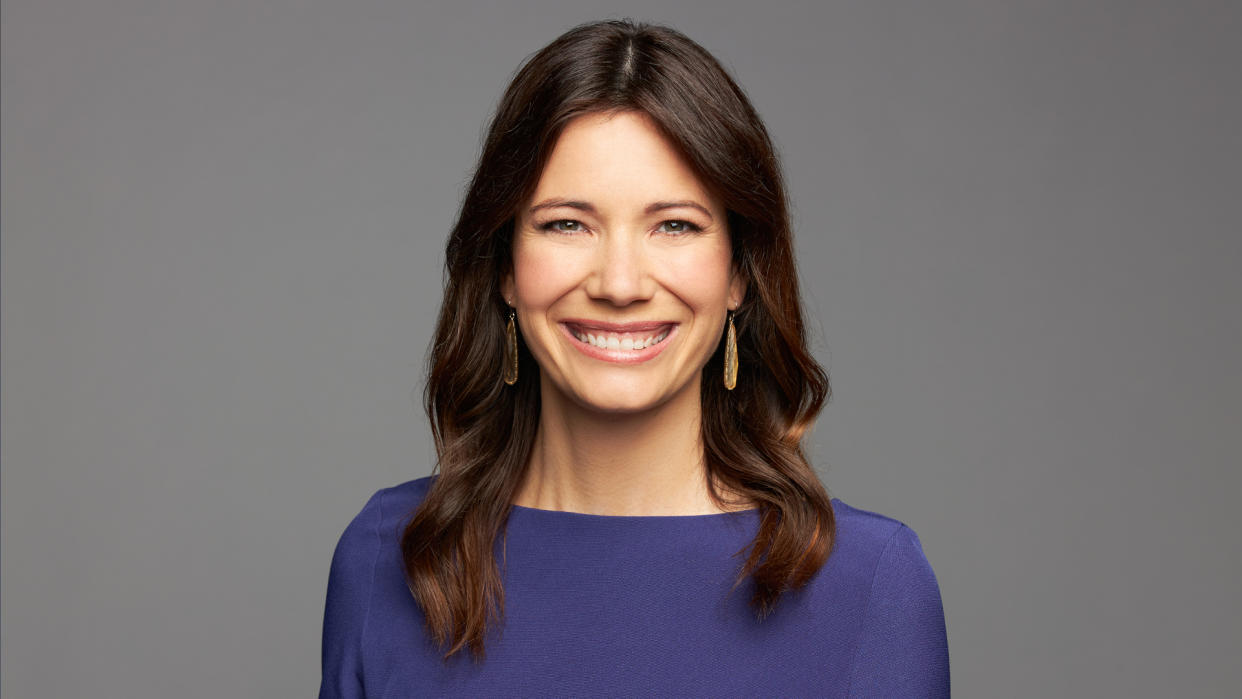

How To Calculate Exactly How Much House You Can Afford, According to Rachel Cruze

You want to buy a house, but you’re not sure where to set your budget. Before making any moves, stop everything and calculate exactly how much you can afford with an easy-to-follow guide from Ramsey Solutions expert, Rachel Cruze.

$2,000 Quarter? Check Your Pockets Before You Use This 2004 Coin

Discover: 3 Things You Must Do When Your Savings Reach $50,000

A two-time number-one national bestselling author, financial expert and host of “The Rachel Cruze Show,” Dave Ramsey’s daughter definitely knows a thing or two about making wise money moves. In fact, she only recommends starting the home-buying process if you have zero debt.

“At Ramsey Solutions, we teach people they can’t afford a house until they are completely debt free, have an emergency fund of three-to-six months of expenses and have a down payment of 20% or more,” she told GOBankingRates.

However, if you’re a first-time homebuyer, she said it’s okay to use a 5-10% down payment. If you meet this criteria, keep reading to learn her five-step plan to determine exactly how much house you can afford.

Don’t Spend More Than 25% of Your Net Income

You might get approved for a mortgage that equates to more than 25% of your net income, but Cruze advised against it in a Ramsey Solutions blog post. She said sticking to this rule will keep you from taking on more than you can handle and “ending up house poor.”

Therefore, if your net pay — or you and your partner’s combined net pay — is $7,500 per month, you wouldn’t want a mortgage greater than $1,875 per month. This includes all fees wrapped into your monthly payment, such as principal, property taxes, homeowner’s insurance and HOA dues.

Use a Mortgage Calculator

After determining the monthly mortgage amount you can afford, you’ll need to figure out the home prices this equates to. In her blog post, Cruze advised using a mortgage calculator to find this value.

The mortgage calculator will have you enter your desired purchase price, interest rate, down payment amount and loan term. When it comes to loans, the most popular product is the 30-year-mortgage, but Cruze told GOBankingRates that she will always recommend a 15-year-mortgage.

Take Our Poll: How Much Salary Would Buy You Happiness?

“At Ramsey Solutions, we suggest never having a monthly mortgage payment that’s more than 25% of your monthly take-home pay,” she said. “That said, if a 15-year mortgage has you going over that limit, it might be tempting to choose a 30-year mortgage to have a lower monthly payment, but in actuality, you’re just trying to buy a house you can’t afford.”

Cutting your repayment period in half has multiple benefits, she said. “Although a 15-year mortgage has higher monthly payments, the interest rate is lower and you’re paying off the principal faster, meaning you’ll pay a lot less in interest and pay off your house twice as fast,” she said.

Keep Closing Costs in Mind

They’re typically not at the front of a buyer’s mind, but closing costs shouldn’t be forgotten or underestimated. Generally speaking, closing costs average 2-5% of the purchase price of the home, according to Zillow.

For example, if you’re purchasing a home for $100,000, you’ll need to have $2,000-$5,000 on hand for closing costs. In her blog post, Cruze said you should hold off on purchasing a home until you have enough saved for a 20% down payment, plus closing costs.

Make Room for Unexpected Expenses

Homeownership is rewarding, but certainly not cheap. If you’re a first-time homeowner or planning to make a few improvements to your new home, you should create extra space in your budget for unplanned expenses, according to Cruze’s blog post.

She noted that this may include increased utilities, maintenance and repairs and upgrades and additions. GOBankingRates also asked her how much extra cash she would recommend having on hand if you’re buying a fixer-upper.

“Before gathering your hammer and nails, the most important tool in your toolbox for a fixer-upper is your budget,” she said. “I like to say, ‘move at the speed of cash.'”

She said this might involve pacing yourself a bit with upgrades. “If you don’t have the money to do everything at once, cash flow project by project,” she said. “Adding an additional 20% into your budget is also a good idea, because we all know, one project or problem typically leads to another.”

Save Up for as Big of a Down Payment as Possible

In her blog post, Cruze noted that the size of your down payment directly impacts the home you can afford. While she recommended purchasing a home with 100% cash, she said it’s okay to get a mortgage if that isn’t practical for your situation.

As previously noted, she advised having a down payment that’s at least 20% of your home purchase price. Her only exception was for first-time buyers, for whom she said it is OK to put down 5-10%, but do realize you’ll have to pay private mortgage insurance — i.e., PMI — that usually costs 1% of the total loan value.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: How To Calculate Exactly How Much House You Can Afford, According to Rachel Cruze