A Burger King employee who never missed a day of work in 27 years got a goodie bag for his service. The internet gave him $450K. Are employers not meeting the needs of workers?

Burger King employee Kevin Ford hadn’t missed a day of work in 27 years. In the early days, his focus was on paying the bills and raising two daughters as a single father.

“I was barely making rent,” Ford told USA Today while recounting his story.

The 56-year-old Las Vegas man, who has been working in food service at the Harry Reid International Airport since 1995, was presented with a meager goodie bag in 2022 that included a movie ticket, a Starbucks cup, candy, a couple of pens and keychains to commemorate his nearly three decades as an employee.

Don't miss

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

Can I collect my dead spouse's Social Security and my own at the same time? Here are 5 secrets of 'survivors benefits' you need to know

Suze Orman: If you think you're ready for retirement, think again — 3 money moves to avoid being poor when you're retired

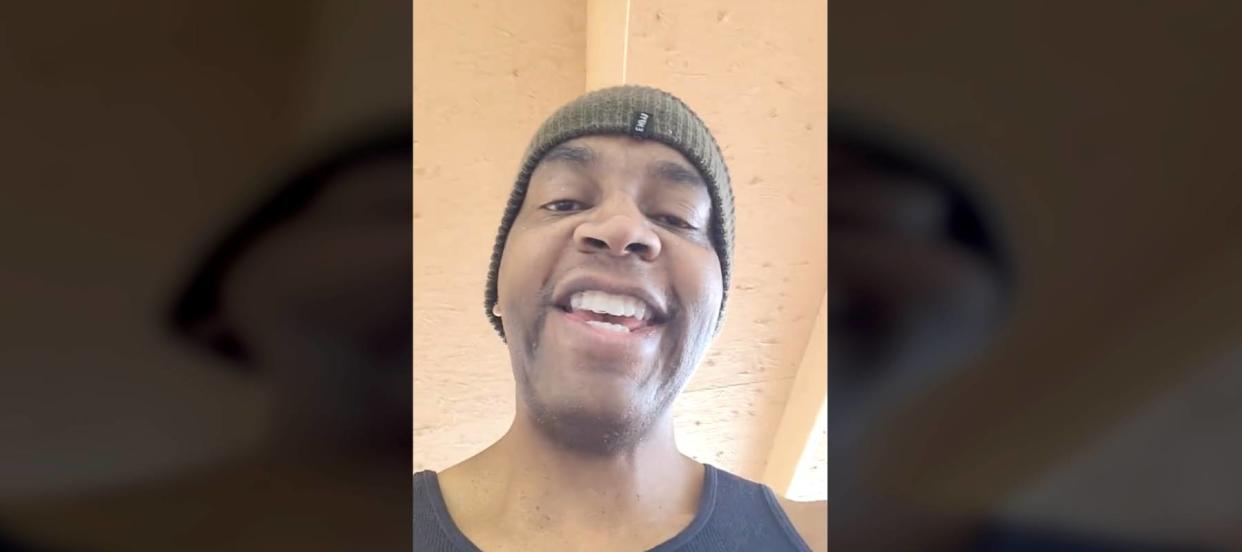

It was no cash bonus, or something else he could meaningfully put toward his retirement savings, but he was grateful nonetheless. He posted a video on TikTok showing off his manager’s gifts, and the clip unexpectedly went viral.

In response, one of his daughters created a GoFundMe page for him, and donations from viewers who were amazed by Ford’s hard-working, humble nature began to pour in. As of Feb. 28, over 15,000 donations had put more than $457,000 in his pocket.

He used the life-changing funds to pay off debts, purchase plane tickets to visit his grandchildren, put money toward his retirement and buy a home just 15 minutes outside of Las Vegas, according to USA Today.

“I know it’s not a mansion, but it's mine,” Ford said while showing off the property in a video clip posted Dec. 29.

“I want to thank everyone all around the world for what you’ve done for me, something that I thought would never be possible for me: home ownership.”

Since starting his job at the airport, Ford remarried and fathered another pair of daughters with his second wife. He has set aside some additional money for his children, per USA Today.

Ford’s positive attitude is unwavering, however, one might wonder if an employee as dedicated as him might deserve more than a movie ticket and a few pieces of candy from their employer after decades of service. This is a rare case where a loyal employee was rewarded thanks to the kindness of strangers. But it also highlights, at times, how little workers can count on their employers to meet their needs, especially as they approach retirement.

Disappearance of pensions

One example of how employers have become less reliable is the demise of penison benefits. Decades ago, number of private companies in the U.S. offered their employees a pension plan. Employers would contribute, invest and manage retirement funds for their workers, who then received guaranteed monthly checks after they retire, often for the rest of their lives.

Over time, many of these companies ended up closing down their pension programs in favour of sponsoring 401(k) accounts, which put more onus on workers to invest, manage and save money for retirement.

“We’ve shifted from a more paternalistic system to a do-it-yourself savings plan,” Karen Friedman, executive director of the Pension Rights Center, told CNN.

Participation in pension plans has dropped steeply, and they’re not likely to make a comeback. There were 27.2 million participants in private-sector pension plans in 1975 — a number whittled down to 12 million by 2020, according to CNN, citing the Congressional Research Service. In that same period, employees in the private sector partcipating in 401(k) or profit-sharing plans soared from 11.2 million to 85.3 million.

If you wish to bolster your financial security and build retirement savings beyond contributing to a 401(k) plan, consider some of the following steps.

Make a plan

Whether you’re saving up for your first home or working on paying off your debts, you’ll need to come up with a solid plan and set yourself some tangible goals.

For example, perhaps you can start by automating your credit card payments. Or, if they’re too difficult to tackle all at once, start with your highest-interest debt and work your way down so you don’t accumulate too much interest.

Read more: Here's how much the average 60-year-old American holds in retirement savings — how does your nest egg compare?

If tackling those debts seems like a tall task, you can take a different approach and pay off your smallest debts first and work your way up toward your larger ones. This method may accrue more interest overall, but the end goal is the same — to get rid of debt, period.

Finally, if you’re still feeling stuck, consider chatting with a financial adviser who can evaluate your situation and help you plan for the future.

Budget and save

Now that you’ve got a plan, you might be unsure about how to scrounge up the funds to complete your goals — but taking a look at your spending can be a good place to start.

There might be ways for you to cut down on costs, like canceling that streaming subscription you never use or securing a lower rate on your car insurance policy.

Perhaps try budgeting for your everyday expenses with a money management app, or use the cash stuffing hack. Make sure to cover your fixed expenses and necessities first before moving onto your savings and discretionary purchases.

Boost your income

If you’re in a place where your existing income and expenses leave you with nothing left each month, look into other income streams to give you more of a buffer.

You could monetize one of your hobbies and set up a side hustle. If you’ve got a spare room at home that’s going unused, consider cleaning it up and posting an ad on Airbnb to rent it out.

Or, do some research and start investing in the stock market. Some platforms will build you a customized portfolio and monitor and manage your investments, rebalancing where needed. You could start with using your spare change, or go a little further with real estate, such as investing in apartment buildings or vacation rentals, to grow your funds.

What to read next

'The biggest crash in history': Robert Kiyosaki warns that millions of 401(k)s and IRAs will be 'toast' — here's what he likes for protection

'We're looking at a downsized America': Kevin O'Leary warns any new house, car and lifestyle you enjoy will be significantly 'smaller' — here's what he means and how you can prepare

Bill Burr once complained to Joe Rogan that his bank took $28 every month 'for no reason' — now the government is taking action on these frustrating fees. Here's how you can avoid them

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.