Bullish on Marijuana Reform? This Cannabis-Focused ETF Could Be the Best Way to Invest in Pot Stocks.

Cannabis stocks have been hot buys of late as investors recently learned that the Biden Administration is going to reschedule marijuana. It's a big development for the industry, and it's welcome news for many cannabis companies. Potentially, it may even pave the way for further reform for the industry.

But investors should be careful. Many pot stocks, including Tilray Brands and Canopy Growth, may look like tempting buys. However, these are also investments that have been downright awful in recent years, and whose businesses remain deeply unprofitable.

What's the best way to invest in cannabis, if you're bullish on marijuana reform? To keep your risk down in this volatile industry, going with an exchange-traded fund (ETF) that focuses on U.S.-based pot stocks can offer you the best of both worlds.

Investors should focus on multi-state operators

Multi-state operators, or MSOs, have more to gain from marijuana reform than their Canadian counterparts (such as Tilray and Canopy Growth), which can't enter the U.S. pot market until it's fully legal. Further reform in the industry can, and likely will, take a while. The markets won't instantaneously open up for Canopy Growth and Tilray Brands just because marijuana is no longer a Schedule I substance.

Instead, there could be a more gradual process where legal obstacles are removed at the federal level for cannabis companies, such as being able to freely do business with the big banks, and perhaps even a path for MSOs to list on major U.S. exchanges such as the Nasdaq or NYSE. If that happens, MSOs could become more popular and visible, and trade at higher valuations.

A cannabis-focused ETF with good exposure to MSOs

If you want exposure to MSOs, a good ETF to consider is the AdvisorShares Pure US Cannabis ETF (NYSEMKT: MSOS), which even has "MSO" in its ticker symbol. Through the fund, investors can have exposure to all of the major MSOs, including Green Thumb Industries, Curaleaf Holdings, Trulieve Cannabis, and many others. It's entirely focused on MSOs, which gives investors more direct exposure to these producers than other cannabis funds that are more diverse.

By focusing mainly on MSOs, investors can avoid risky Canadian-based pot stocks while positioning themselves for the potential gains that might come with marijuana reform, which will primarily benefit producers that are already operating in the U.S. cannabis market.

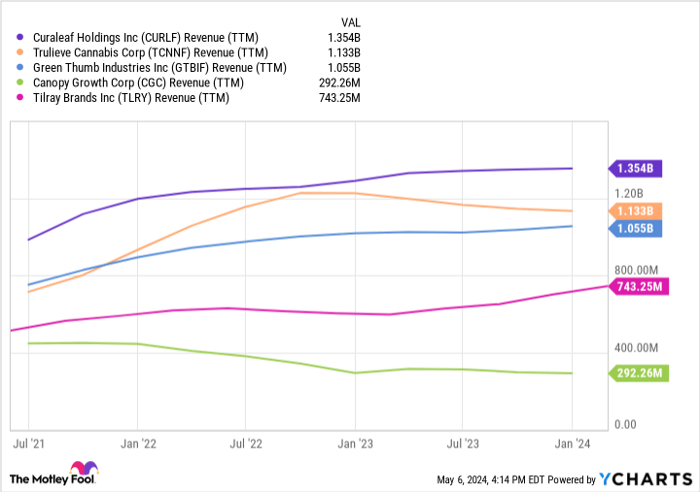

A quick look at the chart below shows you why MSOs might be the best of the bunch. They not only have better near-term growth prospects than Canadian pot stocks, but they are also already generating much more in revenue.

CURLF Revenue (TTM) data by YCharts.

Should you invest in the cannabis industry?

Investing in the cannabis industry is risky, regardless of which stocks you choose. The AdvisorShares Pure US Cannabis ETF has declined by nearly 80% in value in just the past three years. The danger with the industry is that there's often a lot of hype tied to it, but often, there isn't a lot of substance to back it up, leading to disappointment later on. Marijuana legalization in the U.S. is a great example of that. While many people have been hopeful of it for years, it has failed to materialize.

Unless you're willing to be patient and are investing money you can afford to lose, it may be better off to wait to invest in the industry until there's something more substantive than just a rescheduling of cannabis taking place. But if you do want to invest in the industry and are aware of the risks, the MSOS ETF can give you a good, diverse option and exposure to the top U.S.-based producers.

Should you invest $1,000 in AdvisorShares Pure US Cannabis ETF right now?

Before you buy stock in AdvisorShares Pure US Cannabis ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AdvisorShares Pure US Cannabis ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Green Thumb Industries and Trulieve Cannabis. The Motley Fool recommends Nasdaq and Tilray Brands. The Motley Fool has a disclosure policy.