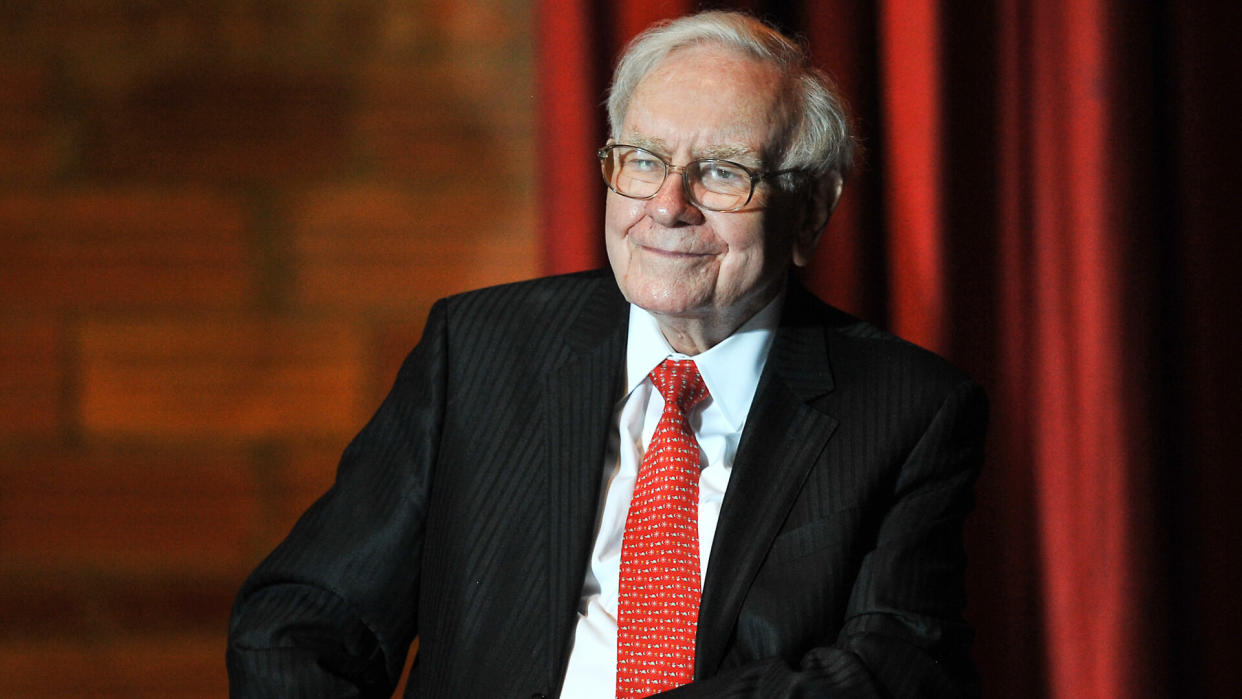

Building Wealth: Should You Trust Other Experts Over Warren Buffett?

Today, there are countless people claiming to be financial gurus who can help you get out of debt or even make you a millionaire. However, long before there were YouTube and TikTok influencers, there was Warren Buffett. Often called “The Oracle of Omaha,” Buffett is known for his sound investment advice and business savvy. He is still considered one of the richest people in the world and is at the helm of Berkshire Hathaway, one of the largest companies by market cap.

Learn More: Warren Buffett’s Parenting Rule: The Key to Raising Money-Savvy Kids

Explore Next: 6 Genius Things All Wealthy People Do With Their Money

With the increase in popularity of gurus on social media, we wanted to know whether people were turning to the tried-and-true advice offered by Buffett or a newer source. At GOBankingRates, we asked over one thousand adults what money expert they trusted most to teach them the basics of money and just 18% said Warren Buffett.

So, we asked financial experts to answer the question, “Should you trust other experts over Warren Buffett?” Here is their advice.

Also here is a controversial investing method approved by Buffett.

Who Do People Trust For Basic Money Advice?

Of those surveyed, only 18% of people said that they trusted the expert advice of Warren Buffett for basic money advice. Another nearly 18% of people said they would trust the counsel of Dave Ramsey.

Check Out: Warren Buffett: 6 Best Pieces of Money Advice for the Middle Class

What Other Money Experts Do People Follow?

When asked, slightly over 1% said they follow Grant Cardone for basic money advice and the same number said they would trust Ramit Sethi. Around 2% responded they trusted Robert Kiyosaki and slightly over 10% said they would trust Suze Orman. An astounding 50% replied that they sought the expert money advice of someone other than those listed above.

What Advice Is Buffett Known For Giving?

Warren Buffett is not only known as one of the world’s wealthiest people but also one of the smartest investors. While he has given a wide range of financial advice, his number one rule is to “never lose money.” He advocates simple principles such as avoiding debt, particularly high-interest credit cards. His most basic tips include minimizing risk by learning about money.

Why Should You Follow Buffett’s Advice?

Financial expert and co-founder of Boomer Benefits, Danielle Roberts, said, “Buffett’s investment philosophy, anchored in fundamental analysis, prudence and a deep understanding of businesses, has undeniably stood the test of time. His ability to uncover undervalued assets and patiently hold through market fluctuations has consistently delivered impressive returns over the decades. As such, for investors aligned with Buffett’s patient, buy-and-hold strategy, his advice remains a beacon of stability and wisdom.”

Why Consider an Alternative Expert’s Advice?

“However, the world of finance is not static,” Roberts said. “Technological advancements, geopolitical shifts and disruptive market forces continually reshape the investment landscape. In this context, diversifying sources of financial advice becomes imperative, allowing investors to glean insights from a spectrum of expertise beyond Buffett’s realm.”

“Alternative experts may offer unique perspectives tailored to specific market niches, emerging trends or alternative investment strategies,” she said. “For instance, experts in technology may provide invaluable insights into the transformative potential of emerging tech sectors, while specialists in sustainable investing can offer guidance aligned with environmental, social and governance (ESG) principles — a growing concern for many investors.”

“Moreover, individual circumstances play a pivotal role in determining the suitability of Buffett’s advice. While his long-term approach may resonate with some, others may have shorter investment horizons, different risk appetites or specific financial goals that necessitate a more agile and diversified strategy,” she said.

Who Should Follow Warren Buffett’s Advice?

Carter Seuthe, CEO of Credit Summit Consolidation, said, “I think Warren Buffett’s advice tends to be more relevant for those in the business or investing worlds. That doesn’t necessarily make it bad or unsound advice for more average people and households — just that there might be better sources of more relevant information and guidance.”

He said, “I would recommend looking closer to home in these cases, to financial professionals who are speaking to working-class households or those who are just starting out in terms of investments or wealth building.”

GOBankingRates surveyed 1,008 Americans aged 18 and older from across the country between March 26 and April 1, 2024, asking twenty different questions: (1) Has a lack of financial literacy caused you to struggle with your money?; (2) Which current money hot topic is most confusing to you?; (3) Which money expert do you trust most for teaching you the basics of money?; (4) Since the pandemic started in 2020, do you think you have become smarter about your money?; (5) What poor money habits did you learn during your childhood? (select all that apply); (6) What poor money habits did you develop in your early adult years? (select all that apply); (7) What poor money habits have had an impact on your marriage/partnership? (select all that apply); (8) What poor money habits do you worry about passing on to your kids? (select all that apply); (9) What aspect of buying a car do you find most challenging/confusing?; (10) What aspect of buying a house do you find most challenging/confusing?; (11) What aspect of paying off debt do you find most challenging/confusing?; (12) What concerns you most about planning for retirement?; (13) What best describes your feelings about investing?; (14) How much have you saved in the last year?; (15) How much debt have you acquired in the last year, not including mortgage debt?; (16) Do you currently bring in enough money to cover your bills?; (17) How much do you think about your financial status?; (18) What best describes your feelings about managing your money?; (19) What is your monthly car payment?; and (20) How much income do you think is needed for a middle-class family to live comfortably?. GOBankingRates used PureSpectrum’s survey platform to conduct the poll.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Building Wealth: Should You Trust Other Experts Over Warren Buffett?