Bitcoin 'just barely hanging on' ahead of historically weak September

After a rough sell-off through May and June, Bitcoin (BTC-USD) is having trouble finding buyer support.

As the asset closes out August, bitcoin is flashing signals that show it is "just barely hanging on" above $20,000, a level that has been a battleground for investors over the last several days.

Over the weekend, Bitcoin traded down to a 7-week low of $19,616. After recovering Monday, its price tumbled again on Tuesday, trading hands as low as $19,649.

As of Wednesday morning, bitcoin was trading near $20,300, a 7% drop in the past week and a 15% loss for the month, according to Yahoo Finance data.

“It remains plausible that Bitcoin is in a bottom formation range and would be historically similar to all past bear markets," James Check, a lead analyst at Glassnode wrote in a note Monday afternoon. "However, Bitcoin prices are just barely hanging on, and any uptick in the fundamentals would be a welcome change."

According to Check’s Glassnode report, Bitcoin investors are realizing around $220 million per day in net losses, a “modest magnitude” relative to the previous three months, yet still troubling as longer term bitcoin holders, or those holding more than 5 months, are selling at a loss between -35% and -45% on average.

Through August, trading volume in bitcoin has fallen by 7.69% to $1.5 trillion, according to Nomics.

Coupled with bitcoin's historical performance in September — an average loss of 6% since 2011 based on data collected by Yahoo Finance — the signals look even worse.

So far in August, the Proshares short bitcoin ETF (BITI), has risen by nearly 19%, reaching an all-time high on Monday. Meanwhile, Proshares' long bitcoin ETF (BITO) is down about 17% over the same period.

“It’s not difficult to make strong arguments against longing this market. There are very few positive narratives outside of the Ethereum merge. The macro backdrop offers a constant pain,” Vetle Lunde, an analyst with Arcane Research pointed out in a recent note.

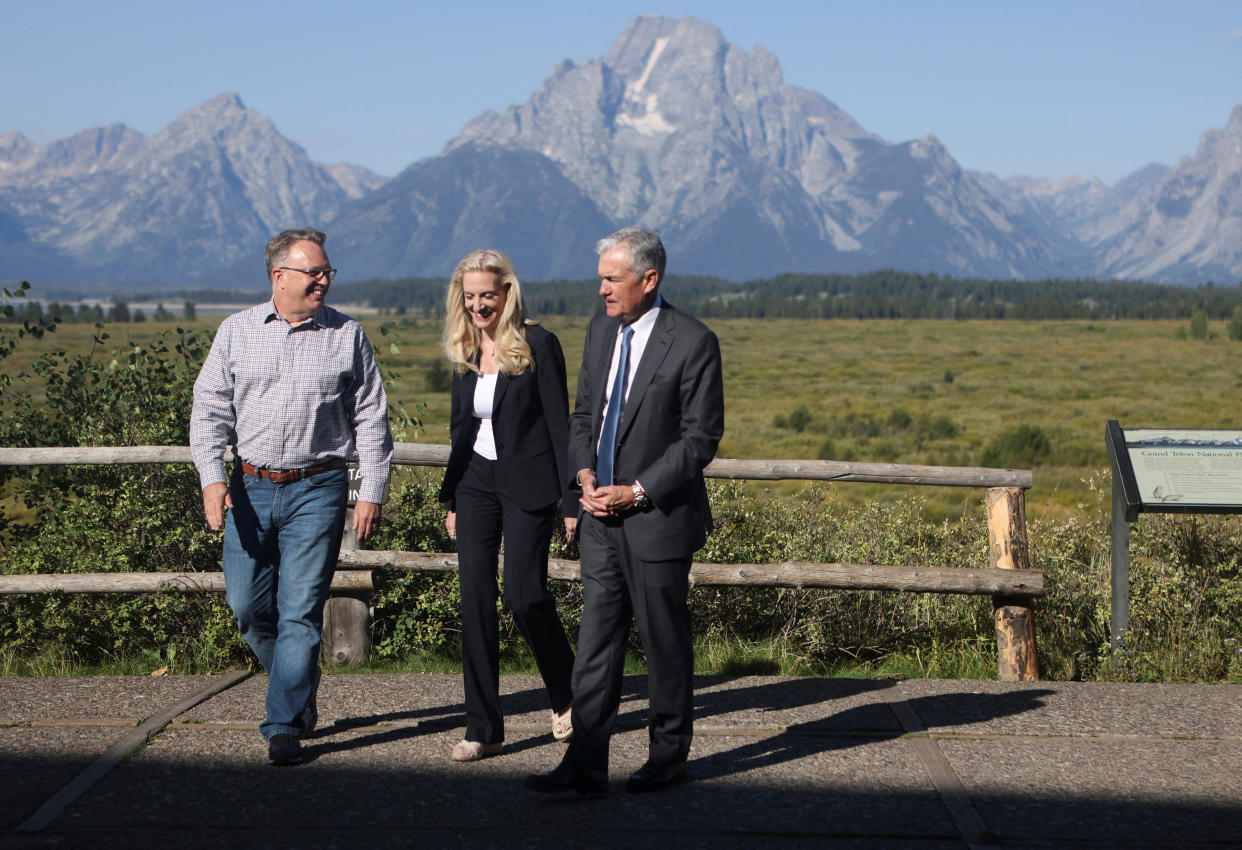

With investor fears renewed by Federal Reserve Chairman Jerome Powell’s latest warning at Jackson Hole, the U.S. central bank’s mandate to keep battling inflation continues to weigh heavy on risk assets.

The U.S. dollar (DX.Y.NYB) has gained over 3% since August 10 and now sits at a level not seen since May 2002. The dollar's strength bodes persistent trouble for cryptocurrencies, which have lost more than half of their total market capitalization value year to date.

"Bitcoin and ethereum are cascading. I'm beginning to wonder sometime soon, we won't even need to have these quoted on the side of the television screen," Mad Money host Jim Cramer said Tuesday night.

In the past three weeks, digital asset investment products have seen net outflows of $46 million, according to data from Coinshares. Last week, net outflows from bitcoin-related products alone totaled $29 million.

Coinshares notes, however, that overall volumes for crypto assets have been quite low of late, totaling just $901 million last week, the lowest since October 2020. "While history indicates this is in part due to seasonal effects, we believe it also highlights continued apathy following recent price declines," the firm said in its report.

Relative to bitcoin (ETH-BTC), ether the second largest cryptocurrency outperformed BTC (-5% v. -13%) over the last month as its blockchain proceeds towards its upcoming Merge transition. Year to date both have lost roughly 57% of their value.

Part of bitcoin’s changing dynamic might not simply hinge on how many investors are buying the asset, but how they trade it, said Luke Farrell, a trader with GSR.

“In earlier days, bitcoin was more driven by narrative speculation around crypto. You could speculate on it being new technology, anti-fiat currency, an inflation hedge, and the market capitalization was small enough that incrementally investors could move the price,” Farrell said.

Since the start of 2021, bitcoin has given away as much as 30% of its market share to other cryptocurrencies according to Coinmarketcap. Currently, the asset accounts for less than 40% of crypto's total value.

Active Entities, a similar metric used to gauge the asset's use as a payments network, is showing little growth in bitcoin's user base with traffic having reached its bare minimum within historical bounds during bear markets, according to Glassnode.

“Generally the larger new money coming in, the less linear exposure there is per dollar. That means new investors aren’t just looking for buy and hold strategies,” Farrell added.

For all its bearish signs, few other crypto assets can tout bitcoin’s level of decentralization and regulatory clarity, the most important aspect of blockchain technology said R.A. Wilson, CTO of 1GCX, an exchange that trades cryptocurrencies, commodities and carbon credits.

Wilson raised the concern that other cryptocurrencies — such as those that rely on proof of stake — can turn out not to be as decentralized as they let on.

Investors aren't currently "pricing in" the importance of decentralization, Wilson argued.

“We might have a little more volatility to the downside in September but I believe through October, November, December we’ll start to see some upside,” Wilson added.

—

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube