Bitcoin’s halving will be over in a flash—but reaping the benefits could take months

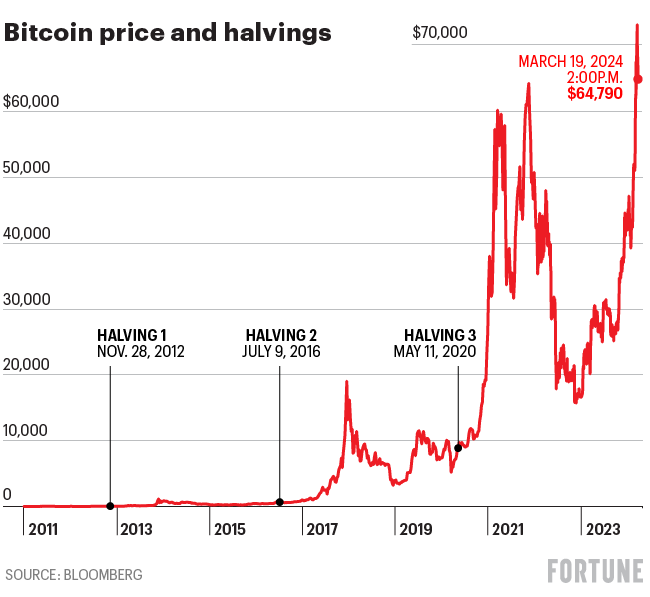

Bitcoin's “halving" is here. The event will see the supply of newly minted coin cut by 50%—this time it will drop from 6.25 to 3.125—and is expected in the coming hours. Occurring every four years, halvings are intended to keep Bitcoin inflation-resistant and has historically caused prices to soar. So, can we expect a Bitcoin price rally in the coming days?

Not exactly, experts told Fortune, as the industry may see an immediate “buy the rumor, sell the news” effect on price, which may already be underway. While Bitcoin rose from about $44,000 in January to an all-time high of almost $74,000 due to demand for exchange-traded funds and the halving, in the past two weeks, it’s dropped 12%.

This retreat was expected, Vetle Lunde, a senior analyst at K33 Research, told Fortune, because the halving has been both widely documented and is anticipated by the Bitcoin algorithm.

“The compounding effect of reduced issuance takes months to materialize, and we do not expect the halving to lead to any meaningful rally neither prior to, nor directly after, the fact,” he added, a view corroborated by analysts at Deutsche Bank in a report this week. Indeed, before the two previous halvings, in 2016 and 2020, major prices occurred in the immediate run-up to the halving— close to 20% and 40%, respectively.

Moreover, the analysts point to the impact of the increased production costs that will occur for Bitcoin miners as a result of the halfing.

“Participating in the process of guessing the hash and adding a block to the blockchain becomes less profitable as the reward to mining decreases," one analyst noted. As a result, the so-called hashrate—the total computational power being used to mine Bitcoin—has plummeted by 25%, 11%, and 25% immediately after each halving, according to the report.

Echoing this, JPMorgan analysts predict production costs will rise—on average—to $42,000 after the halving, and "this estimate is also the level we envisage Bitcoin prices drifting towards once Bitcoin-halving-induced euphoria subsides after April,” the analysts wrote.

But historical data reveals that the price of Bitcoin the year after previous halving has increased significantly, climbing 8,760%, 2,570%, finally 594%, respectively.

So zooming out, the halving should serve to boost the market by next year, but as the data reveals, it’s also worth remembering that each successive halving has a diminishing impact on the new supply of Bitcoin.

“Market demand—or the absence of it—now plays a more pivotal role in driving Bitcoin’s price than the reduction in the rate of new Bitcoins created,” Cory Klippsten, CEO of Swan Bitcoin, told Fortune. Similarly, Geoff Kendrick, head of crypto research at Standard Chartered, added: “I don’t think the halving matters much this time; the ETF flows have been much more sizable in their impact on supply and demand conditions.

"Miner fear factor”

While there may be little initial Bitcoin price movement, there could be more drastic swings in mining stock, as production costs spike.

The halving could spell revenue losses of around $10 billion a year for the industry as a whole, Bloomberg estimates. Public traded miners have been pitching their resilience to investors, insisting they have diversified their offerings, purchased more efficient computers, and sought out facilities with the cheapest power possible. “I wouldn’t be surprised to see acquisitions, distressed asset sales, and potentially some mergers in the U.S. after the halving,” Colin Harper, head of research and content at Luxor, told Fortune. Public miners have been “gobbling up” new computers and acquiring new facilities, he added.

Despite this, mining stocks have been struggling. Riot Platforms Inc and Marathon Digital Holdings have dropped 20% this month—what broker Bernstein has dubbed the “miner fear factor” in a report this week, seen by CoinDesk.

But while the major miners may be undergoing a bumpy teething period, as smaller miners and pools are pushed offline, their portion of the hash rate (and the market) will widen. But of those who do survive, Bernstein says their increased market dominance will only prove to be profitable long-term, particularly as the ETFs continue to provide structural demand for Bitcoin.

“We expect consolidation,” Fred Thiel, CEO of the world’s largest mine, Marathon Digital Holdings, told Fortune. About 10% to 25% of miners—likely smaller players—will come offline at some point, he said.

“Smaller and more inefficient miners will have to begin selling assets to raise capital to support their balance sheet to survive," Core Scientific’s CEO Adam Sullivan, told Fortune, who foresees facilities consolidating as opposed to entire companies.

This story was originally featured on Fortune.com