The bipartisan worry that is uniting Washington: Cheap Chinese goods

For all the differences between Joe Biden and Donald Trump, they share a bipartisan worry about China flooding global markets with cheap goods.

President Biden's recent call for a tripling of tariffs on Chinese steel was just the latest example of how voters will have a choice this fall that is one of degree as opposed to changes in direction when it comes to China trade.

Both camps are lining up behind increasingly protectionist plans.

Biden is calling for tariff hikes on select Chinese sectors. Trump wants 60% tariffs across the board. Biden is looking to "de-risk" the relationship with China while Trump talks about "decoupling" the world's two largest economies.

There is a "bipartisan competition for which party can look toughest on China," Stifel strategist Brian Gardner said during a recent Yahoo Finance Live appearance of a dynamic that spans multiple issues, calling this an "era of escalation and retaliation."

The bipartisan rhetoric is mounting even as China's cheap goods may be having less of an impact in the US after years of protectionist policies. US steel imports from China are down and have been falling for years amid high tariffs.

It was a process that began when Trump first implemented new steel duties in 2018 and has continued as Biden kept duties high.

Similar rhetoric from both sides

Biden's call for more steel duties is in part a result of a worry that cheap Chinese goods could undercut his manufacturing agenda, with Trump also offering tariffs as a way to protect US industry and workers.

In doing so, both sides use strikingly similar language.

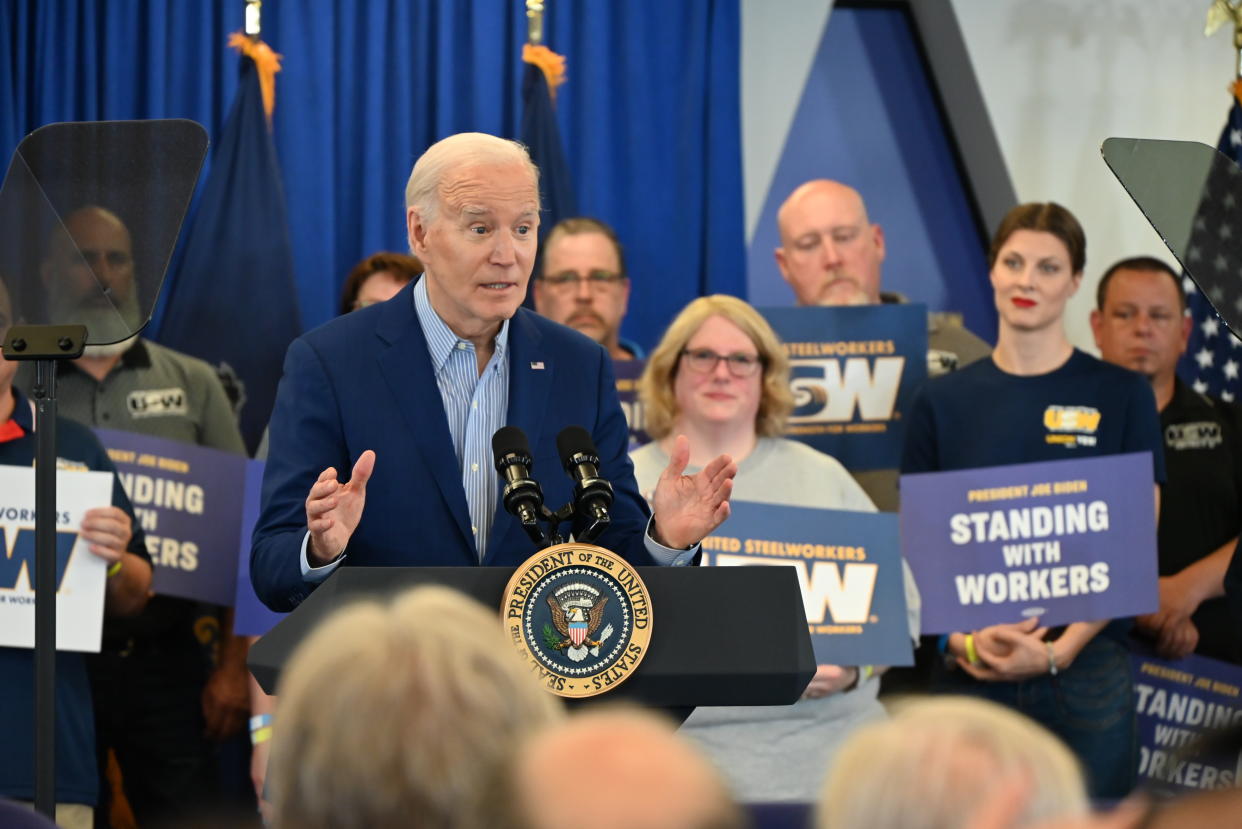

Here's how President Joe Biden recently explained his push.

"Because Chinese steel companies produce a lot more steel than China needs, it ends up dumping the extra steel into the global markets at unfairly low prices," he told a Pittsburgh crowd, adding, "They're not competing. They're cheating."

It's an explanation top Trump aides such as Robert Lighthizer — whether he'd be keen to admit it or not — would likely wholeheartedly agree with.

Here's how Trump's former trade representative — who could be in line for another top job in 2025 — described the China/steel issue during a December Fox Business appearance.

"The big problem with steel globally ... is massive excess capacity. There's way too much steel in the world," he said, adding: "China is a bad actor."

Trump himself also often extols the policy on the campaign trail.

"What you do is you put tariffs on them," he said at a recent Wisconsin rally on how to respond when companies look to move overseas. "It's not that complicated."

A 'bipartisan competition' around China

China's steel glut is largely a result of that country's slowing economy and lessening of construction projects in China itself.

Steel companies there, as a result, have pivoted and sent steel exports to a seven-year high. That, in turn, has led to a global backlash.

But data shows that US steel imports have been on the decline for years even as the rest of the world buys much more.

A recent Wall Street Journal analysis of data from CEIC found US steel imports from China have dropped nearly 20% since February 2023, even as sales have exploded to other nations. India and Vietnam imports are up around 80% in the same timeframe.

In his recent speech, Biden explained the need to tighten even further by focusing on the economic damage from cheap Chinese steel in the early 2000s, saying, "I promise you that I'm not going to let that happen again."

Much of the reason for the US focus on the issue is, of course, the ongoing debate about the proposed $14 billion sale of US Steel (X) to Japanese giant Nippon Steel. Both Biden and Trump are opposed to that deal, and it's another front where usual partisan alliances have been scrambled.

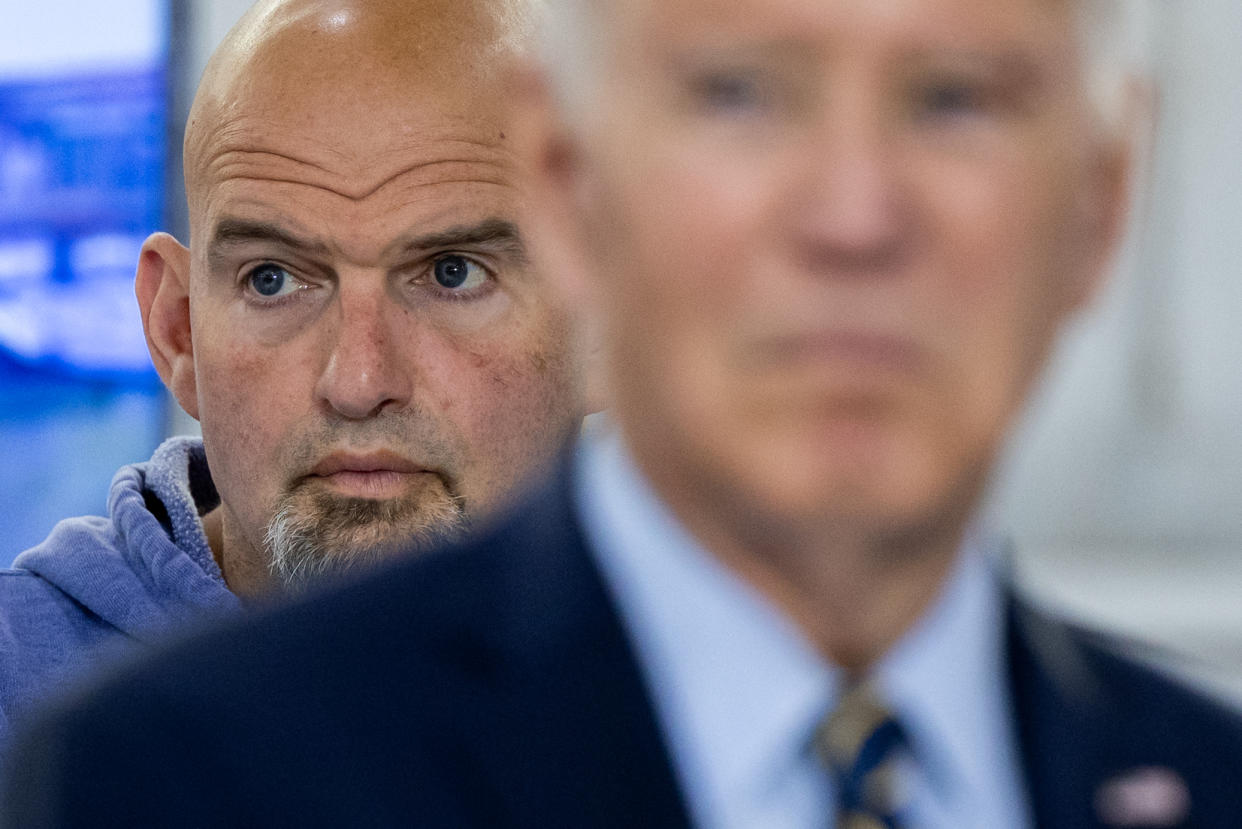

The lawmakers leading the opposition to that deal include Democrats like Sherrod Brown of Ohio and John Fetterman of Pennsylvania as well as Republicans like J.D. Vance of Ohio.

And while there is bipartisan consensus on many aspects of the issue, the 2025 wild card that remains is Trump, who is proposing the most intense measures by far and seemingly determined to enact them.

His plan for 60% tariffs would impact a wide array of goods and could impact the trade in trillions of dollars of goods projected in the years ahead.

Trump's aides are even reportedly proposing more extreme measures, such as devaluing the dollar, a move that could further restrict imports from China (and perhaps boost exports) but also one that could reignite inflation.

Ben Werschkul is Washington correspondent for Yahoo Finance.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance