Billionaire Ken Griffin Just Made a Once-in-a-Generation Bet on This Stock. Time to Buy?

When Ken Griffin, founder and chief executive officer of Citadel, makes an investment decision, everyone stands up and takes notice. That's because this investing giant has produced show-stopping results over time, with Citadel bringing in about $74 billion in returns since its 1990 launch. That makes it the most successful hedge fund ever.

So it's no surprise investors are eager to hear about Griffin's latest moves. This superstar investor holds more than 4,000 stocks and funds in the Citadel portfolio, and more than 19% of the portfolio is made up of technology stocks. Clearly, Griffin believes in the potential of some of today's biggest tech companies. And that leads me to one of his latest moves.

Griffin increased his position in Amazon (NASDAQ: AMZN) by more than 200% in the fourth quarter, buying more than 4 million shares to lift his holding to about 6.2 million. Thanks to Amazon's dominance in the two high-growth industries of e-commerce and cloud computing and the company's strategy to win in the artificial intelligence (AI) market, this looks like a once-in-a-generation bet. Is it one you should follow? Let's find out.

Image source: Getty Images.

Amazon's track record

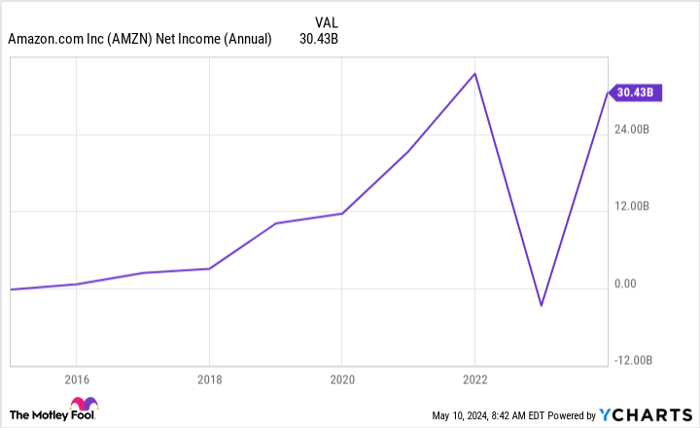

First, before we even get to the much-talked-about area of AI, we'll talk about Amazon's track record. The company has progressively added to its e-commerce and cloud computing services, and this has translated into billion-dollar sales and profit. Amazon has even demonstrated its ability to manage a difficult high-interest rate environment. As higher rates and general economic pressure weighed on demand for discretionary items and cloud services, the company revamped its cost structure, focused on efficiency -- and went on to shift from a rare annual loss to profit last year.

AMZN Net Income (Annual) data by YCharts

These efforts should help Amazon continue to control costs and increase revenue. For example, the move to a regional fulfillment model from a national one -- bringing inventory closer to the customer -- has decreased Amazon's cost to serve.

Now, Amazon's focus on AI across its businesses may supercharge this already solid growth story. Amazon represents a unique AI bet because the company uses the technology to improve its operations, and therefore lower costs and better serve customers -- and through Amazon Web Services (AWS), it sells AI products and services to customers. So Amazon is benefiting from AI in two ways.

In e-commerce, for example, Amazon uses AI to determine the best delivery routes, a key step in making deliveries cheaper and faster. This pleases Amazon and its customers. And Amazon uses AI in many other ways across the fulfillment process.

From chips to Amazon Bedrock

But AWS may be where Amazon is set to score the biggest AI victory. AWS delivered $25 billion in sales this past quarter, for a $100 billion annualized run rate, and this is thanks to the cloud provider's strengths in AI. Amazon, through AWS, offers customers AI solutions to meet all of their needs from a broad range of chips to a fully managed service called Amazon Bedrock that allows customers to customize top large language models for their own purposes.

And Amazon offers a range of AI-powered apps across its e-commerce and cloud businesses to help customers with everything from shopping to coding.

One reason I believe AWS could be among the biggest players in AI over time is that it's the world's leading cloud provider by far -- and this means potential customers already are right there, ready to turn to AWS for their AI needs too. Since Amazon has built a vast selection of AI products and services corresponding to the needs of both cost-conscious customers and those with significant budgets, it's ready to deliver.

Should you follow Ken Griffin's move?

Considering the increase in Ken Griffin's Amazon investment and his presence in AI tech stocks, he clearly sees this potential. So, should you follow this billionaire investor into Amazon right now?

A look at Amazon's valuation shows it's trading for 41x forward earnings estimates. That's lower than levels approaching 60 late last year. At the same time, sales are on the rise at the company, and AWS has seen customers emerge from a period of cost cutting and start deploying new projects. So a new wave of growth may just be getting started, and that makes the shares look pretty reasonable at today's level.

And it's important to remember the general AI growth story is just getting started too, with the market forecast to grow at a double-digit compound annual growth rate to reach more than $1 trillion by the end of the decade.

All of this means, right now, Amazon looks like a once-in-a-generation investment opportunity -- not only for billionaire Ken Griffin but possibly for you too.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.