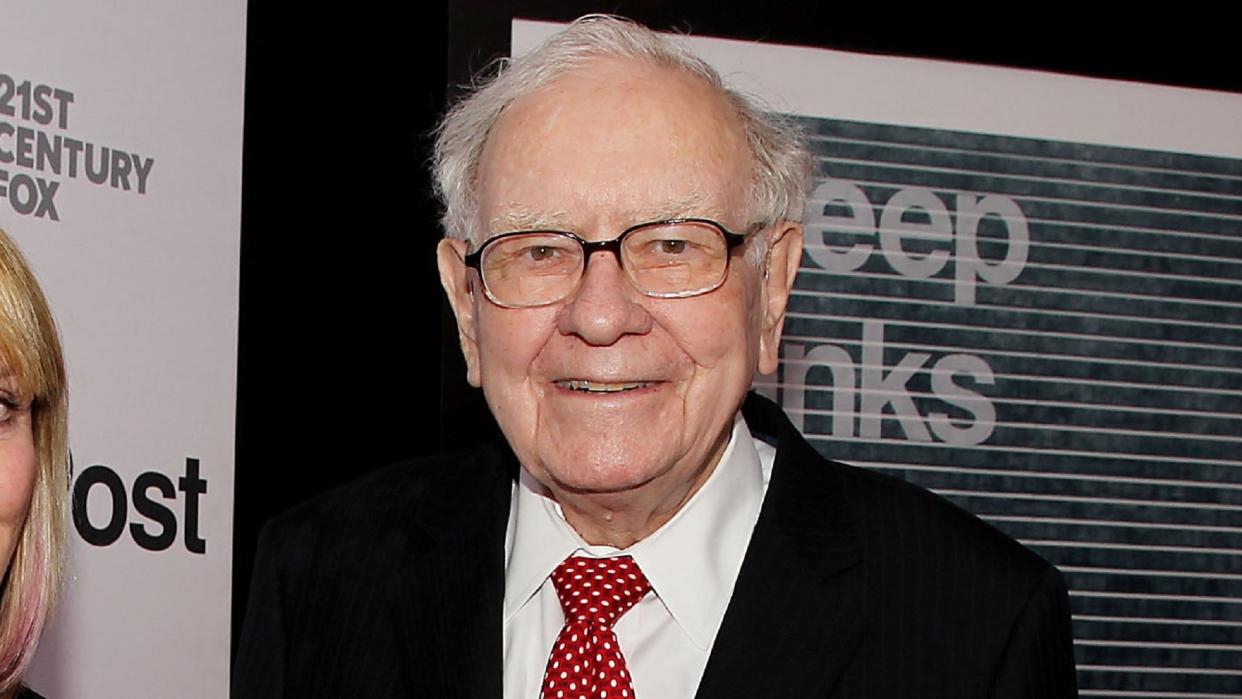

This Billionaire Calls Himself a Warren Buffett ‘Devotee’: Here’s Why

Bill Ackman, billionaire CEO and portfolio manager of Pershing Square Capital Management, has called himself a Warren Buffett “devotee,” adding that the famed investor has been his “unofficial mentor for years.”

Check Out: I’m a Self-Made Millionaire — 5 Stocks You Shouldn’t Sell

Read Next: 6 Genius Things All Wealthy People Do With Their Money

Activist hedge fund manager Ackman — an extremely successful investor himself, with a net worth standing at $4.2 billion according to Forbes — has been a long-time admirer of Buffett.

Learn More: 401(k) Growth Potential — Ways to Double Your Savings in 10 Years

Ackman on Buffett’s Long-Term Investing View

During CNBC’s Delivering Alpha 2023 conference, Ackman said:

“I’ve been kind of a Warren Buffett devotee, he’s been my unofficial mentor for many years… He started out as, what today you would call an activist hedge fund manager, running a series of private partnerships. Over time, he took control of what was best described as a crappy textile company,” said Ackman. “But the access to the permanency that capital gave him the ability to take [a] long-term view in a world where people in the investment management business generally have to make short-term decisions because their capital can leave.”

In turn, Ackman added that his firm also got to that same place, which allowed it to also take a very long-term investing view. “… We can buy Google at $94 a share when people are scared… and we can own it. And that, I think, is a nice, very fortunate competitive advantage we have.”

Buffett’s investing philosophy has long included a belief in strong long-term positions, with Investing.com writing: “Warren Buffett’s investment strategy has remained relatively consistent over the decades, centered around the principle of value investing. This approach involves finding undervalued companies with strong potential for growth and investing in them for the long term.” This focus on long-term holdings dovetails perfectly with the thrust of Ackman’s remarks above.

As of April 16, Ackman’s Pershing Square Capital Management had $16 billion in assets under management and its portfolio is concentrated in just seven companies — including Chipotle, Hilton and Google parent Alphabet — according to Forbes.

Meanwhile, Berkshire Hathaway released record earnings In February, reporting $37.4 billion full-year operating profit. The conglomerate sat on “an all-time high of $167.6 billion in cash and equivalents,” as GOBankingRates previously reported.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: This Billionaire Calls Himself a Warren Buffett ‘Devotee’: Here’s Why