Big Tech earnings: Everything you need to watch for

This article was first featured in Yahoo Finance Tech, a weekly newsletter highlighting our original content on the industry. Get it sent directly to your inbox every Wednesday. Subscribe.

Second quarter earnings season is here.

That special time of year when publicly traded companies give investors way more information than they'd ever willingly disclose about their business's performance over the last three months.

And for Big Tech, a big part of that means offering updates on whether lofty promises around artificial intelligence are actually starting to pay off.

AI, more specifically generative AI, has been the go-to phrase for seemingly every tech company throughout the first half of 2023. Heck, non-tech companies are talking about it, with even grocery store chains and soft drink makers bringing up the technology's potential for everything from logistics to marketing.

Shares of Microsoft (MSFT), Alphabet (GOOG, GOOGL), Meta (META), and Nvidia (NVDA), all seen as artificial intelligence plays, are outpacing the Nasdaq, which was up about 37% year-to-date as of Tuesday afternoon.

In the same period, shares of Microsoft were up 49%, while Alphabet's stock jumped 39%. Meta and Nvidia, meanwhile, have gained 157% and 220% year-to-date, respectively.

Is tech's AI bet paying off?

Generative AI has been Big Tech's go-to topic for the first half of 2023.

Now, however, is when all of that talk needs to start paying off. All of the products, updates, and features tech companies announced or said they are working on don't mean much if they don't also pad their bottom lines.

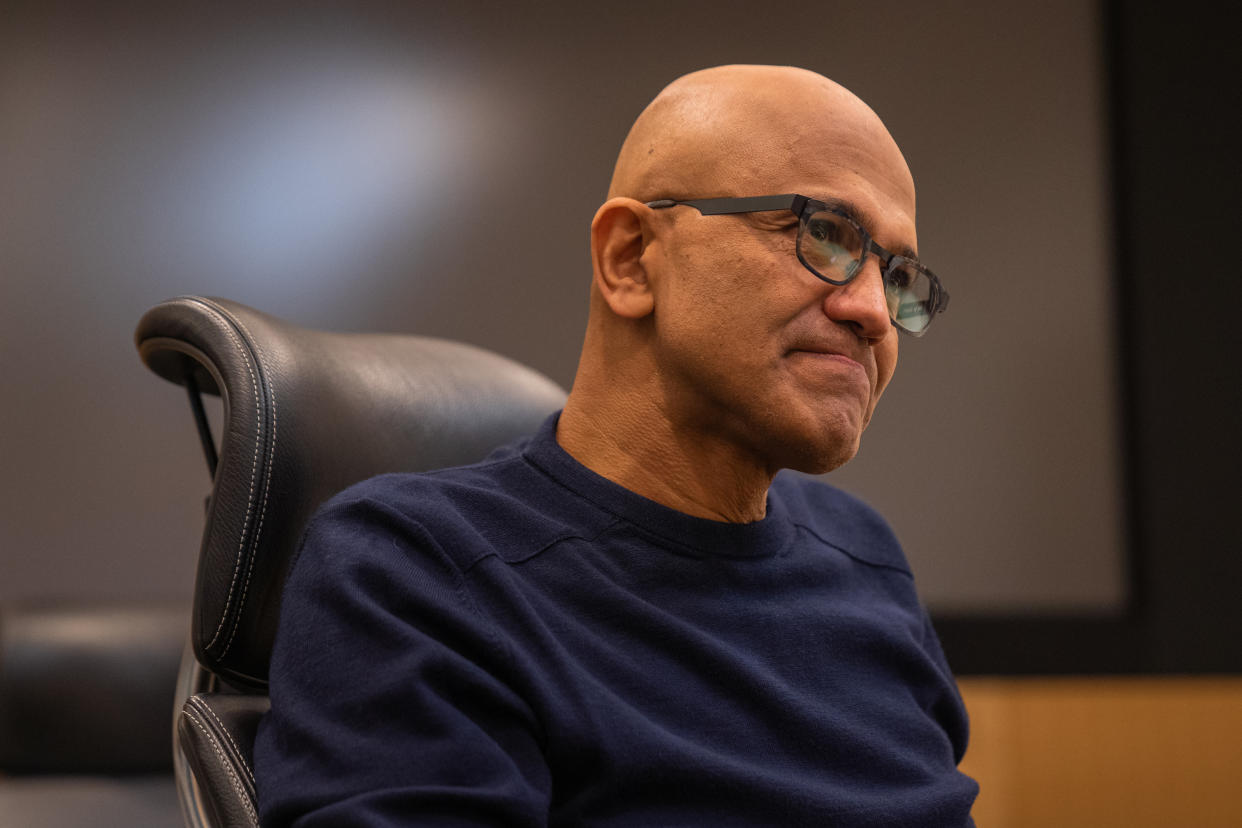

Microsoft, for instance, will need to give analysts and investors some kind of insight into how its multiyear, multibillion-dollar investment in ChatGPT creator OpenAI is helping to push sales of its enterprise and cloud products.

The company got started on that front on Tuesday, announcing that it will charge businesses $30 per user per month for its new Microsoft 365 Copilot software. Shares of the company jumped 5% on the news.

Google, meanwhile, is offering its generative AI capabilities via its Workspace enterprise software, but it'll likely make the bulk of its cash — as it always does — via advertising.

That means figuring out a way to monetize both Bard and its Search Generative Experience, an experimental version of Google Search that takes advantage of the company's generative AI technology.

Nvidia, for its part, already telegraphed that its AI work is paying off handsomely back in May, when the company said it expects current quarter revenue to come in near $11 billion; Wall Street had been looking for revenue closer to $7 billion.

In the weeks that followed this report, the company's market cap topped $1 trillion.

A PC market turnaround

Last quarter, Apple (AAPL) reported a year-over-year slowdown in its Mac, iPad, and wearables businesses.

The Mac and iPad have been hurt by the computer industry's ongoing COVID hangover. After millions of consumers around the world purchased desktops, laptops, and tablets during the pandemic, there was no real need to go out and buy new ones.

And it's not just Apple that's suffering from the slowdown.

Intel (INTC) and AMD (AMD) both took one on the chin last earnings season as sales of PC chips plummeted year-over-year. Intel reported a staggering 38% decline in its client computing business, while AMD reported a massive 64% drop in client revenue.

But the market could be turning around. According to Gartner analyst Mikako Kitagawa, PC sales were still down 16.6% year-over-year in Q2, but the decline has slowed.

"There has been progress in reducing PC inventory after more than a year of issues, supported by a gradual increase in business PC demand," Kitagawa wrote in a recent research note. "Gartner expects that PC inventory will normalize by the end of 2023, and PC demand will return to growth starting in 2024."

Meta is battling everyone

Facebook parent Meta Platforms should have one of the most interesting earnings announcements and calls of the quarter.

While the most important news will be how its advertising business is performing, analysts and investors will be looking for hints as to how well Meta's Threads is performing relative to rival Twitter.

Analysts and investors will also be hoping for guidance about when CEO Mark Zuckerberg plans to start monetizing Threads via advertisements, something the app currently lacks.

Then there's Meta’s Quest 3 AR/VR headset. Scheduled to launch in September for $499, the Quest 3 will compete with Apple’s upcoming Vision Pro headset, which is expected to hit the market in early 2024.

Look for any indication about how many units Meta expects to ship, and whether the headset will meaningfully contribute to the company's bottom line anytime soon.

Daniel Howley is the tech editor at Yahoo Finance. Follow him @DanielHowley.

Click here for the latest technology business news, reviews, and useful articles on tech and gadgets

Read the latest financial and business news from Yahoo Finance