Are Biden's student debt moves enough?

President Joe Biden didn’t offer much new to student loan borrowers, experts said, after the Supreme Court last month ruled against student loan forgiveness.

Instead, the president provided a watered-down forbearance via the “on-ramp” program, more details on the previously announced updated income-driven repayment (IDR) plan — Saving on a Valuable Education (SAVE)—and a promise to again try for debt forgiveness.

On Friday, the administration said it would start discharging loans for borrowers who’ve been in repayment for 20-25 years under the previously announced one-time payment adjustment. Some 800,000 borrowers will have $39 billion in federal student loans discharged.

Read more: Will I be taxed on student loan forgiveness?

Still, the announcements have disappointed many borrower advocates who were worried about the lack of broad-based student debt cancellation, loan servicer abuses, and broken forgiveness programs like Public Service Loan Forgiveness (PSLF).

"What he has proposed isn’t relief — it’s a protracted negotiated rule-making period… setting the policy up for a slow-death at a moment when debtors need the exact opposite," The Debt Collective, a borrower advocacy organization said in a press release.

Although Biden announced the programs on the day of the Supreme Court decision, questions remained about implementation and how the process would impact borrowers.

Here’s what advocates are saying about the on-ramp program, SAVE income-driven repayment (IDR) plan, the promise to try loan forgiveness using the Higher Education Act, and the status of the one-time payment adjustment.

On-ramp program

To help borrowers adjust to their monthly payments that restart in September, the president announced the on-ramp repayment program, which will last for 12 months.

"The on-ramp is like a forbearance in many ways," Mark Kantrowitz, author and student loan expert, told Yahoo Finance. "It will not necessarily fix the problems experienced by borrowers, so much as delaying them."

If borrowers can afford to repay their student loans, some advocates recommend they should not use the on-ramp program— and thus avoid interest accrual.

"Borrowers should be aware that interest will be charged during the on-ramp period, so if they don't make payments or enroll in the new SAVE program they will see their balance grow," Abby Shafroth, co-director of advocacy at the National Consumer Law Center, told Yahoo Finance.

During the on-ramp period, borrowers who miss payments won't be reported to credit bureaus, won't be considered in default, and won't be referred to collection agencies for those payments.

That’s similar to the payment pause during the pandemic — which was also called forbearance — but interest will accrue, a key difference. During the pandemic payment pause, interest was set at 0%.

"Although payments won’t be due for another year, balances will start accruing interest on September 1, 2023," The Debt Collective said. "The longer it takes for Biden to cancel debt, the more it costs debtors."

Interest accrual and capitalization

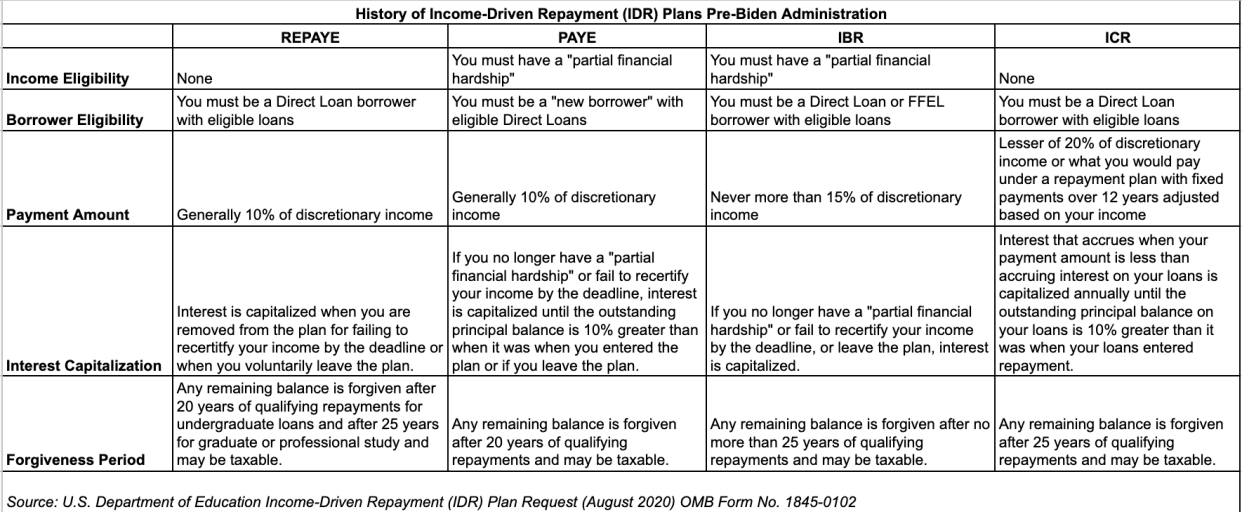

Federal student loans accrue interest and many income-driven repayment plans also have interest capitalization.

Previously, if a borrower enrolled in an income-driven repayment plan switched to a different plan, or missed certain deadlines, interest capitalization occurred. Capitalization meant any unpaid interest charges would accrue and be added to the student loan balance in the new income-driven plan.

"Interest is a big and often overlooked part of the student debt crisis," Shaforth said. "Many borrowers have made payments for years only to see their loan balances grow as a result of interest accrual and unnecessary interest capitalization that has long dogged borrowers in the federal loan program."

Read more: What is compound interest, and how is it calculated?

One crucial relief that Biden is providing: no interest capitalization, according to the White House. That means while borrowers will owe the accrued interest, the unpaid interest will not be added to their principal at the end of the on-ramp period. That prevents a ballooning balance.

Interest capitalization has been eliminated for all income-driven repayment plans, except the IBR plan because of a statutory requirement, according to an Education Department spokesperson.

Not only will borrowers in IDR plans still see interest capitalized if they switch to the SAVE plan, but also borrowers with commercially-held Federal Family Education Loans (FFEL).

"Borrowers with FFEL loans will continue to experience interest capitalization in many instances, including if they use the on-ramp forbearance, but can get out of FFEL by consolidating into a Direct Consolidation Loan to take advantage of the SAVE plan, access to PSLF, and protections against interest capitalization," Shafroth said.

SAVE IDR plan

The White House also announced that enrollment in its Saving on a Valuable Education (SAVE) plan would occur this summer, instead of next year.

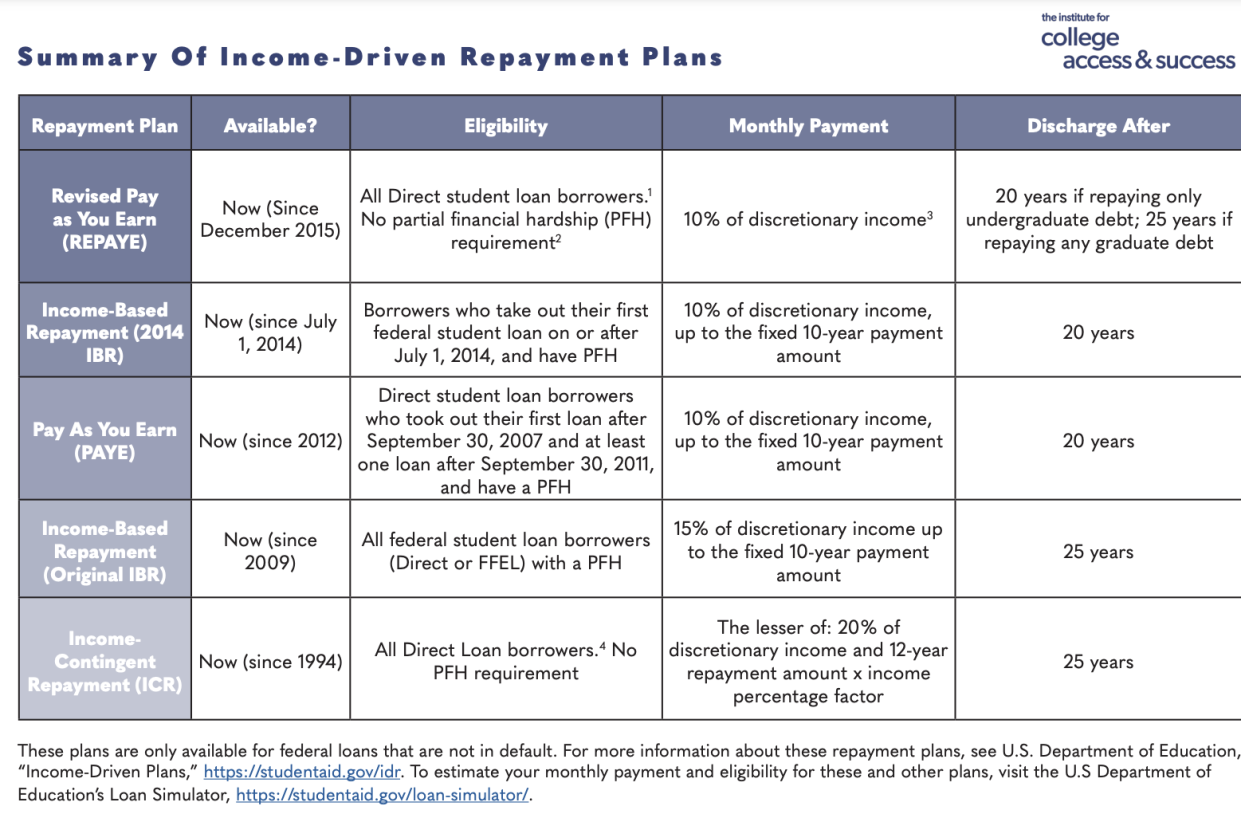

Biden’s IDR reform was initially announced last August and details about a new IDR plan were introduced earlier this year. SAVE is the replacement for the REPAYE income-driven repayment plan.

"SAVE is the new name for the updated REPAYE plan, but no change from the previously announced changes to REPAYE," Kantrowitz said. "Some aspects of SAVE will be implemented this summer, some not until July 1, 2024. In particular, the cut in the percentage of discretionary income for undergraduate debt from 10% to 5% will not be implemented until July 2024."

Although SAVE is an improvement on the REPAYE plan, critics say it has limits.

"This is not a meaningful substitute for broad-based student debt cancellation," Cody Hounanian, executive director of the Student Debt Crisis Center, told Yahoo Finance. "The [SAVE] program prevents people with graduate degree debt from receiving the most generous relief."

Other advocates agree that although SAVE has potential, it isn’t a complete solution.

"How helpful the plan actually is to borrowers depends on how well it is implemented," Shafroth said. "Loan servicers have a bad track record of telling borrowers about their best payment options—and quickly and accurately rolling out new relief programs. So the new plan offers a lot of potential help to borrowers, but it's still unclear if it will deliver."

New attempt to forgive student loans likely to fail

In January, Yahoo Finance spoke to experts about options President Biden had if the Supreme Court blocked loan forgiveness.

Some recommended using the Higher Education Act of 1965 to achieve broad-based student loan forgiveness using the same arguments the Supreme Court recently rejected.

"The administration has not yet utilized the Higher Education Act's authority to achieve widespread debt cancellation," Eden Iscil, a public policy manager at the National Consumers League, told Yahoo Finance.

But not all borrower advocates agree that the legal authority exists.

"Using the Higher Education Act is a misreading of the law," Kantrowitz said. "They will need to change the regulations to permit broad student loan forgiveness and this will take as long as a year. This effort will ultimately fail for the same reasons as the previous US Supreme Court ruling."

Borrowers face struggles without loan forgiveness

With repayments to start at the end of September, some borrowers may face problems due to high inflation and rising costs.

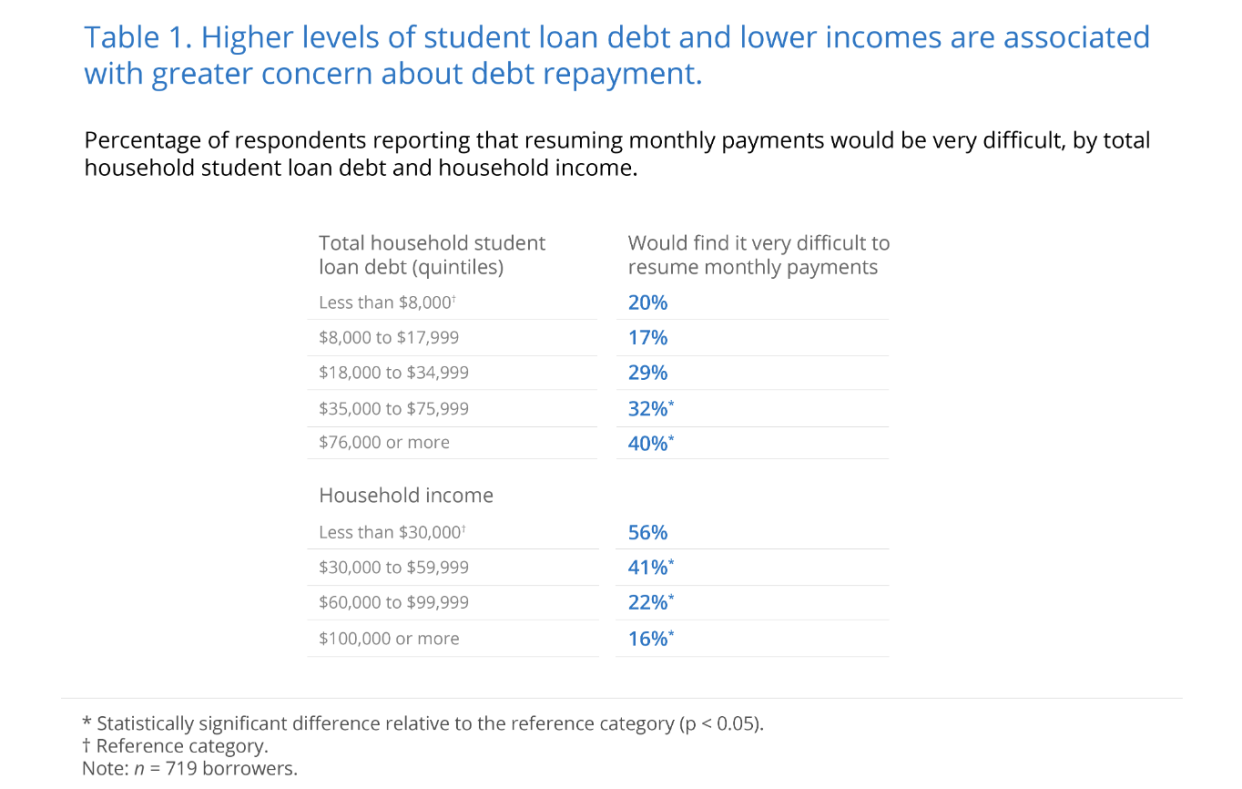

One in five borrowers indicated that they could struggle when scheduled payments resume as other debt obligations have increased by 24%, according to a Consumer Financial Protection Bureau report.

Around 59% of borrowers said restarting payments would be at least somewhat difficult, with 29% saying repayment would be very difficult, according to an analysis from the Financial Health Network.

"Research suggests those who benefited from [student] loan forbearance increased their auto and credit card debt during this period…and many borrowers will now face increased consumer debt on top of their student loans," Jim Mahaney, a certified financial planner at Mavericus Retirement, said. "With inflation, the cost of living has also increased. We may see parents working far longer than they initially planned, while younger adults with student loan debt could reduce their contributions to retirement savings and the 529 plans of their own children."

One-time payment adjustment a consolation prize

There is a bit of good news for borrowers.

The Education Department has started to apply the one-time payment adjustment to borrowers' accounts, which will help borrowers get closer to forgiveness under income-driven repayment plans.

"For years, many people have been impacted by predatory business tactics by loan servicing companies that protected their profits and left borrowers holding the bag dealing with bureaucratic red tape that makes it difficult for borrowers to receive the relief they are eligible for," the Student Debt Crisis Center advocacy group said in a statement. "The Department of Education's decision to erase this student debt is a powerful step towards righting these wrongs."

The one-time payment adjustment the Department of Education announced last year will count certain months toward student loan forgiveness that were previously ineligible under income-driven repayment plans. Around 3.6 million borrowers will receive at least three years of credit toward loan discharge as a result of the adjustment, according to Federal Student Aid (FSA).

The one-time payment adjustment helps to reverse some of the damage caused by loan servicers that did not properly track deferments or steered borrowers to forbearance instead of income-driven repayment plans that would have counted toward years of payment.

Borrowers that have been in repayment for 20-25 years, will start to see their debt discharged and receive notices in the upcoming weeks, according to a press release from the Education Department.

All other federal loan borrowers will see the adjustment applied in 2024.

Borrowers with commercially-held FFEL, Perkins, or Health Education Assistance Loan (HEAL) need to consolidate with Direct Consolidation Loan by December 31, 2023, to become eligible for the adjustment.

Default borrowers have until December 31, 2023, to use the Fresh Start Program to become in good standing and take advantage of the one-time payment adjustment.

Learn more about the one-time payment adjustment.

"The Department of Education's announcement is a cause for celebration and a testament to the power of advocacy and collective action,” Cody Hounanian, Executive Director of the Student Debt Crisis Center, said in a press release. “It is a reminder that progress can be made, and that a fairer, more just society is within our reach."

Ronda Lee is a personal finance senior reporter for Yahoo Finance and attorney with experience in law, insurance, education, and government.Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Finance. Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn