Student loan borrowers could see their ‘runaway interest’ erased in new debt relief plan

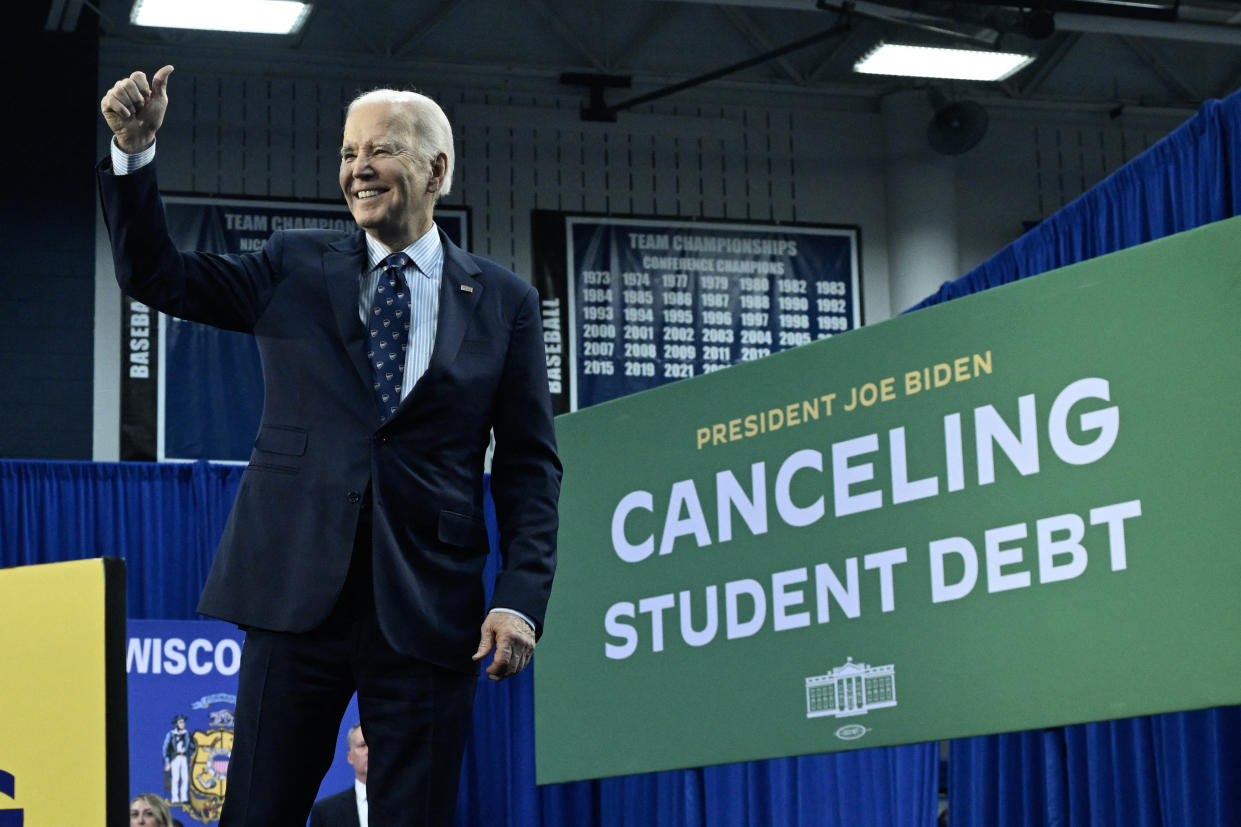

President Joe Biden is doubling down on his student loan forgiveness promise with a new plan that would bring relief to over 30 million Americans.

The proposal announced last week would fully wipe accrued interest for 23 million student loan borrowers, eliminating college debt for 4 million Americans. Overall, 10 million borrowers would see debt relief of $5,000 or more, the White House said.

The proposal also targets a narrower group who now owe more than they originally borrowed due to “runaway interest.”

“One major aspect of the plan is that we’re helping people that owe more than they borrowed because interest can often run away from them,” US Department of Education Under Secretary James Kvaal told Yahoo Finance. “We hope to finalize these plans over the next coming months.”

The rules will be published on Wednesday and allow for public comment for 30 days.

How do people end up owing more than they borrowed?

More than 25 million student loan borrowers owe more than they originally borrowed, even after being in repayment for decades.

That’s because of interest accrual, which can even begin during the six-month grace period on most loans.

Say you borrowed a $30,000 loan in college and entered Standard 10-year repayment at a 3.6% interest rate. Your monthly payment would be $298.06 over the next 120 months, adding up to $35,767.92.

Overall, you would have paid $5,767.92 in interest by the end of your repayment.

But with an income-driven repayment plan (IDR), which adjusts monthly payments to be affordable, the payments can be so low they don’t cover your monthly interest charges, which continue to build up.

For example, if you qualify for a $5 monthly payment under IDR, that payment would not be enough to cover your interest — resulting in negative amortization or “runaway interest.” In other words, interest would accrue more quickly than the borrower can pay down their principal and interest, the NASFAA said, resulting in the balance ballooning over time.

Additionally, under all IDR plans, any remaining balance is supposed to be forgiven on loans that aren’t fully paid at the end of the repayment period (either 20 or 25 years), but for some borrowers that didn’t happen.

Still, “runaway interest” happens well before borrowers reach the point of forgiveness on IDR plans, the NASFAA told Yahoo Finance.

Read more: Do I qualify for student loan forgiveness?

It’s ensnared many borrowers over the past decades, said Melissa Byrne, co-founder and executive director of We The 45 Million, a national advocacy group for student loan borrowers.

“An exchange for doing longer repayment terms is that for every month that you’re paying less than you would have been doing under a 10-year Standard plan, you just kept getting interest capitalized,” Byrne said. “So people saw their balances balloon from like 40 grand to a $200,000 balance over the course of the time.”

Under Biden’s new proposal, some borrowers could see up to $20,000 of their accrued interest forgiven — regardless of income. Specifically, interest accrued while the borrower was in repayment, the White House said.

This relief would be delivered automatically to all types of federal student loans, including parent loans, consolidation loans, and loans in default. It does not apply to private student loans.

Additionally, low and middle-income borrowers enrolled in any income-driven repayment plan and have an annual income of $120,000 if single, or $240,000 (for married couples who file taxes jointly) would be eligible to have their entire balance wiped since entering repayment, the Biden administration said.

Overall, the Department of Education said that over 75% of borrowers who would benefit from interest relief are recipients of Pell Grants, which are federal awards granted to undergraduate students based on economic need.

The burden of accrued interest

Biden’s new plans come seven months after the conservative-led Supreme Court struck down his first attempt at widespread student loan relief. By a vote of 6-3, the justices ruled that Biden had "overstepped" his authority when announcing plans to cancel up to $400 billion in student loans.

This time, the Biden administration is using a different approach under the legal justification of the Higher Education Act. Under that law, the education secretary can provide student loan forgiveness under certain circumstances.

“We are targeting our relief on specific problems that people are experiencing like runaway interest,” Kvaal said. “It turns out a lot of people are struggling with their loans for a lot of reasons. So we’ll be helping [them] with these plans.”

The proposal couldn’t have come at a better time for some households.

“We are struggling now to make ends meet,” said Lina Henao, a member of the nonprofit parent and family advocacy group ParentsTogether Action. “I will for sure default on loans or literally take food security off the table.”

Another parent advocate based in Michigan said she had been paying off her student loans for years to no avail, with the balance totaling $80,000 despite years of repayment.

“Student loan payments are taking a big chunk of my paycheck,” Crystal Payne said.

Who else could get forgiveness?

Biden’s new plan targets five groups of student loan borrowers. If enacted as proposed, folks could see relief if they are part of these categories:

Borrowers with balances bigger than what they originally borrowed due to accrued interest.

Borrowers who qualify for debt cancellation under an existing government program such as Public Student Loan Forgiveness, IDR plan. or SAVE, including those who have not applied.

Borrowers who entered repayment at least 20 years ago on their undergraduate loans or over 25 years ago on their graduate loans.

Borrowers who enrolled in “low-financial-value” programs or institutions — defined as programs that failed accountability measures, closed, or left students in debt but without good job prospects. These could amount to roughly 250,000 borrowers based on closed school discharges alone, the White House said.

Borrowers experiencing financial hardship, though what is considered hardship is not yet defined.

“These historic steps reflect President Biden’s determination that we cannot allow student debt to leave students worse off than before they went to college,” said Kvaal.

Gabriella Cruz-Martinez is a personal finance and housing reporter at Yahoo Finance. Follow her on X @__gabriellacruz.