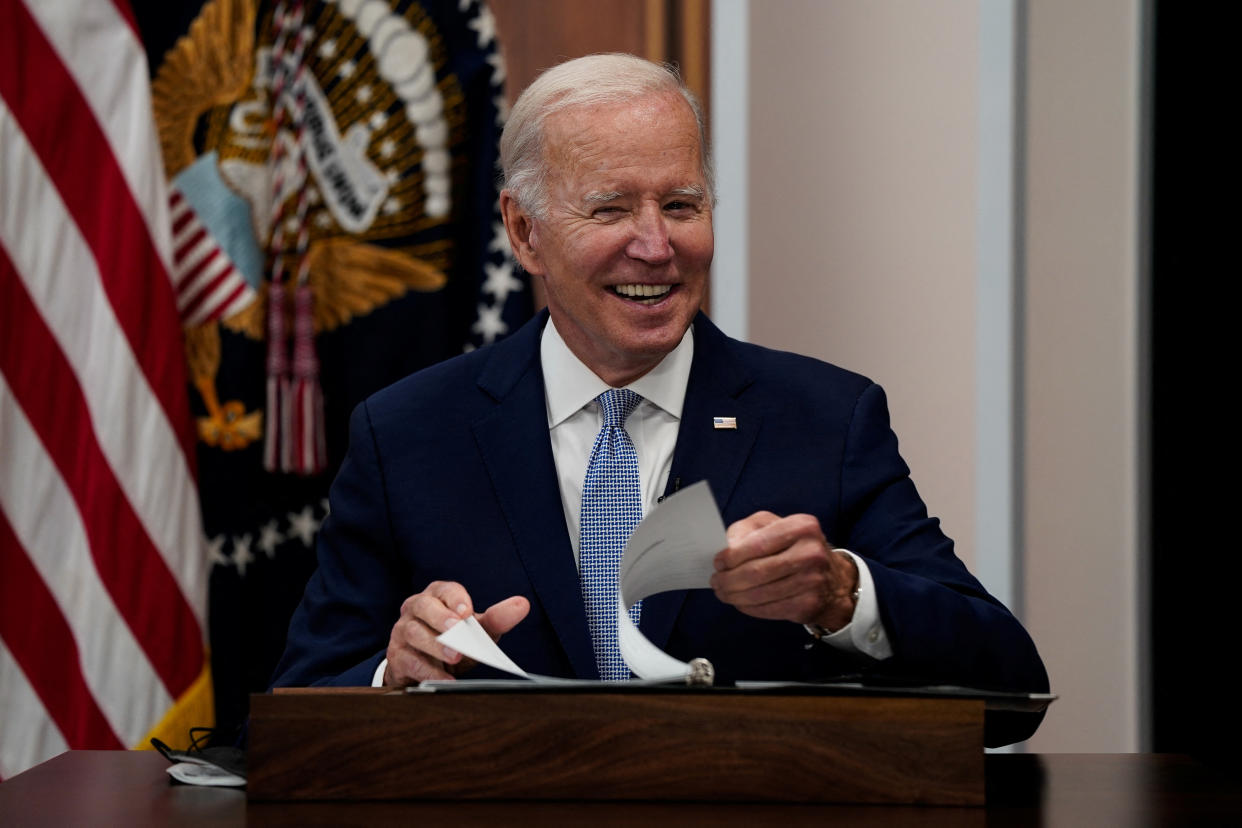

Biden will survive the shrinking economy

President Biden got more lousy economic news on July 28, when the government announced that the economy shrank by 0.9% in the second quarter of 2022. That’s the second consecutive quarter of negative growth and a clear sign the post-COVID boom that lasted 18 months is over.

No biggie!

Some people worry we’re now in a recession. But it’s something of an urban myth that two consecutive quarterly declines in gross domestic product mean a downturn has begun. That used to be a shorthand way of understanding what a recession is, but it’s not how economists determine when a recession begins and ends.

The National Bureau of Economic Research formally identifies recessions, often months after they’ve begun. It defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” That’s a qualitative assessment that involves judgment and isn’t triggered by some strict numerical alignment.

We’re probably not in the midst of a “significant decline” in economic activity. It’s more of a marginal decline. The labor market remains very strong, with employers creating more than 2.7 million jobs this year, even with a shrinking economy. The unemployment rate remains at a near-record low of 3.6%.

“The 0.9% annualized fall in GDP in the second quarter is disappointing but doesn’t mean the economy is in recession,” Capital Economics told clients in a July 28 research note.

An amorphous concept

A shrinking economy gives Biden’s Republican opponents one more piece of ammunition to use in their argument that Biden is a poor caretaker of the economy. But it won’t hurt Biden very much, if at all. Consumers don’t really think about GDP. They don’t go to work or shop for groceries wondering if the economy if growing or shrinking. GDP, in fact, is kind of an amorphous concept, since it’s an attempt to capture what’s going on in an incomprehensibly huge economy in a few oversimplified numbers.

What consumers do care about is job security and getting ahead. This remains Biden’s biggest challenge. Job security is good, given the strong labor market, but layoffs are ticking upward and there are signs hiring will slow considerably for the next several months. The Federal Reserve is actually trying to cool the hot labor market by raising interest rates and tightening monetary policy. That’s the indirect way the Fed tries to tamp down demand, to bring prices back under control.

[Follow Rick Newman on Twitter, sign up for his newsletter or send in your thoughts.]

Inflation of 9.1% is preventing many Americans from getting ahead. Wages are rising by just 5.1%, so the typical worker’s purchasing power is down 4 percentage points during the last 12 months. Consumers can mitigate high inflation to some extent, by conserving and substituting cheaper goods here and there. But that type of austerity can be dispiriting in its own right.

Consumers know that something is wrong

Many Americans already think the U.S. economy is in a recession, regardless of what the GDP numbers say. In a Morning Consult/Politico survey conducted two weeks before the latest GDP numbers came out, 65% of respondents said they think the U.S. is in a recession. That’s probably because many workers feel they’re falling behind—and they are, in fact, falling behind. Soaring prices for gasoline, food, housing and other important things signal to consumers that something’s wrong, even if it’s not a recession, in technical terms.

That’s trouble enough for Biden. His approval rating has plunged in inverse proportion to rising inflation, and now stands at a feeble 39% or so. In a certain respect, it matters a lot more how people feel about the economy than what’s actually happening in the economy. If many millions of Americans feel they’re in a personal recession, no president can point to a handful of numbers and convince them otherwise.

It is worth looking at the longer-term trends. A sharp decline in GDP in the second quarter of 2020, right after COVIID hit, was followed by a boom in the following quarter nearly as big. GDP growth for the next five quarters was higher than pre-COVID growth rates, as massive amounts of stimulus funding and monetary easing triggered one of the fastest recoveries ever. Overall output is now well above pre-COVID levels, even with a small step back so far in 2022. That’s generally good.

Yet Biden is in the awkward position of continually saying there’s no recession, and in economic terms, he’s right. But ordinary people don’t define recession the way economists do, and if they’re falling behind, it doesn’t matter what you call it — it’s bad. Things can be painful even without a recession.

Click here for politics news related to business and money

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube