Unanswered election questions, and why forecasters expect stocks to go up: Morning Brief

Monday, November 9, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

While uncertainty persists, there have been no market-shaking surprises

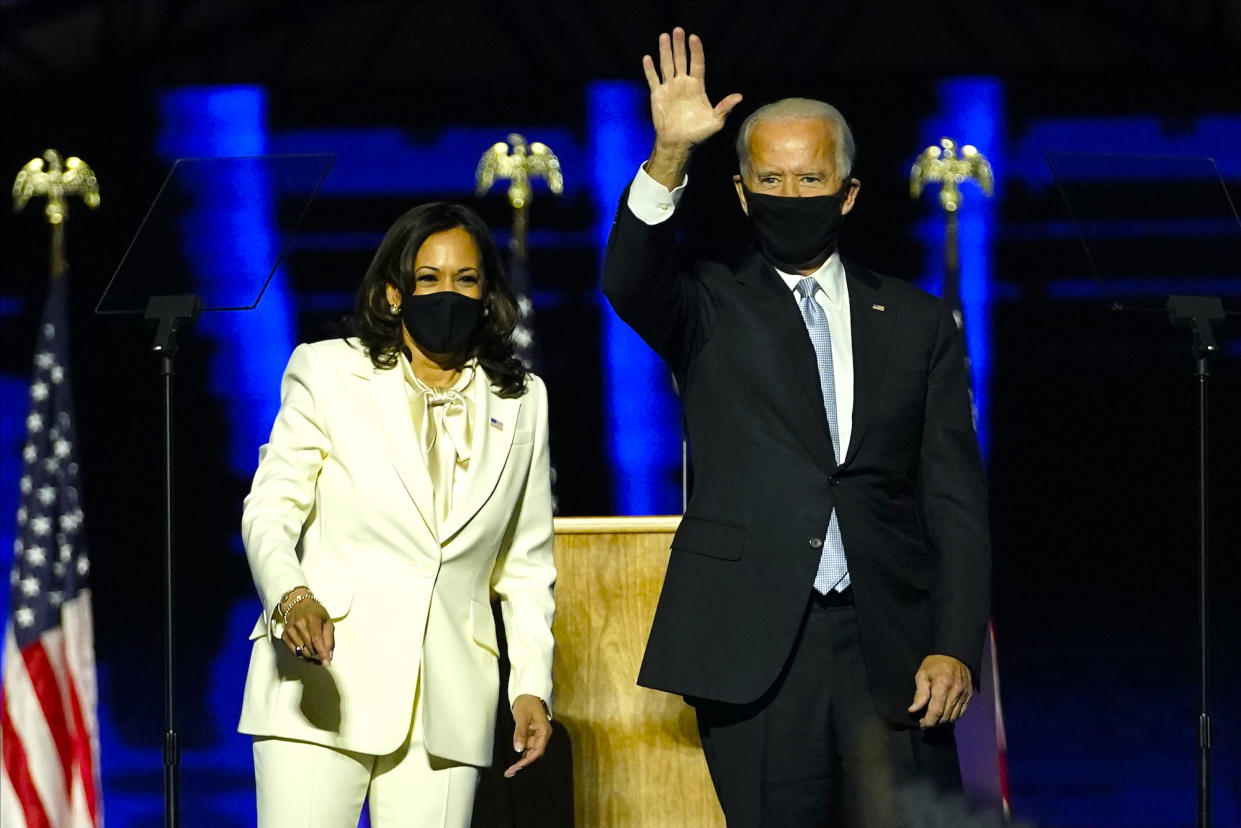

Joe Biden won the 2020 presidential election, the AP projected Saturday. And so we can now refer to the former Vice President as President-elect.

For investors, this removes some uncertainty. However, two important questions remain unanswered: 1) what will the outcome of President Trump’s contesting of the votes be, and 2) will the next president be working with a divided Congress or will the so-called “blue wave” have come to fruition.

The good news for investors is that these outstanding risks reflect scenarios known for weeks if not months. In other words, the last has come with no unlikely, black-swan type result that would prompt a major repricing of assets by investors.

Regarding Trump contesting the vote, his administration has already filed multiple lawsuits aimed at overturning voting results in states that went to Biden. An election contested by Trump has been a known risk for a long time, leading a number Wall Street strategists to consider it part of their base-case, expected scenario. And so, the fact that the president has yet to concede comes as no surprise for markets. That said, Trump isn’t getting much traction in the courts and experts broadly agree that the administration’s claims lack the merit that would lead to results being flipped.

Regarding the make up of Congress, this is a bit more interesting as Democrats and Republicans each control 48 Senate seats. And the tiebreaker comes down to the outcome of the Georgia Senate race, which heads to a runoff on Jan. 5.

“Although the likelihood that both Georgia Senate seats flip from Republican control to Democratic appears low, markets indicate that those probabilities are rising,” Goldman Sachs’ David Kostin wrote on Friday. “Prediction market odds of a Democratic sweep plummeted from 51% to 9% on Election Day, but have since risen to 23%.“

In other words, we should prepare for a divided Congress.

“A divided government would constrain the Biden administration’s ability to implement plans for large-scale fiscal stimulus and public investment, tax, health care and climate related legislation,” BlackRock Investment Institute analysts wrote on Saturday afternoon. “We see an increased focus on sustainability under a divided government, but through regulatory actions, rather than via tax policy or spending on green infrastructure. It also would likely signify a return to more predictable trade and foreign policy – even as U.S.-China rivalry is set to stay elevated due to bipartisan support for a more competitive stance.”

All plausible scenarios suggest stocks will keep going up

We should note that most experts agree that the makeup of Congress won’t determine whether stocks go up or down. Rather they see it as resulting in different degrees of stocks going up. Indeed, there’s almost no election scenario that market forecasters don’t like.

A divided government outcome is among the reasons why Jefferies’ Sean Darby sees the S&P 500 (^GSPC) rallying to 3,750 in 2021.

“Although we think the equity markets ‘churn’ until a result is determined, history suggests that periods of Democrat Gridlocked Congress tend to deliver positive returns,” Darby wrote on Thursday.

All of that is to say that everything remains far from certain, and investors should always be prepared for surprises.

“[O]ur common-sense nature must acknowledge that 2020 is what 2020 is — unrivaled in terms of precedent,” wrote BMO Capital Markets’ Brian Belski, who sees the S&P 500 rally to 3,850 within 12 months.

“Therefore, we believe it remains too soon to not count out a potential blue wave let alone any other ‘surprises’ given the fragility of emotions and volume of the rhetoric that seem to unfortunately grip investors more than the facts.”

But like his peers, Belski acknowledges history suggests the outlook for stocks looks good under “all of the plausible election scenarios,” especially in 2021 when there are no elections on the calendar.

“The S&P 500 has historically posted solid double-digit percentage gains under a Democratic president, regardless of Congress composition,” Belski observed. “More specifically, a Democratic president and a split Congress has yielded a 14.8% average S&P 500 gain during non-election years, while full Democratic control has yielded a 12.1% average S&P 500 gain during non-election years.“

By Sam Ro, managing editor. Follow him at @SamRo

What to watch today

Earnings

Pre-market

Before market open: Aurora Cannabis (ACB) is expected to report an adjusted loss of 46 Canadian cents per share on revenue of 63.87 million Canadian dollars

6:00 a.m. ET: NewAge Beverage (NBEV) is expected to report an adjusted loss of 6 cents per share on revenue of $70.75 million

7:00 a.m. ET: McDonalds (MCD) is expected to report adjusted earnings of $1.91 per share on revenue of $5.38 billion

7:00 a.m. ET: Canopy Growth Corporation (CGC) is expected to report an adjusted loss of 40 Canadian cents per share on revenue of 119.07 million Canadian dollars

7:30 a.m. ET: Cars.com (CARS) is expected to report adjusted earnings of 41 cents per share on revenue of $140 million

7:30 a.m. ET: Plug Power (PLUG) is expected to report an adjusted loss of 7 cents per share on revenue of $106.78 million

Post-market

4:00 p.m. ET: Nikola (NKLA) is expected to report an adjusted loss of 20 cents per share on revenue of $50,000.

4:00 p.m. ET: Novavax (NVAX) is expected to report adjusted earnings of $1.73 per share on revenue of $230.6 million

4:05 p.m. ET: ZoomInfo Technologies (ZI) is expected to report adjusted earnings of 9 cents per share on revenue of $117.3 million

4:15 p.m. ET: Occidental Petroleum (OXY) is expected to report an adjusted loss of 77 cents per share on revenue of $4.34 billion

4:05 p.m. ET: The RealReal (REAL) is expected to report an adjusted loss of 38 cents per share on revenue of $78.5 million

4:20 p.m. ET: Beyond Meat (BYND) is expected to report adjusted earnings of 5 cents per share on revenue of $132.06 million

5:00 p.m. ET: Norwegian Cruise Line Holdings (NCLH) is expected to report an adjusted loss of $2.24 per share on revenue of $82.50 million

Top News

Stocks rally worldwide as markets welcome Joe Biden victory [Yahoo Finance UK]

Biden win lifts oil prices but IEA official says Europe lockdowns could hit demand [Yahoo Finance UK]

SoftBank Group posts $1.3B loss on tech stocks bet [Yahoo Finance UK]

Berkshire operating results fall even as Apple boosts profit [Reuters]

YAHOO FINANCE HIGHLIGHTS

Negative yields may be coming to U.S.: Guggenheim CIO Minerd

Kohl’s made ‘unimaginable decisions’ to get through COVID-19 pandemic: CEO

Economists are all sounding the same warning about the better-than-expected jobs report

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay