Biden Administration to forgive $7.4 billion in student loans. How are Texans affected?

This week, the Biden Administration announced a plan to cancel $7.4 billion in student loans for 277,000 borrowers.

The U.S. Department of Education reports that Texans have the second-highest amount of student debt, behind Californians. 3.8 million students owe $33,400 on average. Fewer than 20% of Texas borrowers are on an income-driven repayment plan.

Here's what we know.

What's the latest on student debt relief?

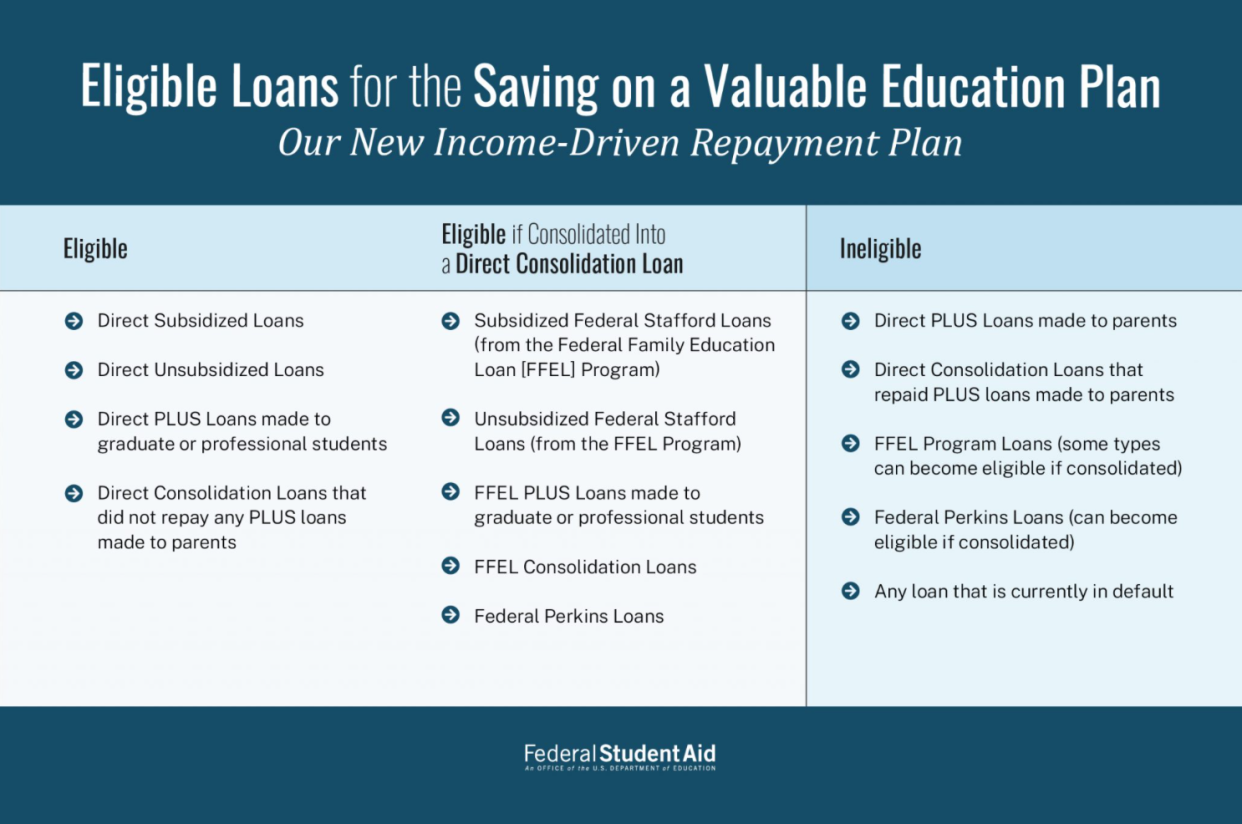

On Friday, President Joe Biden announced another round of debt relief will help those enrolled in the Saving on a Valuable Education (SAVE) repayment plan as well as those in Income-Driven Repayment (IDR) or Public Service Loan Forgiveness (PSLF) plans.

The White House provided a breakdown of the $7.4 billion that was recently approved:

$3.6 billion: Almost 206,800 borrowers enrolled in the SAVE plan who had taken out smaller loans for postsecondary education will see debt relief.

$3.5 billion: 65,800 borrowers will have their debts reduced through administrative adjustments to the IDR plan, in an effort to address loan servicers' misuse or forbearance.

$300 million: The latest actions of the PSLF plan, which helps those working in public service or for a non-profit, will impact 4,600 borrowers.

“Today we are helping 277,000 borrowers who have been making payments on their student loans for at least a decade,” said U.S. Under Secretary of Education James Kvaal. “They have paid what they can afford, and they have earned loan forgiveness for the balance of their loan.”

This brings the total amount of student loans forgiven to $153 billion, with 4.3 million benefitting from the initiative, the U.S. Department of Education reports.

People are also reading: Texas student loan borrowers get loans forgiven through Biden's SAVE Plan. What to know

What is the SAVE Plan?

The SAVE Plan lowers payments for most borrowers, compared to other income-driven repayment (IDR) plans, because payments are based on monthly income and family size.

Beginning in February 2024, the SAVE Plan will give borrowers who originally borrowed $12,000 or less forgiveness after as few as 10 years, according to studentaid.gov.

The Saving on a Valuable Education replaced the Revised Pay As You Earn (REPAYE) Plan. Borrowers on the REPAYE Plan automatically get the benefits of the new SAVE Plan.

More than 590,000 Texans are enrolled in the SAVE Plan, according to the Texas Tribune. Nearly 14,510 Texans no longer owe student loans thanks to the program, forgiving nearly $117 million in debt — more than any other state, the Dallas Morning News reports.

How much will I pay with the SAVE Plan?

The SAVE Plan decreases monthly payments by increasing the income exemption from 150% to 225% of the poverty line, Student Aid said.

Studentaid.gov shared a case of how much money borrowers can save:

"For example, 225% of the Poverty Guideline amount for a family size of one (in the 48 contiguous states) is $32,800, which means that if your annual income is equal to or less than $32,800 and your family size is just yourself, your discretionary income is $0 and your monthly payment will be $0. The same is true for a family size of four with an annual income of $67,500 or less," it said.

Can Texans still apply for the SAVE Plan student loan repayment program? Is there an income limit?

Borrowers can still apply for the SAVE program. There is no income limit to be eligible for the SAVE Plan. However, depending on the amount of loan debt, it might not be the best plan for a borrower’s situation.

According to the plan, there will be more benefits coming this summer. “The SAVE Plan includes additional benefits that will go into effect in July 2024. These additional benefits will likely reduce payments further and make it easier to manage repayment,” the program said.

If Texas residents applied for the SAVE program, be sure to check the email account (and Spam folder) used to register for the program. Borrowers can also check studentaid.gov.

This article originally appeared on Austin American-Statesman: Biden cancels $7.4M more in student loan debt: How are Texans affected?