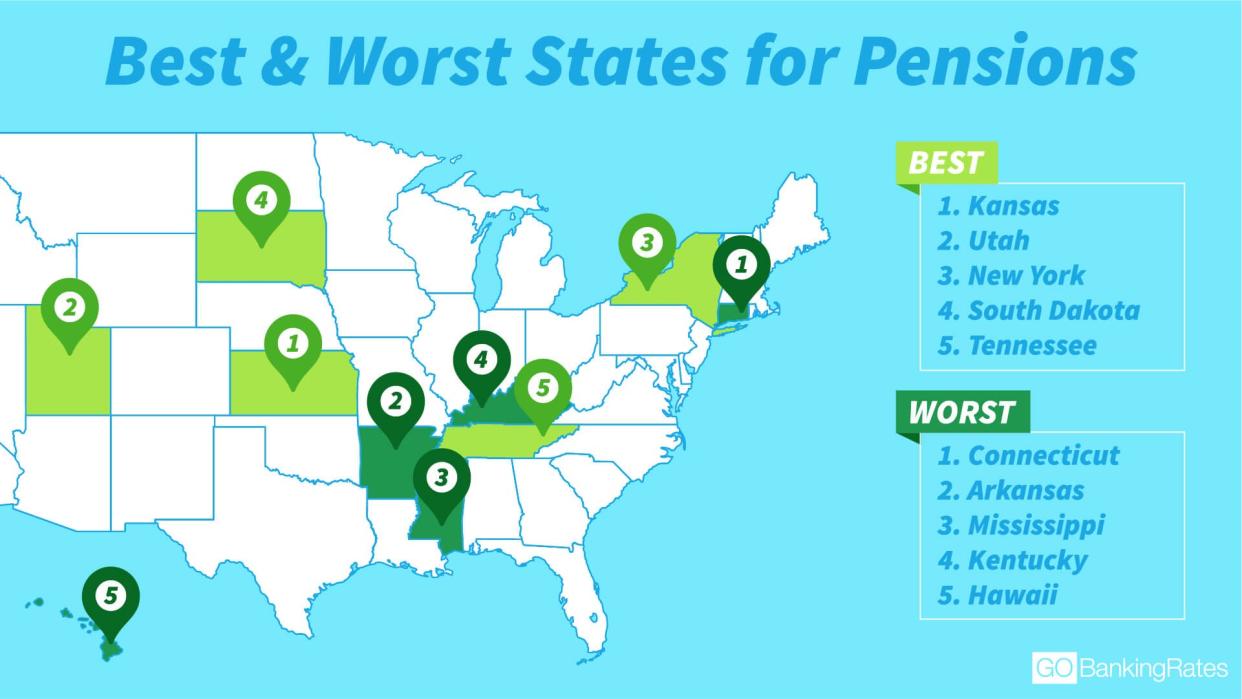

Best and Worst States for Pensions

The pension has long been a standard part of retirement for many Americans, particularly for public sector employees like police officers and mail carriers. Offering a pension — a set annual income for long-time employees after they retire — used to help attract quality employees and offered financial security in their golden years.

See: 30 Reasons It’s Hard To Retire at 65

Does the same hold true today? Private companies rarely offer pensions anymore, and states are struggling with pension commitments they made decades ago. The relative security of a pension is tied to the well-being of the government that offers it, and a great many U.S. states currently have unfunded pension liabilities.

See which states are well-prepared to continue funding their pension systems, and which ones might find themselves in fiscal hot water in the near future.

Last updated: April 19, 2021

50. Connecticut

Anyone living in Connecticut might consider other ways to save for retirement in case the state government doesn’t get its house in order. It has the lowest funding ratio — the percentage of money owed that’s been funded — for 2017 in the study.

Read: 42 Easy Ways To Save For Retirement

49. Arkansas

If you’re an Arkansas resident who’s counting on your pension and not saving anything for retirement, you might want to consider some backup options: Arkansas saw an increase in its unfunded liabilities by a third, the largest increase in the study.

Find Out: How Long $1 Million in Retirement Savings Will Last in Every State

48. Mississippi

Mississippi is the seventh-best state to live in if you’re in the middle class, but that could just as easily change if the state doesn’t take better care of its pension system in the coming years.

47. Kentucky

While concerns about the pension system must weigh heavily on Kentucky residents, the news isn’t all bad for retirees in the Bluegrass State: Louisville is among the cities where your retirement nest egg will stretch the furthest.

46. Hawaii

Hawaiians are already dealing with the highest cost of living in the country, but without more done to protect the state’s pension system, that could get even harder for its retirees.

45. Alaska

While the total unfunded liabilities are relatively low, that has more to do with Alaska’s small population than anything else. Per capita, the state’s unfunded pension liabilities are the highest in the country.

44. Oregon

Oregon is one of just 13 states that have more than $25,000 in unfunded pension liabilities per state resident.

43. Illinois

At 23.3%, Illinois has the third-lowest funding ratio for its pension system in the United States.

42. California

California is the state with the most unfunded pension liabilities in 2017, with nearly $1 trillion in pensions that aren’t currently accounted for.

41. Colorado

Coloradans’ pensions might not be as solid as they would like, but if they own their own home, they might have some flexibility. At over $350,000, the median home price in the state is the fifth highest in the nation.

40. New Jersey

At over a quarter of a trillion dollars, New Jersey’s total unfunded pension liabilities for 2017 are the sixth highest in America.

39. Georgia

Georgia saw the size of its unfunded pensions grow by over 16 percent from 2016 to 2017, the fourth-largest increase over that time frame in the country.

38. Ohio

Ohio might be struggling to fund its pensions, but that doesn’t mean it’s a bad state for retirees. Clintonville in Columbus, Ohio, is ranked the No. 5 best neighborhood to retire in.

37. South Carolina

South Carolina might be facing down an underfunded pension system, but it made up ground last year. In the 12 months ending June 30, the state’s five pension funds added almost 12% to their value.

36. Arizona

Arizona’s unfunded pension liabilities jumped by just under 13% from 2016 to 2017, taking them to over $100 billion.

35. New Mexico

New Mexico might be looking at a pension system that’s underfunded, but the state’s retirees have some bright spots. Albuquerque, N.M., is one of the best places to live on only a Social Security check.

34. Nevada

The culprit for Nevada’s pension problems could be the state’s labor market, as its unemployment rate of 4.9% is the fifth-highest in the country.

33. Alabama

The retirement system of Alabama manages some 23 funds with total assets of more than $40 billion, but it’s still looking at almost double that in total unfunded liabilities.

32. North Dakota

North Dakota’s $11.5 billion in unfunded pensions for 2017 is the second-lowest total on the list, but that was an increase of 12.9% from 2016, the ninth-largest proportional increase in the nation.

31. Wyoming

The current Wyoming Retirement System was created in 1953 to bring all of the state’s teachers and public employees into a single system, but today the state has more than $25,000 in unfunded liabilities per person. Whatever issues the pension system in Wyoming might have, the state’s retirees can enjoy the fact that they live in the second-most tax-friendly state for retirees.

30. Texas

While Texas might have nearly $400 billion in unfunded pension promises, it remains a relatively friendly state to retirees. Texas has eight different cities among the best cities to retire on a budget of $1,000 a month.

29. Michigan

A recent study found that more than 110 of the 490 local units of government in Michigan have underfunded pensions or retirement healthcare plans.

Pension or no, you need less than $1 million to survive retirement in the Great Lakes State, which is the fourth lowest in the country.

28. Washington

Washington has eight state-administered public retirement systems that include 15 different plans and serve nearly 750,000 current and former employees with almost $4 billion in annual payments.

27. Massachusetts

Massachusetts set aside $2.4 billion for pension contributions in 2017, but that figure is expected to balloon to $5.2 billion by 2027 and $11.2 billion by 2036.

Retirees in Massachusetts had better hope their pension system remains intact into the future: The cost of a comfortable retirement there is higher than in any other state.

26. Vermont

Vermont has the lowest amount of total unfunded pension liabilities as of 2017 of any state in the U.S.

Click to Read: 15 Mistakes Even Smart People Make in Retirement

25. Minnesota

The state of Minnesota might owe almost $120 billion in unfunded pensions, but the state could be doing better with finances than its residents: Minnesota is one of just seven states where a recent GOBankingRates survey found the average debt level per person is over six figures.

24. Pennsylvania

With over $223 billion in unfunded pension liabilities, Pennsylvania is among the top 10 states for the most total pension promises that aren’t currently budgeted for.

23. North Carolina

North Carolina might be doing relatively well for now, but the state is trending in the wrong direction. Its unfunded pensions jumped by over 15% from 2016 to 2017, the sixth-largest increase in this study.

22. Rhode Island

Rhode Island has much of its pension system under control, but the state still has some work to do. It is one of 17 that has less than 30% of total pension liabilities funded.

21. Idaho

Idaho’s pension system doesn’t have large levels of unfunded pensions, but that could be changing. It is among the top 10 states for the highest percentage increase in its unfunded pension liabilities.

20. Louisiana

Louisiana’s per-capita unpaid pension liabilities exceed $20,000 for every resident of the state.

19. Delaware

Total unfunded pension liabilities for Delaware jumped by 12.8% from 2016 to 2017, despite the fact that the state’s fund had a weighted return of 11.3% for the fiscal year 2017. The more retirement income, the better in Delaware; it ranked as the top state to retire rich in another GOBankingRates study.

18. Missouri

Almost half the states in America have unfunded pension liabilities of $100 billion or more, including Missouri.

17. Montana

Montana’s public pensions provide an average of $34,308 a year to its retirees and manage to do so while keeping the second-lowest total tax burden in the country.

16. Maryland

Maryland’s $51.9 billion pension fund is in better shape than most, but the state did see the size of its unfunded liabilities creep up 6.2% last year, putting it just shy of $100 billion in total unfunded pension promises. Plenty of Marylanders might not be heavily reliant on pensions: The state has the third-highest average household income of any state in the country.

15. Iowa

Iowa’s unfunded pension liabilities just cleared $50 billion for the first time in 2017.

14. New Hampshire

New Hampshire is one of just five states that managed to improve their funding ratios from 2016 to 2017. The state boosted the total percentage of its pensions that are funded by 2.9% last year.

13. Florida

Florida’s unfunded pension liabilities are the seventh highest on the study, but on a per-capita basis, it’s just under $11,000, the sixth lowest in the country.

12. West Virginia

West Virginia actually closed its teacher pension plan in 1991 and shifted to a 401k-style plan for new teachers, only to switch back in 2006 after discovering that a pension plan cost about half as much. West Virginia has the highest percentage of its residents collecting Social Security benefits — one of the largest pension systems in the world — out of any state in the country.

11. Indiana

Indiana’s pension system has about $32 billion in assets under management, servicing 473,000 members and retirees from more than 1,200 different employers.

10. Virginia

Virginia’s per-person unfunded pension liabilities increased by only 5.9% last year, placing it among the 15 lowest in the country.

9. Nebraska

Nebraska structures its pension with five mandatory plans — State, County, School, Judges and Patrol employees — with approximately $23 billion in managed assets across them all. Nebraska’s pension system might be relatively healthy, but retirees are struggling with at least one thing: The state is the least tax-friendly to retirees in the country.

8. Maine

Maine needs to keep its pension system in good working order as it’s the oldest state in the country by median age. Good thing, then, that Maine’s funding ratio is over 40%, and its unfunded liabilities grew less than 5% last year.

7. Wisconsin

Wisconsin has got the most of its total pension system funded for the future; it has the largest funding ratio of any state in the country.

6. Oklahoma

Oklahoma’s pension system managed to boost its funding ratio from 2016 to 2017 by 2%, one of just five states that raised its ratio.

And Oklahoma’s pensioners have more going for them than just the stability of their system. It is also the state where $1 million lasts the third longest in retirement.

5. Tennessee

At just $7,601, the per-capita unfunded pension liabilities in Tennessee are the lowest the country.

4. South Dakota

Totaling $11.7 billion, South Dakota’s total unfunded pension liabilities are the third lowest in the country. What’s more, Aberdeen, S.D., is among the best cities to retire in states without any income tax.

3. New York

New York’s $345.3 billion in unfunded pension promises is the fifth highest in the country, but it is ranked third in this study because it lowered that number in 2017 and boosted its funding ratio by 3.1 percent.

2. Utah

Utah might have the least to gain from a solid pension system of any state just now, as it has the lowest median age in the country. That youthful populace might also be helping the state keep its pension system in good health, as the state trimmed its per-capita unfunded pension liabilities by 3.3% from 2016 to 2017.

1. Kansas

Kansas saw the largest decrease in its unfunded pension liabilities in the country, dropping the total unfunded liabilities by 5.4%.

How the States Compare

The unfunded pension liabilities in the United States total more than $6 trillion as of 2017, approaching a third of the country’s total GDP. Of that, about 16.5% of the total is accounted for by California alone.

Click through to learn about the retirement planning mistakes that waste your money.

More From GoBankingRates

Methodology: GOBankingRates analyzed all 50 states in terms of three overarching factors: (1) unfunded pension liabilities for 2016 and 2017; (2) unfunded pension liabilities per capita for 2016 and 2017; and (3) funding ratio of public pension plans for 2016 and 2017, sourced from American Legislative Exchange Council. States were scored using these three factors and scored for their respective year-over-year change for each metric. Scores were combined, with unfunded pension liabilities receiving half weight since larger states naturally have larger liabilities, while all other factors received full weighting.

This article originally appeared on GOBankingRates.com: Best and Worst States for Pensions