Here Are the Finance Pros Each Generation Trusts Most

Just as it is with musicians, comedians and authors, some financial experts manage to capture the voice of a generation.

Experts Reveal: How Much Money You Should Have in Your Savings Account If You're in Your 50s

Learn: How To Build a Financial Plan From Zero

GOBankingRates examined the 100 most influential money experts -- including authors, podcasters, radio hosts, business magnates, news columnists, TV personalities and celebrity advisors -- and picked the ones whose wisdom resonates the loudest with each age group.

The following is an introduction to six of the country's most popular money pros and the generations they click with -- even if they're not of those generations themselves. There are three for Gen Z -- young people starting out need the most help -- and one each for millennials, Gen X and the baby boomers.

Gen Z: Farnoosh Torabi

Farnoosh Torabi rose to prominence just as the oldest Gen Zers were coming of age -- and Torabi recognized a new kind of danger facing the only generation that never knew life before social media. She's now one of the most authentic voices speaking to that young generation and is working to guide them through life in post-pandemic America.

In chronicling the financial anxieties of her young podcast listeners, she wrote for CNET, "When they want to know how to ask for a raise, it's because they're afraid of discussing their achievements with their boss. When they're on the fence about quitting their job, it's because they're scared of economic uncertainty. When they don't know how to approach finances with their partner, it's because they're fearful of starting an argument."

She advises confronting and managing financial fear instead of letting it keep you from acting in your best interest.

"Money fear or anxiety may prompt you to establish a healthier relationship with your finances," she wrote.

Gen Z: John Liang

One of the brightest and most popular TikTok stars, John Liang has 2.2 million followers on the platform.

Although his personality is exciting, his advice for investing is quite the opposite.

"The 'secret' to investing is that there is no secret," he said in an exclusive Q&A with GOBankingRates. "The most successful investors are the ones with the most 'boring' portfolios. A low-cost, broad-based market index fund is one of the surest ways to long-term wealth gain. Just buy and hold, and let time do the rest.

"There are countless studies that show us that the professional fund managers on Wall Street fail to consistently (meaning greater than 50% of the time) beat their benchmark market index. Think about that: People get paid millions a year, but they can't even beat the market. So then why should retail investors even try? They shouldn't. Just be the market."

Gen Z: Carmen and Darius Britt

Darius and Carmen Britt drew legions of young followers to their brand by setting a firsthand example. The couple erased six figures worth of debt in just three years and now spend their time sharing their Lifestyle Banking system with young up-and-comers.

The philosophy -- and their Wealth Nation brand -- is hot with Gen Z, which tunes into their YouTube channel, follows their blog and takes their master classes in droves. The couple's system has helped their users generate $75 million.

Millennials: Michelle Singletary

Washington Post columnist Michelle Singletary's influence spreads far beyond the pages of her newspaper. The four-time author has amassed a following of 39,000 on Twitter and nearly 7,000 on Instagram.

According to Credit Karma, millennials have among the highest debt of any generation -- and they'd be wise to adopt Singletary's ruthless attitude toward borrowing.

In an exclusive Q&A with GOBankingRates, she said, "The most important thing you can do to build wealth is to develop a healthy and life-long hatred of debt. If debt were a person, I'd slap it. Many people are living the 'American dream' but on borrowed money."

Gen X: Grant Cardone

Gen Xers are on deck for retirement, but there's still time to make a few good -- or bad -- moves that could change everything in their golden years.

Self-made millionaire/sales guru Grant Cardone thinks one of the good ones is to stop contributing to 401(k)s right away. That advice runs contrary to everything Gen Xers have been told their whole lives about saving for retirement, but Cardone made his bones on bold ideas.

He said to CNBC: "Why would I go to work, have my employer give me another $6,000 a year and then take that money and send it off to Wall Street, where I can't even touch it for 30 years?"

Cardone insists that neither that Gen Xers nor anyone else can save their way to financial freedom. Instead, he wants them to earn their way to their goals by taking that savings and investing it in a business or some other wealth generator.

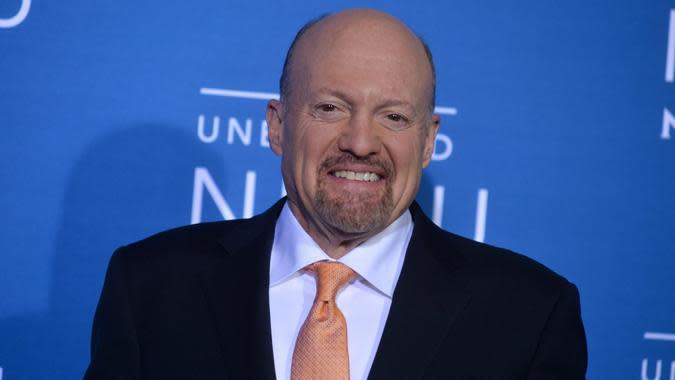

Baby Boomers: Jim Cramer

Known for the zany persona he crafted on his groundbreaking "Mad Money" TV show, Jim Cramer used his status as a Wall Street insider to build trust with baby boomers on Main Street.

Although his show is dedicated to stock picking, he cautions against choosing individual companies until you have a sizable sum invested in a broadly diversified fund.

In an exclusive Q&A with GOBankingRates, Cramer said, "Everyone should own an index fund first; and, only after you think you have built it up considerably, then can you buy individual stocks."

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Here Are the Finance Pros Each Generation Trusts Most