Bay Area housing market — once fueled by tech — cools amid layoffs

Andy Chen, a home seller in California's Bay Area, was dreaming of Waikiki, where he planned to buy a condo, after getting an offer $50,000 over his $1.5 million listing price and with all contingencies removed.

But Chen’s fortunes took a fast turn three days before the closing when the buyers killed the deal after the husband got laid off from his tech job in Silicon Valley and the family needed their deposit back.

"I was told that their life is in turmoil," Chen said. "They are a single-earner family with young children."

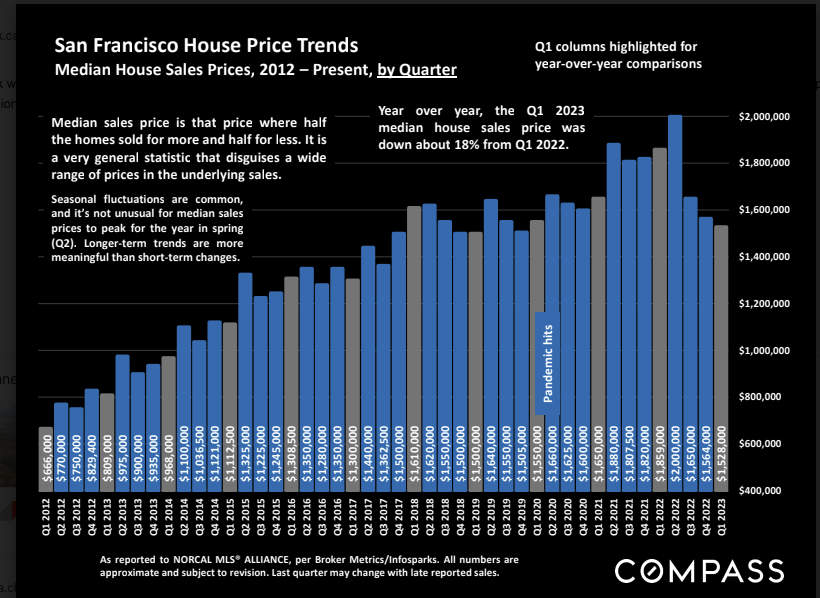

Chen’s experience is not unusual for a seller in the once lucrative Bay Area housing market. Plagued first by workers seeking remote opportunities then by widespread tech layoffs, the San Francisco county market experienced its first three-consecutive quarter decline in home prices in a decade, with the median house price dropping 23% in just nine months.

"So we have this combination of macro economic factors that were affecting every place in the country, like interest rates going up and so forth," Patrick Carlisle, Compass's San Francisco senior market analyst, told Yahoo Finance, "And then you've had these very specific factors like high tech layoffs, the highest home prices in the country, work from home affecting our industries more than others."

The market’s woes were first set off by the rise in remote work.

"The whole work-from-home thing put in people's heads the idea that they could keep an urban area job, but not pay an urban area housing cost," Carlisle said.

Average home prices in the Bay Area are elevated compared with the rest of the nation. The median house sales price is $1,528,000 in San Francisco and $1,590,000 in Santa Clara, based to data provided by Compass. These prices are four times higher than the U.S. median price of $375,700.

And even though some companies have started to ask employees to return to the office, the city's office space vacancy rate remains at 30% compared with the overall U.S. rate of 12%.

Loss of tech money

Further exacerbating the housing downturn in San Francisco is the waning confidence among potential homebuyers as they grapple with the fact that tech firms are not what they used to be.

Bonuses are shrinking and employment has been dipping since mid-2022.

"A few months ago, it was completely unthought of that Google and Meta would be having this scale of layoffs," Carlisle said. "They hadn't had layoffs in forever."

The unemployment rate for Santa Clara County, the approximate geographical location of Silicon Valley, has been ticking up since last year, reaching 3.2% in March 2023. Other Bay Area counties, such as Alameda, San Francisco, San Mateo, and Marin, have also seen an increase in unemployment rates in the last six months, according to Compass data.

Not only have employment opportunities declined in the Bay Area, but venture capital (VC) investments and initial public offerings (IPO) have dropped as well, drying up the startup and stock bonanza the region previously experienced.

"People's net worth in the tech industry has gone down and stock prices have fallen, IPOs stopped, a lot of the startup business is dependent on some of these things and that money won't be there," said Ken Rosen, chairman of Berkeley Haas Fisher Center for Real Estate.

IPO deal volume declined 8%, and proceeds were down by 61% year-over-year in the first quarter, according to a report published by Ernst and Young, and VCs have also pulled back on private funding for startups. That’s a far cry from when unprofitable businesses like Peloton raised over $1 billion in 2019.

"If you don't have the jobs and don't have the wealth, you'll be less aggressive as a buyer." Rosen added.

While big tech companies beat earnings and performed better than analysis expectations last week, home experts don’t expect the positive quarterly financials to impact the Bay Area market in the short-term.

“The earnings positives didn’t change the layoff plans, which are large,” Rosen said.

Carlisle agreed.

“While financial markets can move very quickly and dramatically, the housing market is more like a huge ship, which only changes direction slowly,” Carlisle said. “People don't suddenly make the decision to buy or sell homes based on short-term changes in quarterly earnings.”

Still, this remains the region that roared back from the dot-com bust. And since 2012, home prices are still up 130%, according to Compass statistics

"They're a good place to invest for the long term if you believe in the intrinsic value of this area being the company and the people," said Adam Touni, a broker with The reSolve Group, a Bay Area based real estate company.

Just ask Chen, who told Yahoo Finance that he received an all-cash offer just a couple of days after his first offer fell through.

“I am in escrow now," Chen said, "but still nervous after what happened last time."

Rebecca is a reporter for Yahoo Finance and previously worked as an investment tax certified public accountant (CPA).

Read the latest financial and business news from Yahoo Finance