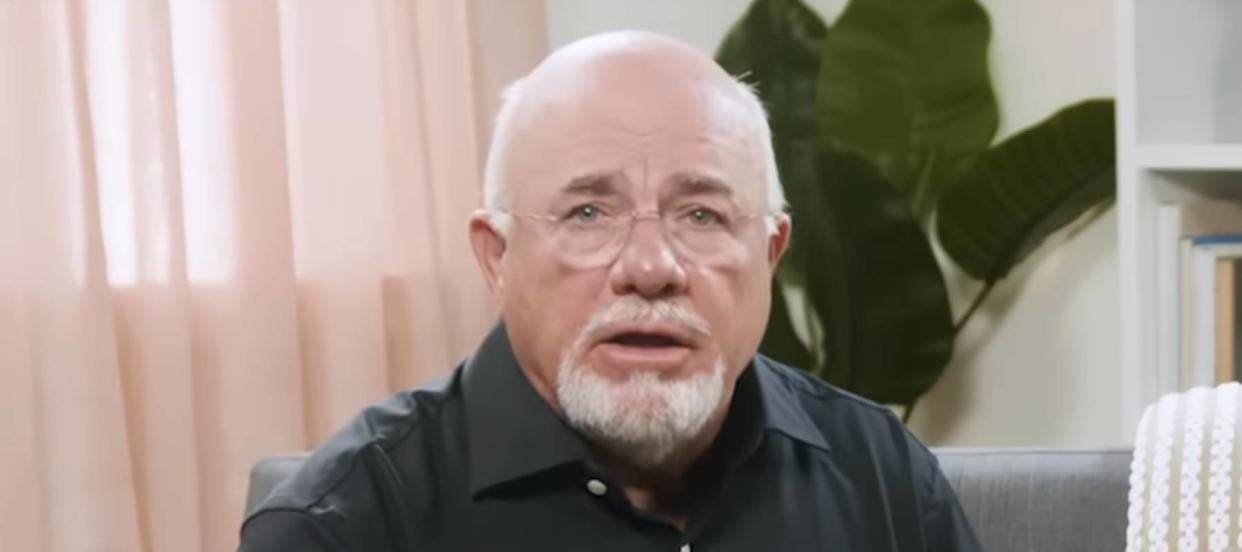

‘They are awful’: Dave Ramsey is fed up with millennials and Gen Z who he claims don't work but want to own homes — here’s what he says you need to be a ‘successful' investor

We adhere to strict standards of editorial integrity to help you make decisions with confidence. Some or all links contained within this article are paid links.

Dave Ramsey has never been shy about what really grinds his gears when it comes to the financial habits of young Americans.

In a recent interview with Fox News, Ramsey — a boomer — shared his true feelings about millennials and Gen-Z’s financial habits: ”They are awful. They live in their mother’s basement. They can’t figure out why they can’t buy a house because they don’t work.”

While this sentiment may ring true for people of any generation, younger Americans certainly have some odds stacked against them amidst high home prices and interest rates.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

A Consumer Affairs report found that Gen Z’s money had 86% less purchasing power than baby boomers did when they were in their twenties.

Despite these daunting economic circumstances, it is still possible for millennials and Gen Z to invest in the real estate market even if they are priced out of buying a home right now.

Investing for the future

Ramsey is a big proponent of the importance of investing for the long term. In a February blog post, he wrote: “A solid investment strategy gives you focus, clarity and direction — and you need all three to become a successful investor.”

But having this clarity and direction is easier said than done, whether you're just starting to build your portfolio or looking ro expand it.

Luckily, there are investing platforms out there that come equipped with expert guidance so you can start building your wealth without having to become an investing savant.

Motley Fool Stock Advisor is a subscription-based service that provides users with market insights and expert-stock picks, so you can better allocate your money for the returns you want.

From informational articles and market reports to a community of more than half a million investors and more, Stock Advisor is a one-stop shop for valuable investing tips to help you diversify and improve your portfolio — or your money back.

Grow your money with real estate

Research published by The National Association of Realtors in February found that home prices are on the rise in 85% of U.S. cities, with the median price of a new home sitting at $430,700 in March according to The U.S. Census Bureau. With mortgage rates also still hovering near 7%, it shouldn’t come as a shock that many Gen Zers and millennials aren’t yet able to purchase their first home.

That being said, even if you’re not able to purchase a home, you can still invest in the real estate market in a number of ways.

Ramsey himself is passionate about earning passive income through real estate, and in a March blog post suggested investing in residential and vacation rentals, with the caveat that “renting out a house isn’t for the faint of heart — even if you hire a property manager.”

If you’re looking for an accessible option to invest in vacation and rental properties, Arrived is an online platform that allows you to invest in shares of these types of properties without having to navigate the workload and hassles of property management. — comes into play.

You can browse a curated selection of homes and once you find a property you like, you can choose the number of shares you want to buy and start investing in real estate right away.

Read more: Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

Accredited investors can also take the commercial real estate route through First National Realty Partners. Commercial real estate has long been touted as a solid hedge against inflation and a source of passive income.

With FNRP’s investment platform, you can invest in necessity-based commercial real estate without having to find the deals yourself or shell out all your cash. FNRP’s team of professionals will manage your investments throughout their entire cycle, so you can sit back and trust their professional guidance.

If you’re not keen on focusing on one type of real estate, there are still options out there.

Compound Real Estate Bonds is a real estate company that offers an opportunity to earn 8.5% APY through their SEC-qualified Real Estate Savings Bonds.

Compound has a strong focus on income producing real estate and real estate private credit, that can help you diversify your portfolio while helping to hedge it against inflation.

By choosing to invest with Compound, you can boost your savings over time and also enjoy the freedom of no fees or lock-in periods, with the flexibility to withdraw your funds whenever you need to.

Prioritize planning

Recently, the hashtag #daveramseywouldntapprove on TikTok has appeared across thousands of posts and millions of views. In these videos, millennials and Gen Z are exposing their money habits that the financial guru in question definitely wouldn't approve of — like a Disney World shopping spree on credit or a $16 cocktail.

Creating a budget and overall financial plan can be the exact spark you need to ignite to improve your financial situation. In a video with his daughter Rachel Cruze on her YouTube channel, Ramsey shared that getting on a budget is one of the best things you can do with your money in 2024.

He quipped that “no one accidentally wins the Super Bowl, The World Series or the World Cup.”

In other words, you can’t expect wealth to fall in your lap without effort, and we can’t all call in to the Ramsey Show when we need advice. But, hiring a professional near you could help ensure your financial plan is comprehensive.

With Advisor.com, getting set up with a suitable — and professionally-vetted— financial advisor is easy. All you need to do is answer a few questions about your financial situation, and they'll match you with advisors who suit your needs. Then, you can set up a free consultation with no obligation to hire to ensure you find the right fit for your wealth-building goals.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

Jeff Bezos, Mark Zuckerberg, and Jamie Dimon are selling out of US stocks in a big way — here's how to diversify into private real estate within minutes

'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling rising costs — take advantage today

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.