Trump, likely to benefit from new bill, still refuses to release taxes

The White House said Tuesday that President Trump would likely owe more in taxes under the bill that passed the House but declined to release his 2016 returns on the grounds they are being audited. Both claims are disputed by tax experts.

“We expect that it likely will, on the personal side, could cost the president a lot of money,” said press secretary Sarah Sanders when pushed on Trump’s claim that the bill would cost him “a fortune.”

Multiple analyses have shown that one of the primary beneficiaries of the tax bill will be commercial real estate, the business from which Trump and his family members receive the majority of their income. An analysis done for NBC News based on Trump’s leaked 2005 returns estimated he could personally save $22 million under the new bill. The Trump family would also save money from the doubling of the estate tax exemption.

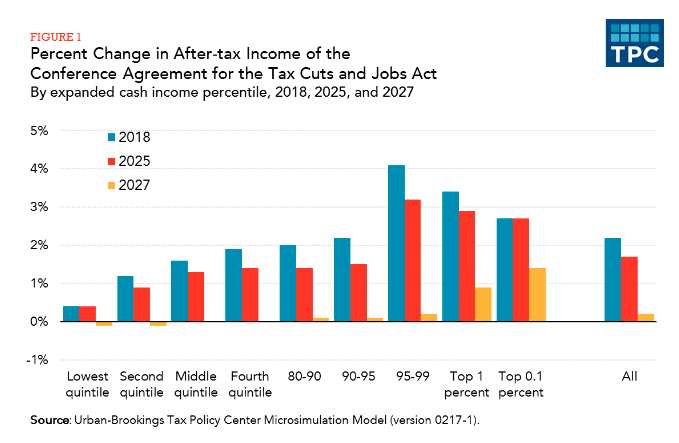

An analysis from the Tax Policy Center found that a majority of the benefits in the tax bill would go to the top 5 percent of earners.

When pressed on why Trump didn’t simply release his tax returns as presidents had done for decades, Sanders said it wasn’t possible while an audit was ongoing. Former President Richard Nixon released his tax returns while under audit and Trump could release his pre-2009 returns, which his attorney said are not under audit. Trump said during an interview in April that he might release them after his time in the White House ended, reneging on a promise to release them as soon as the audit was complete.

As president, Trump will be audited every year due to an IRS bylaw.

The House passed the Tax Cuts and Job Acts conference report on Tuesday afternoon prior to the briefing. The Senate is expected to pass the bill along party lines Tuesday evening.

Read more from Yahoo News: