Here's how the Biden tax plan would affect each U.S. state

Presidential candidate and former Vice President Joe Biden has said that he wants to lower taxes for the middle class.

His plan would raise the corporate tax rate to 28%, require a true minimum tax of 21% on all foreign earnings on U.S. companies, levy a tax penalty on corporations that move jobs overseas, place a 15% minimum tax on book income, raise the top individual income tax rate to 39.6% (the current maximum is 37%), and require those who make more than $1 million annually to pay the same rate on investment income as they do on their wages.

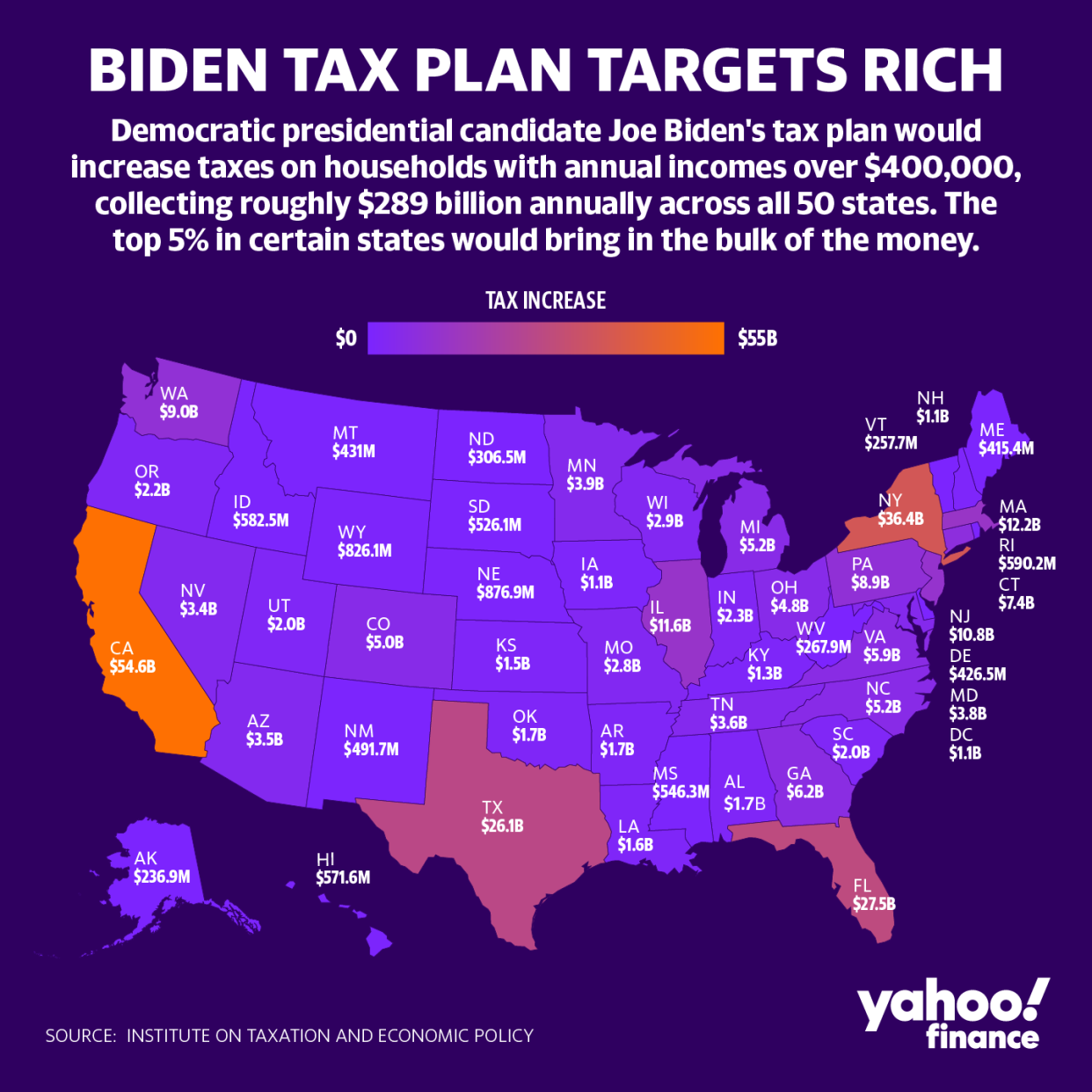

Biden’s plan would generate over $289 billion in tax revenue, according to research from the Institute on Taxation and Economic Policy (ITEP). About 1.9% of the U.S. population would see an increase in taxes.

The ITEP data broke down the impact by state. Population has a major impact on the overall total in tax increases.

Who actually pays

With its massive population of over 39.5 million people and median income of $71,228, it’s no surprise that California would see the highest tax increases under Biden’s plan.

On Biden’s campaign website, it states that “he won’t ask a single person making under $400,000 per year to pay a penny more in taxes.”

Here’s what the ITEP research shows.

On average, the bottom 95% in California will see no change in their taxes, even though collectively their tax bill may increase or decrease, according to ITEP. It’s those in the top 5% that will see a higher bill, with those making $347,200 to $948,300 a year paying $5,310 more on average each year. Those in the top 1% would see their tax bill increase by $279,300 on average.

In total, the state would see a $54.6 billion more in tax revenue.

Other states with significant tax increases on their top 5% include New York, Florida, Texas, Illinois, and New Jersey. All of these states are among the most populated states in the country, according to the U.S. Census Bureau data.

“The plan will increase personal income taxes and payroll taxes for very high-income people,” Steve Wamhoff, director of foreign federal tax policy at ITEP, told Yahoo Finance. “That will only happen for 1.9% of taxpayers.”

The share of taxpayers affected by these taxes, he said, is what he thinks is the most “compelling” part of the data.

States like New Jersey, Connecticut, and California, which have some of the highest taxes in the country, would see upwards of 3% of their residents impacted by these taxes. Meanwhile, states like West Virginia and Arkansas would have less than 1% of their residents affected.

“That's the thing that's easiest to understand because regardless of how big a state's population is, we know some states just have a higher percentage of their taxpayers who are high-income people,” Wamhoff said.

Part of this tax revenue would fund his health care plan, which would build upon the Affordable Care Act (ACA) and create a public option.

Correction: A previous version of this article misstated how Joe Biden's payroll tax would be applied.

Adriana Belmonte is a reporter and editor covering politics and health care policy for Yahoo Finance. You can follow her on Twitter @adrianambells.

READ MORE:

Obamacare repeal would bring a huge tax cut for the rich, research shows

2020 election: Trump and Biden diverge sharply on health care

'Bidencare' is taking shape as a health care policy proposal

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.