U.S. jobless claims skyrocket to 3.283 million

The COVID-19 pandemic is wreaking havoc on the U.S. economy, and data released Thursday morning reflected the severe damage being done to the labor market.

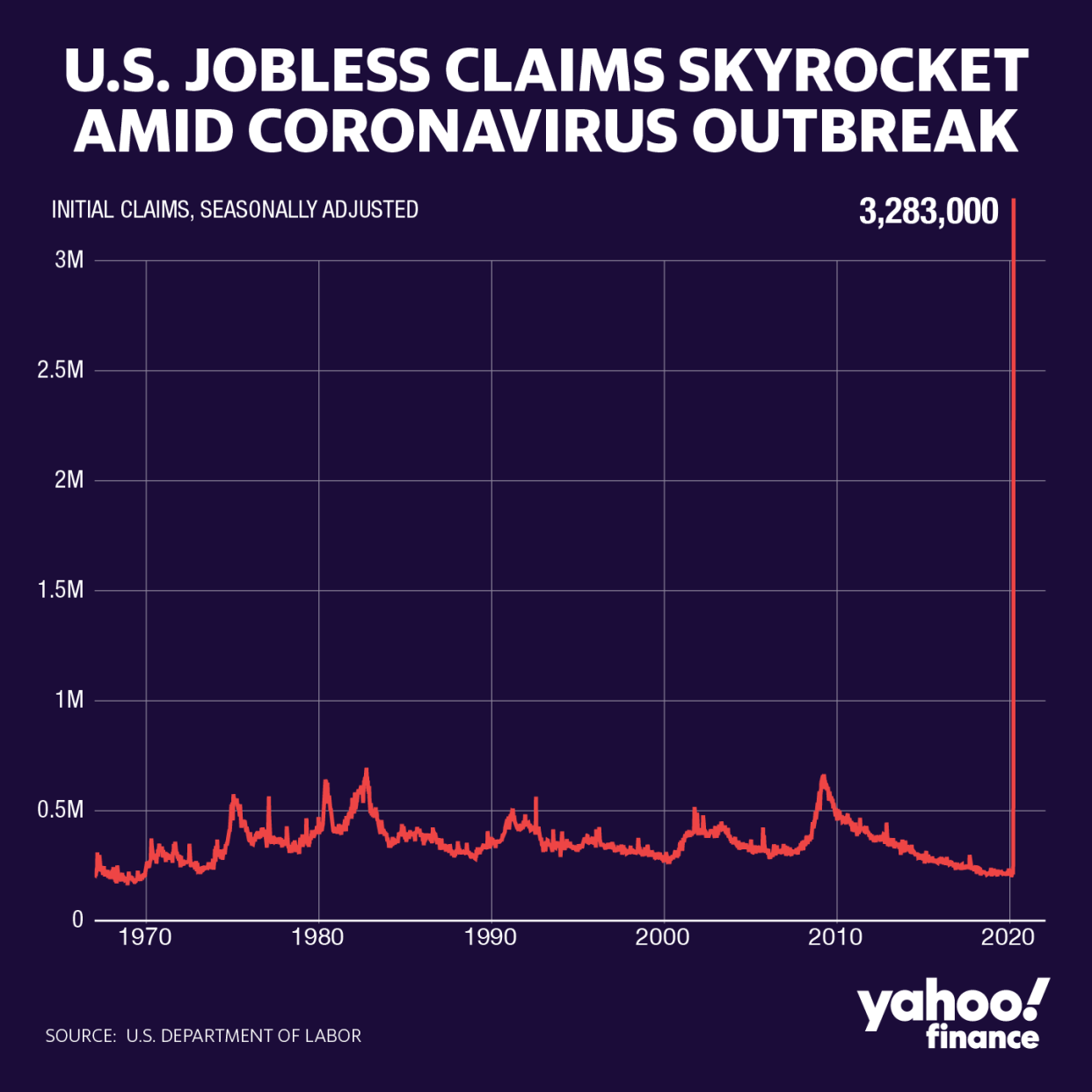

The number of Americans filing for unemployment benefits skyrocketed to a record-breaking 3.283 million for the week ended March 21. Consensus expectations were for 1.64 million claims. The previous record was 695,000 claims filed the week ended October 2, 1982. Initial jobless claims for the week ended March 14 was revised higher to 282,000 from 281,000 and was the largest single-week increase since the Great Recession.

“Millions of Americans are filing for benefits, and that means the economy is not just staring down at the abyss, it has fallen off the cliff and down into the depths of recession,” Chris Rupkey, chief financial economist at MUFG Union Bank, said in an email Thursday. “How far it goes is anyone's guess, but certainly close to 10 million people are out of work, and this means the official unemployment rate will match the 10% threshold of pain reached in the 1981-82 and 2007-09 recessions.”

“In previous deep recessions, most notably in 2008 and 1980, initial claims during the worst four weeks of the recession would total 2 [million],” Nomura economist Lewis Alexander wrote in a note to clients March 22. “That is consistent with the shock from COVID-19 compressing a significant deterioration in the labor market into a much shorter period relative to previous contractions.”

[See Also: The computers can't handle the spike in unemployment claims: Connecticut governor]

Uncertainty is high, and so the range of estimates for Thursday’s report was unusually wide. Economists at Citi estimated claims would explode to 4 million. Meanwhile, UBS economists estimated the tally would come in at 860,000.

Alexander noted that the sudden spike in weekly initial jobless claims will likely not persist for long at these elevated levels; however, it implies that non-farm payroll job losses could be heavily front loaded relative to previous recessions which means the unemployment rate could rise even more rapidly.

Recent indications from individual states pointed to initial jobless claims in the millions.

“Early state reports this week indicate initial claims for the week ended March 21 will rocket well over one million next week—and possibly as high as three million,” Wells Fargo wrote in a note March 20. “That would surpass anything we saw during the financial crisis and could be upwards of three times the all-time high in claims set back in 1982. This will shock even the most bearish forecasters. As economic activity is grinding to a halt, the U.S. economy is quickly catapulting into a recession.”

Connecticut was expected to see approximately 80,000 claims last week, according to data compiled by Morgan Stanley.

“The [unemployment claims] are going through the roof,” said Connecticut Gov. Ned Lamont in an interview with Yahoo Finance. “The computer system has reached its threshold a couple of times right now.”

[See Also: Unemployment insurance: What it is and how to get it]

In addition, many states waived requirements that recently laid off workers must wait one week before filing a claim.

The rapid spread of the coronavirus has led to massive business disruptions in the U.S. over the past several weeks. A growing number of cities across the country ordered residents to “shelter in place,” and non-essential businesses such as sit-down restaurants and retail stores have been forced to shut their doors. As a result, the pace of layoffs has been swift.

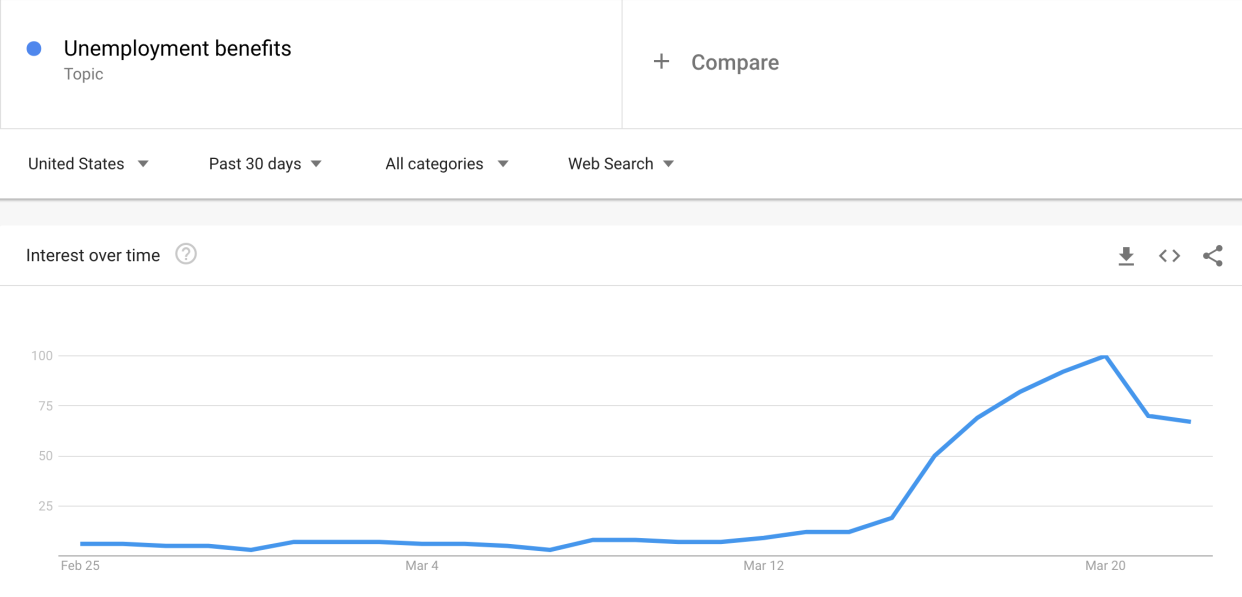

While the U.S. Senate unanimously approved a $2 trillion fiscal stimulus package late Wednesday evening, many believe it may be too late to prevent the damage done to the U.S. labor market. Google searches for “unemployment benefits” have surged over the past month in the U.S. The upward trend began March 11 before peaking on March 20. President Donald Trump declared the COVID-19 outbreak a national emergency on March 13.

There are currently more than 487,600 confirmed cases of coronavirus worldwide and 22,029 confirmed deaths as of Thursday morning, according to Johns Hopkins.

—

Heidi Chung is a reporter at Yahoo Finance. Follow her on Twitter: @heidi_chung.

More from Heidi:

How consumer trends have changed amid the coronavirus pandemic

These stocks are poised to benefit as coronavirus roils markets

Find live stock market quotes and the latest business and finance news

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.