Washington is debating extending the tax season. One expert’s response: ‘File right now’

Personal income taxes are due in about a month.

President Trump announced that “certain individuals” will be able to defer their tax payments without penalty given the ongoing coronavirus crisis. Treasury Secretary Steven Mnuchin added a promise of “substantial relief to certain taxpayers” on Wednesday.

Yet, details are scarce. Trump says he plans to act using emergency authority and he’s asked Congress for legislation.

However the plans shake out, experts are predicting a bumpy ride for taxpayers for the remainder of the filing season.

“What Trump is going to do is create an enormous amount of confusion,” says Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, referring to the idea of changing the tax-filing schedule for some people.

Caroline Bruckner, a professor at American University, has some advice to those expecting to get a refund and who want to avoid potential messiness: “Go ahead and file, right now,” she says.

Many have taken that advice: according to IRS data through March 6, almost 68 million Americans – roughly half of all filers based on previous years – have already filed their tax returns, and nearly 53 million have gotten their refund.

“It's like an immediate stimulus,” says Bruckner.

In 2018 and 2019, as in other years, the vast majority tax of filers got a refund as opposed to a bill after filing their returns.

Confusion about a plan to extend tax season for ‘certain individuals’

The plans sketched out by the Trump administration – which the Treasury Department declined a request from Yahoo Finance to clarify – left some experts scratching their heads.

“We don't know who those certain people are,” Gleckman says. “The more you think about it, the more complicated it gets.”

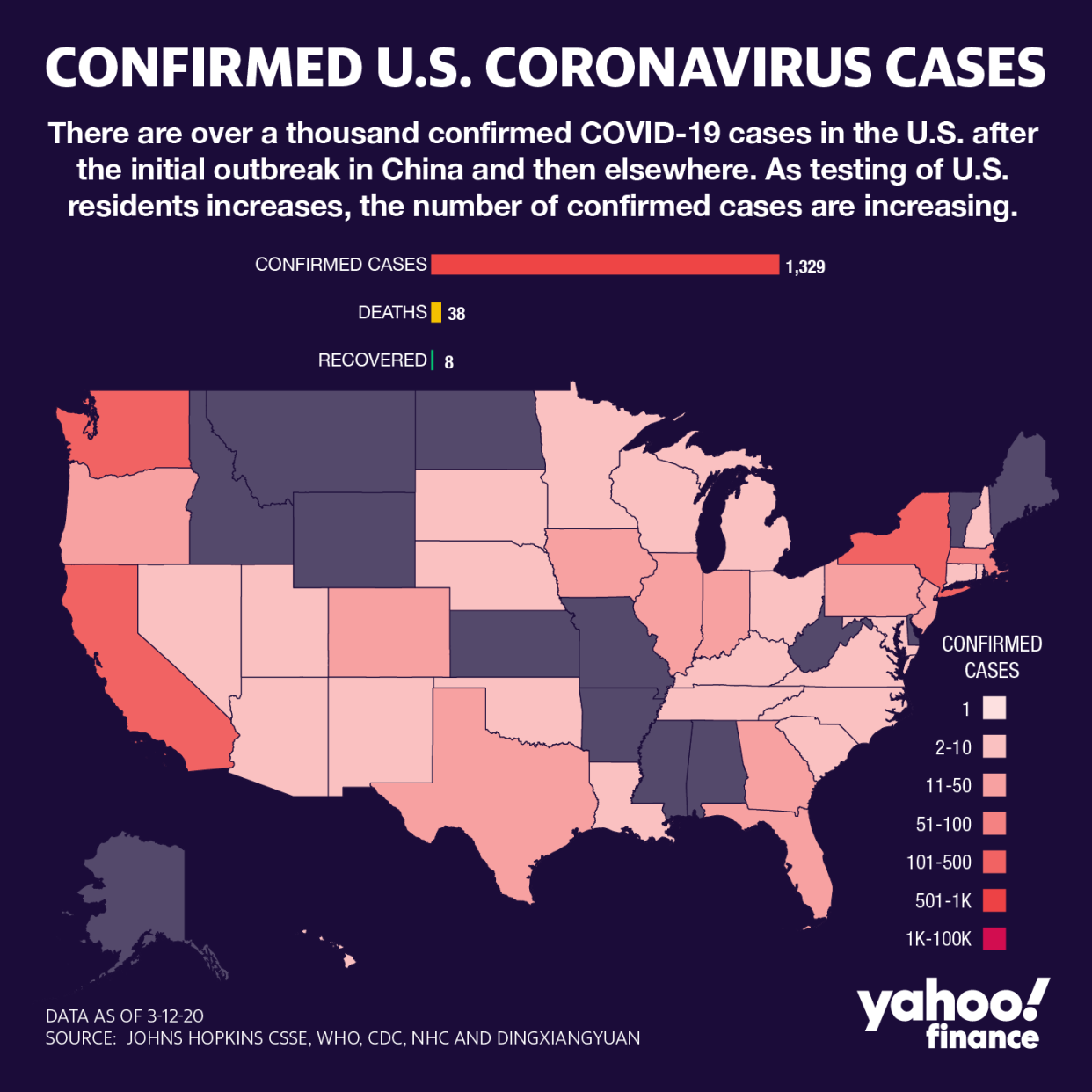

For example, perhaps you define an impacted individual as someone living in a state with a confirmed coronavirus case? At this point, there are almost no states left that do not fit that description.

“I don't think there's a good way of sort of creating rules that carve out taxpayers very precisely,” says Seth Hanlon, a senior fellow at the Center for American Progress, who advocates for extending the deadline for everyone. “I don't know why you'd draw lines.”

Language in the Internal Revenue code says that “the Secretary may grant a reasonable extension of time” for filing a return and “no such extension shall be for more than 6 months.” The question is how that rule will be applied to the U.S. population and how many will be granted extensions.

“Perversely, what that could do actually is delay people who are claiming refunds from getting those refunds,” says Gleckman. “That could not only hurt them personally, but it actually could reduce consumption, which is exactly the opposite of what Trump wants.”

Concerns about the IRS amid an ongoing outbreak

The coronavirus has already hit Washington’s bureaucracy. The SEC has asked its D.C. workers to telecommute after a coronavirus scare. The IRS has not reported any similar exposure, but such news in the day ahead could hit the agency especially hard as it enters the crucial tax deadline month.

A group of Democratic lawmakers recently sent the IRS a letter to outline their concerns “about the ability of the IRS to provide taxpayer assistance and process returns” given the impact of coronavirus.

The agency has not responded publicly to the letter and didn’t respond to requests from Yahoo Finance for comment on how it’s preparing if a need arises to process tax returns remotely.

According to IRS data through last week, the agency received 0.4% more tax returns than at a similar point in 2019, but it has processed 1.4% fewer refunds.

The IRS has also been plagued by understaffing issues for years that could become a factor in an emergency response. As Hanlon notes, "the funding crisis and the brain drain at the IRS predates the Trump administration."

Hanlon takes a wider view and wonders if the entire system – including tax preparers – will be able to handle the strain if there are widespread self-quarantines in the weeks ahead. “People do file electronically, but there's too many things that need to be done physically,” he says.

There might be security concerns if the system needed to change in a hurry. “You're always going to be worried about identity theft, taxpayer identity theft,” Bruckner says. ”It's not as easy as being able to move everything immediately online.”

A possibly bumpy ride ahead

The next few weeks or months may be difficult for taxpayers as they navigate their Form 1040 alongside a public health crisis, but experts expressed optimism that the system can hold together.

“What you want to think about is whether or not you're one of the majority of people who are going to actually be getting a refund this year,” says Bruckner. If so, “that refund check could be a way that you can stabilize your finances as we move forward through this crisis.”

“I think for now, it's okay,” says Gleckman, before adding a major caveat about the weeks ahead. “As long as we don’t turn into Italy,” he says, “we should be able to handle this filing season fine.”

Ben Werschkul is a producer for Yahoo Finance in Washington, DC.

Read more:

Former Obama official on coronavirus: 'Both the president and Congress are utterly failing'

Coronavirus response: Why Democrats are ‘lukewarm’ on the idea of a payroll tax cut

Coronavirus response: Breaking down the $8.3 billion emergency spending bill Trump signed

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.