There's a hidden cost to your big tax refund

Getting a big fat check from Uncle Sam probably seems like a win. After working hard all year and diligently completing your tax return, a major windfall in the form of a refund feels like a reward. Unfortunately, it’s not.

The truth is that a tax refund is simply your own money, which you earned throughout the year, being paid back because you had too much tax taken out of your paychecks. Even though you worked all year to earn the money, you didn’t actually have access to it until the following April.

It might not seem like a big deal to get a tax refund. In a way, it’s like a forced savings account, which could be a good thing for people who aren’t great at consistently saving throughout the year. The problem? That “savings account” doesn’t earn any interest and you can’t withdraw from it if you need the money for something more important.

That’s a concept that personal finance site SmartAsset sought to explain with a new study highlighting tax refunds and their hidden costs. Getting a big refund in April isn’t so great after all.

RELATED: Take a look at these super simple ways to lower your tax bill:

How Tax Refunds Cost You Money Over Time

“Tax time is a time when people are generally very excited to get a refund, and sometimes, unhappy to be paying taxes,” said AJ Smith, vice president of financial education at SmartAsset. “If you’re getting a refund in 2020, it means that throughout 2019, too much money was taken out of your paycheck by the government and now you’re getting that money back. You essentially gave the government an interest-free loan.”

Smith said her team wanted to show what that really could mean if you took intentional action with that money throughout the year instead of getting a refund later.

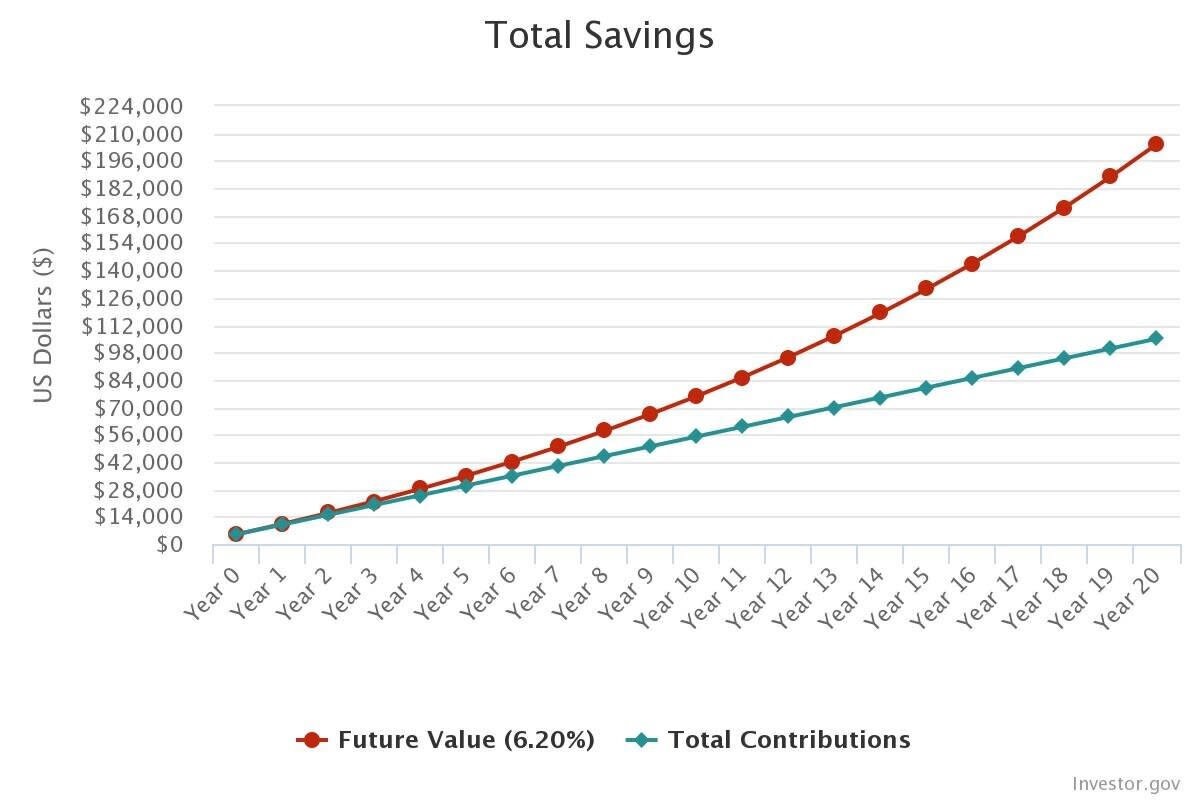

As you can see below, waiting to receive your refund in April might mean missing out on savings or investment interest, or paying more interest on debt, depending on how you’d choose to use the funds if you received them in your paycheck instead.

To calculate the cost of getting a tax refund, SmartAsset assumed that the refund would otherwise be spread out evenly across the year (i.e., one-twelfth of the tax refund was received at the end of January, one-twelfth was received at the end of February and so on). Additionally, they assumed that the taxpayer received the refund on April 15, though some people may actually get their refunds earlier or later.

Losing out on $12 in savings account interest, as one example shows, probably won’t wreck your finances. But consider how impactful losing out on a year of investment returns can be ― especially because that money will continue to compound over the years.

For instance, according to SmartAsset’s analysis, receiving a $5,000 tax refund instead of getting that money in your paycheck and investing it in the market could cause you to lose out on $502 in returns. That’s nothing to sneeze at. But let’s say you’ve been happily getting your $5,000 refund for 20 years. If you had been investing it throughout the year each year instead, plus reinvesting the returns, you’ve missed out on making $204,585 ― about double the total amount you’ve been taking home in a cash tax return.

“You do benefit when you do that from compound interest. That’s the money that your money makes then making more money,” Smith said. “And so you’re losing out on that opportunity, even if you are really great and take that whole refund and put it towards your goal of ... saving or investing.”

What if you chose to pay off debt instead? According to the study, using that same $5,000 to pay down credit card debt throughout the year instead could save you $595 in interest. “It means that was interest you were paying throughout the year, on something that you eventually paid off, that you could have paid off throughout the year and saved yourself that money,” Smith said.

How To Adjust Your Tax Withholding

So how do you ensure that rather than receiving a refund (or owing money) at tax time, you break even?

Whenever you start a job, you fill out a W-4 form to determine how much tax should be withheld from your paycheck by your employer. You can update this form at any time for the upcoming tax year, if desired. In fact, you should update your W-4 if you experience any major life changes such as getting married or having a child.

Just be aware that, along with the many other recent updates to our tax code, the way W-4s work also changed. It no longer has you claim “allowances,” which were tied to personal exemptions ― money that could be deducted from your taxable income for you and any dependents. Exemptions were eliminated as part of the 2017 Tax Cuts And Jobs Act, so the W-4 was updated to reflect this big change.

Now, the new W-4 for 2020 is completed by answering a few personal questions about you and your spouse’s job, dependents and other adjustments. Your employer will update your W-4 for this year based on last year’s information, but it’s not a bad idea to double-check that the info is correct. If your W-4 is completed accurately for 2020, you should end up having roughly the correct amount of taxes withheld from each paycheck.

Note that certain people, especially lower-income taxpayers, will still end up getting a refund thanks to tax credits. But that’s extra money awarded to them by the government and not earnings withheld from their paychecks.

The Bottom Line

“Personal finance is personal,” Smith said. “And if you’re someone who is really great at getting that $3,000 and doing something really smart and intentional with it ― you’re able to put that money to good use ― that’s great.” However, she said the point is that many people might think of their refund as found money they can use to treat themselves, when it’s really just part of their wages.

“It’s really important to make sure that you’re the active party when it comes to your money and that you’re intentional about what you’re doing, and that it matches up with your values and your goals. That can be a really powerful thing,” Smith said.

This article originally appeared on HuffPost.