Elizabeth Warren unveils wealth tax calculator for 'confused' billionaires

Presidential candidate Elizabeth Warren (D-MA) hasn’t been shy about her desire to impose a tax on the wealthy.

The Massachusetts senator exchanged Tweets with billionaire Microsoft (MSFT) co-founder Bill Gates after he spoke out against her wealth tax. Now Warren has revealed just how much he would pay under her wealth tax plan — and how much other well-known, high-wealth figures would pay as well.

Some billionaires seem confused about how much they would pay under my #TwoCentWealthTax. Don’t worry, we've got a calculator for that, too.

The bottom line: If you made it big, you should chip in to make sure everyone else also has a chance to succeed: https://t.co/6UMSAf90NT— Elizabeth Warren (@ewarren) November 7, 2019

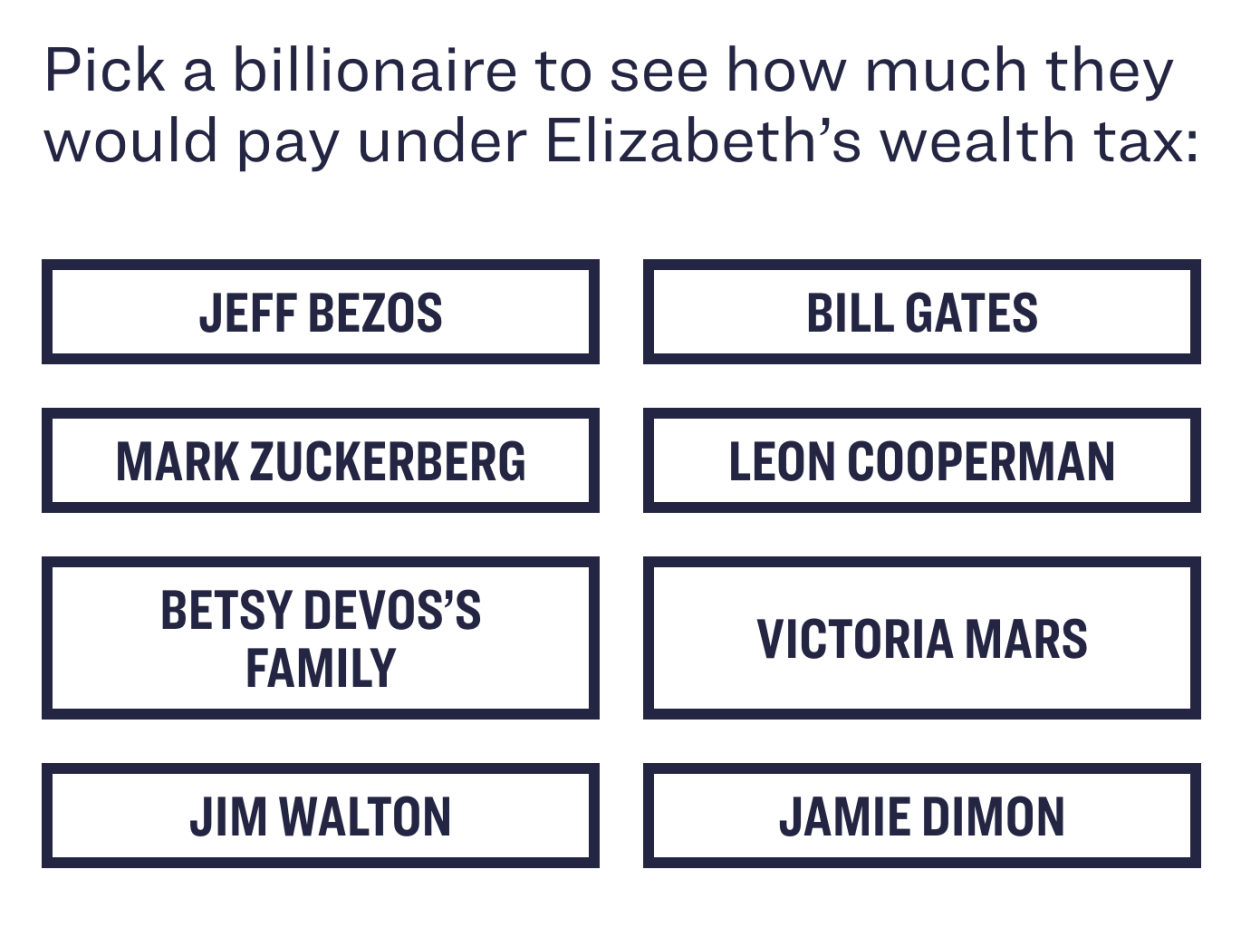

Her website created a Calculator for the Billionaires and features sections for various figures at the top of the income bracket, including Amazon (AMZN) CEO Jeff Bezos, Facebook (FB) CEO Mark Zuckerberg, Gates, JPMorgan Chase (JPM) CEO Jamie Dimon, and even Education Secretary Betsy DeVos’ family. Individuals who identify as billionaires can also enter in their respective incomes to find out how much they’d pay.

‘Don’t worry too much about Bill Gates’

The Warren wealth tax plan would impose an annual tax of 2% on every dollar a household has above $50 million, which increases to 6% for households with more than $1 billion. Under this plan, Gates, who has a net worth of approximately $107 billion, would pay $6.4 billion in taxes.

“Don’t worry too much about Bill Gates,” Warren’s website stated. “If history is any guide, if billionaires do nothing other than invest their wealth in the stock market, it’s likely that their wealth will continue to grow.”

And although Amazon paid $0 in federal taxes last year, its CEO, Jeff Bezos would have to pay $6.7 billion under this plan.

Meanwhile, Dimon, another vocal critic of Warren’s wealth tax, would pay $55 million based on his net worth of $1.6 billion. Betsy DeVos’s family would be taxed a whopping $283 million for their collective net worth of $5.4 billion.

Warren has repeatedly emphasized that the revenue generated from her wealth tax would go towards programs she hopes to fund, like Medicare for All and expanded Social Security. The idea has garnered the support of other politicians, like Sen. Bernie Sanders (I-VT) and Rep. Alexandria Ocasio-Cortez (D-NY).

Experts project that Warren’s wealth tax would generate $2.75 trillion in revenue over a 10-year period.

‘My friends and I have been coddled long enough’

There appears to be growing support for a wealth tax from the public — a Politico/Morning Consult poll from earlier this year indicated that 76% of registered voters believe wealthy Americans should pay more taxes. Additionally, a Fox News survey revealed that 70% of Americans, including 54% of Republicans, are in support of raising taxes on those who earn more than $10 million.

“Consider two people: an heir with $500 million in yachts, jewelry, and fine art, and a teacher with no savings in the bank,” Warren said in her plan. “If both the heir and the teacher bring home $50,000 in labor income next year, they would pay the same amount in federal taxes, despite their vastly different circumstances. Increasing income taxes won’t address this problem.”

Yet, many billionaires have come out against Warren’s plan, including Dimon, Gates, Mark Cuban, and Leon Cooperman.

One notable billionaire — Warren Buffett — has voiced support for a sort of wealth tax in the past.

“My friends and I have been coddled long enough by a billionaire-friendly Congress,” he wrote in a 2011 op-ed for the New York Times. “It’s time for our government to get serious about shared sacrifice.”

Adriana is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

Why rich Americans believe they pay enough taxes, in 2 charts

AOC: 'Y’all, the billionaires are asking for a safe space'

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.