Oil tycoon T. Boone Pickens dead at 91

T. Boone Pickens, the billionaire tycoon who made his fortune in fossil fuels — only to spend his latter years advocating passionately for alternative energy — died on Wednesday, his office confirmed. He was 91.

Pickens, who began his career in oil and gas, became a titan of his industry, and helped to pioneer shareholder activism in the 1980s. Yet his thinking eventually evolved in a way that led him to embrace wind, solar, and other forms of natural energy to chip away at the dominance of fossil fuels.

Pickens actually didn’t become a billionaire until after age 70. During a TV appearance, he was asked at what point he felt like he had made it.

To that, he responded: “When I realized I had 12 bird dogs.”

He later elaborated in a blog post: “OK, it was a little tongue in cheek. But I’ve always felt that to be wealthy is to have an abundance of something you really love. And for me that something would be bird dogs.”

Born on May 22, 1928 to Thomas Boone Pickens and Grace Molonson Pickens, the tycoon was considered a miracle baby. During the long and complicated labor, the doctor told Pickens’ father that he could either save the mother, or the child — but not both.

Pickens’ father urged the doctor to try a Caesarean section using a one-and-a-half page description in a medical textbook. Pickens was the first baby successfully delivered by C-section in Holdenville, a small railroad town in eastern Oklahoma.

An entrepreneur from an early age

Raised during the Great Depression, Pickens was an entrepreneur from a young age, mowing lawns and taking up a paper route at the age of 12 that expanded from the smallest in his hometown to the largest.

“It was my first experience in the takeover field: expansion by acquisition,” he wrote in his book, “The First Billion Is The Hardest.”

In high school, the Pickens family relocated to Amarillo, Texas. After graduation, Pickens went to Texas A&M on a basketball scholarship. After losing his scholarship, he transferred to Oklahoma A&M, now known as Oklahoma State University. He graduated in 1951 with a degree in geology, and never stopped being a die-hard booster for OSU sports.

Pickens began his career at Phillips Petroleum as a geologist. After more than three years, he struck out on his own as an independent geologist in the Texas Panhandle.

Two years later, in 1957, he would build an oil and gas company that eventually became Mesa Petroleum — a company he took public and led for four decades. After leaving Mesa in 1996, he started a commodities hedge fund, BP Capital, at age 68.

Pickens transitioned BP Capital into a family-office in December 2017. Shortly after, his legacy in the energy space continued as the NYSE Pickens Oil Response ETF (BOON), though it was not managed by him. The BOON ETF recently moved away from fossil fuels into renewables.

Pickens was among the big activist shareholders of the 1980s. Among his famous deals and attempted deals were Cities Service, Gulf Oil, and Unocal.

In 1986, he formed the United Shareholders Association, a lobbying organization for shareholders. During a speech at the Economic Club of Detroit in 1988, he highlighted a "transformation of Corporate America" that "focused on results, not size" and one that would "create value, not empires."

"It seemed like no matter how poorly management performed, there was nothing shareholders could do about that," he said, noting that it was "slowly starting to change" and "large shareholders are making a difference" by forcing restructuring, including takeovers, LBOs, and selling off unproductive units.

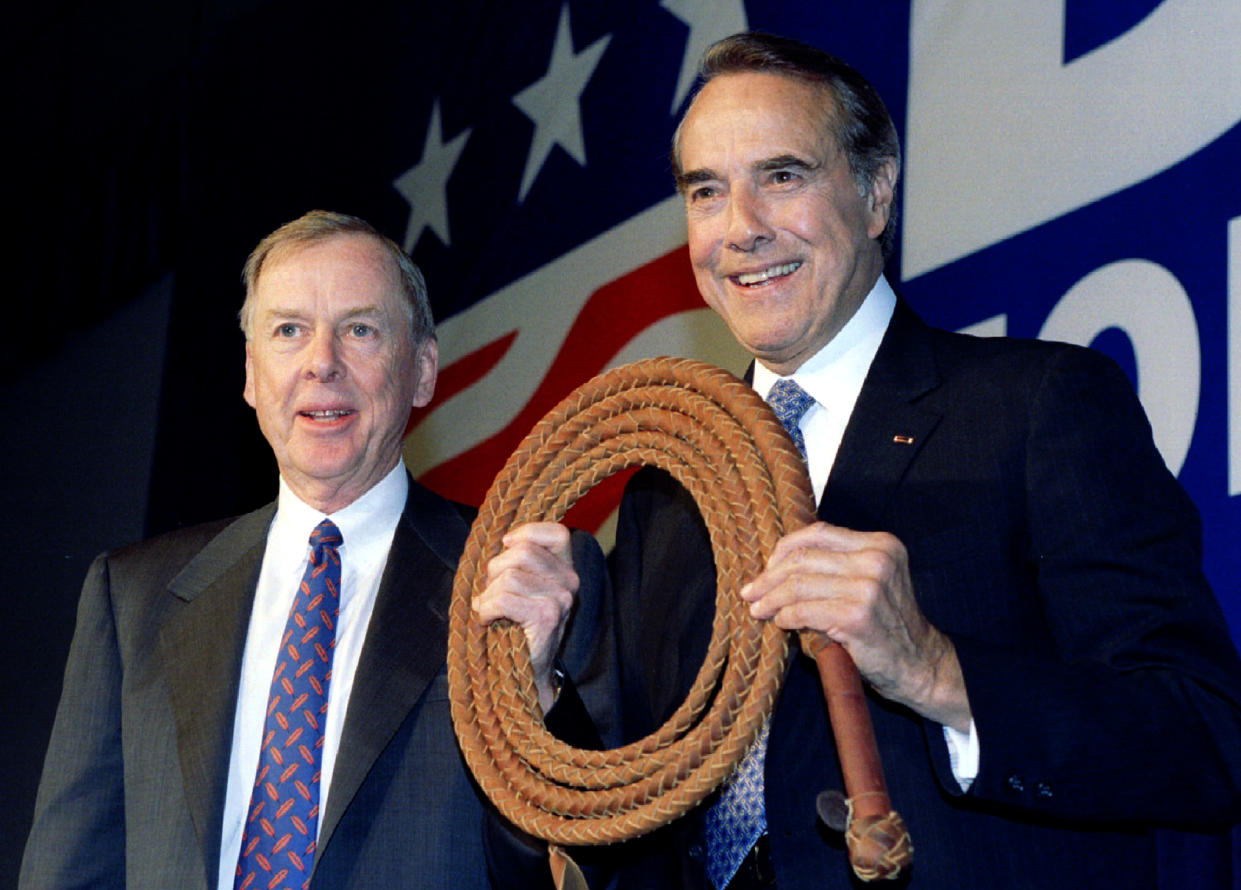

He was also politically active, having donated to Republican candidates over the years. Naturally, energy policy was his biggest focus.

In 2008, he authored The Pickens Plan, a self-funded $100 million grassroots campaign that outlined steps for the U.S. to reduce the reliance on foreign oil by using natural gas and other American resources. The crux of the plan is to get heavy-duty trucks to switch to natural gas, which is cheaper and emits less carbon dioxide than oil. Pickens maintained that the United States’ reliance on foreign energy was the "greatest transfer of wealth in human history."

‘Not a big fan of inherited wealth’

In his philanthropic endeavors, Pickens remained a devoted fan of the Oklahoma State Cowboys and was a huge backer of the school’s athletics and academics having given $652 million over the years.

In 2009, Oklahoma State named and dedicated a newly renovated football stadium after Pickens. In an August 2019 letter to OSU fans, he outlined his approach to charity.

“I have a unique approach to giving. While many others of my status endow foundations that spin out millions of dollars over the course of generations, I want to see the good that’s done with my money today, while I’m alive, and not wonder what is done with it long after I’m gone,” the billionaire said.

This year, he was unable to make the season’s opening game. One of his last wishes was to win another Big 12 football championship.

Pickens also had a penchant for clever one-liners known as “Booneisms.” These were phrases, such as: "Don't rush the monkey and you'll see a better show" and “a plan without action is not a plan. It’s a speech.”

He even shared his wit on Twitter. In 2012, Canadian rapper Drake Tweeted, “The First Million Is The Hardest.” To that, Pickens replied, “The first billion is a helluva lot harder.”

One of Pickens’ loves was spending time at his 100-square-mile Mesa Vista Ranch in the Texas Panhandle. The property is currently listed for sale for $250 million.

A long-time fixture on the Forbes’ billionaires list, he fell off the ranking in 2014. However, he gave away more than $1 billion during his lifetime.

He also signed The Giving Pledge, an initiative started by Bill Gates and Warren Buffett, where the wealthiest agree to give more than half of their net-worth away to philanthropic causes when they die.

“I’ve long stated that I enjoy making money, and I enjoy giving it away. I like making money more, but giving it away is a close second,” Pickens wrote at the time of signing the promise.

He added that he was anticipating “the day I hit the $1 billion mark. I’m not a big fan of inherited wealth. It generally does more harm than good.”

One of the greatest influences in his life was his grandmother Nellie Molonson, who taught him many life lessons.

In his book, he told a story about how he found a man’s wallet while on his paper route. Upon returning it, he received a dollar as a reward. He ran home to tell his grandmother, mother, and aunt about his good deed.

But to his surprise and over his protests, his grandmother forced him to return the dollar. She told him he wasn’t going to be paid for honesty.

On his way back from returning the dollar to the man, he got caught in a downpour. His aunt told him that if he didn’t argue he would be home and dry.

Pickens is survived by five children, 11 grandchildren, and eight great-grandchildren.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.