A JPMorgan bot analyzed 14,000 Trump tweets and found they're having an increasingly sharp impact on markets

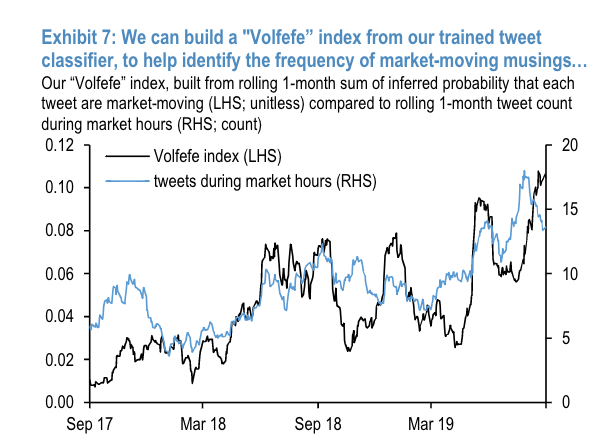

JPMorgan's new "Volfefe" index tracks the impact of Trump's tweets on markets.

"We can train a classifier to infer how likely each tweet is to move markets," JPMorgan said in a note to clients.

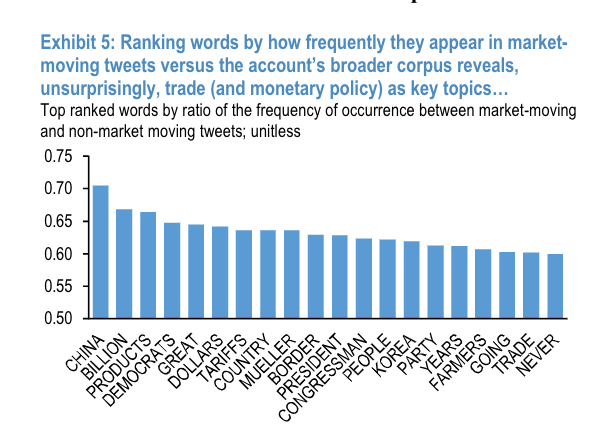

Certain words had more of an effect on markets, including China, trade, and Mueller.

"A broad swath of assets from single-name stocks to macro products have found their price dynamics increasingly beholden to a handful of tweets from the commander in chief."

JPMorgan created a tracker to monitor the impact of Trump's tweets on markets, and the bank said it found "strong evidence" that the president's tweets "increasingly moved US rates markets immediately after publication."

The "Volfefe Index" created by the bank analyzed more than 10,000 of Trump's tweets since he took office, with the aim of measuring their impact on rates volatility. The bank found "the effect of tweets on the market is a real one."

"We find strong evidence that tweets have increasingly moved US rates markets immediately after publication," JPMorgan said in a note dated September 6.

RELATED: Take a look at the New York Stock Exchange before the election:

While the bot's "utility in scoring any given tweet is somewhat limited," the bank said the findings allow it to "construct statistical aggregates — a Twitter-vol index — with which to monitor and quantify shifts in the market environment."

"We can use this dataset to perform a supervised machine learning exercise — specifically we can train a classifier to infer how likely each tweet is to move markets," the bank said.

The bank found Trump had been increasingly tweeting about "market-moving topics," mainly in trade and monetary policy.

As a result, JPMorgan said: "A broad swath of assets from single-name stocks to macro products have found their price dynamics increasingly beholden to a handful of tweets from the commander in chief."

JPMorgan also said that Trump has been averaging more than 10 tweets a day, which came to roughly 14,00 tweets since taking office.

JPMorgan

But it said that the president since late 2018, which also happens to be in line with the trade war escalating, has been upping the number of tweets each day. The bank said: "Market moving tweets' have ballooned in frequency this August."

JPMorgan also noted that his "market-moving" tweets were less popular in terms of likes or retweets, but also they tended to contain the same keywords: China, billions, dollar, tariffs and trade. The bank also said that tweets containing Mueller were categorized as market moving.

"We can move toward a rough estimate of how much these market-moving tweets have pushed up volatility pricing in the swaptions market," JPMorgan said. "This index can explain a measurable fraction of moves in implieds, particularly in shorter tails (2-year rates, and 5-year rates, as opposed to 10-year rates)."

The index could also be applied to currency and equity markets, JPMorgan said.

Recently, Trump was accused of attempting to move stock markets. Trump has also consistently ripped into Jerome Powell and the Federal Reserve to push for lower interest rates.

JPMorgan

NOW WATCH: The US women's national team dominates soccer, but here's why the US men's team sucks

More from Business Insider:

The best photos from every single year of Prince Harry's remarkable life

Here's everyone who's running for president in 2020, and who has quit the race

Costco sells millions of pumpkin pies every year — and the recipe has apparently been the same since 1987