‘Enough is enough’: Warren officially introduces bill to cancel student debt

Senator Elizabeth Warren (D-MA) is tripling down on combating student debt.

In an announcement today along with House Majority Whip James E. Clyburn (D-SC), the presidential candidate announced the “Student Loan Debt Relief Act of 2019.”

Warren first pitched a student debt plan as a presidential candidate in April, and then started discussing the upcoming legislation in June.

Taken together, Warren’s plans attack student debt in three ways: Cancelling debt, reforming the predatory — or “lousy” — student loan system that’s in place, and making college free for all.

“I was shocked when I woke up one morning … and saw that student loan debt had eclipsed credit card debt,” Rep. Clyburn said at a press conference to unveil the legislation. “This may be depressing to current holders of this debt. But when you think about a college graduate going out to start a career and a family, the impact of student loan debt goes far beyond that generation.”

The duo hopes that this would “end the student debt crisis,” on top of helping “millions of struggling families obtain financial stability” and closing the “racial wealth gap.” The move comes a day after Warren published a dire warning that the economy was in danger of collapsing.

What the plan says

There’s more than a trillion dollars in outstanding student loans, affecting millions of Americans. Warren and Clyburn’s plan proposes a number of actions that would uniformly ease the financial pressure.

First they want to cancel up to $50,000 on student debt for people who earn a household income of less than $100,000. She also proposes automatic cancellation for these individuals.

This has been a contentious point, as with government debt to GDP projected to go up to 144% by 2049, such a measure could really hurt the U.S. economy.

“My very first bill when I got to the Senate was legislation to tackle the growing student debt crisis because I was sick of Washington allowing the wealthy to pay less, while burying tens of millions of Americans in mountains of student loan debt,” Warren said in the press release. “Since then, Washington has only allowed this crisis to get worse—especially for people of color. Enough is enough.”

The new bill also aims to allow private borrowers to convert their private student loans into federal student loans through refinancing, allowing them to be eligible for debt cancellation.

This would make a difference especially for those who go to for-profit colleges and take on heavy debt loads to finance that education.

The duo also wants to make sure canceled debt is not taxable income and allow a yearlong freeze on loan payments that borrowers make. Warren and Clyburn would do away with wage garnishments by Department of Education on troubled loans and interest that’s accumulated on student loans while debt cancellation is being implemented. They also want to allow borrowers to automatically refinance remaining federal student debt to interest rates specified in another one of Warren’s bills, Bank on Student Emergency Loan Refinancing Act.

Lastly, they also want to allow student loan borrowers to discharge their loans in bankruptcy, such as the Student Borrower Bankruptcy Relief Act of 2019.

States taking matters into their own hands

The student debt crisis hasn’t affected all Americans the same.

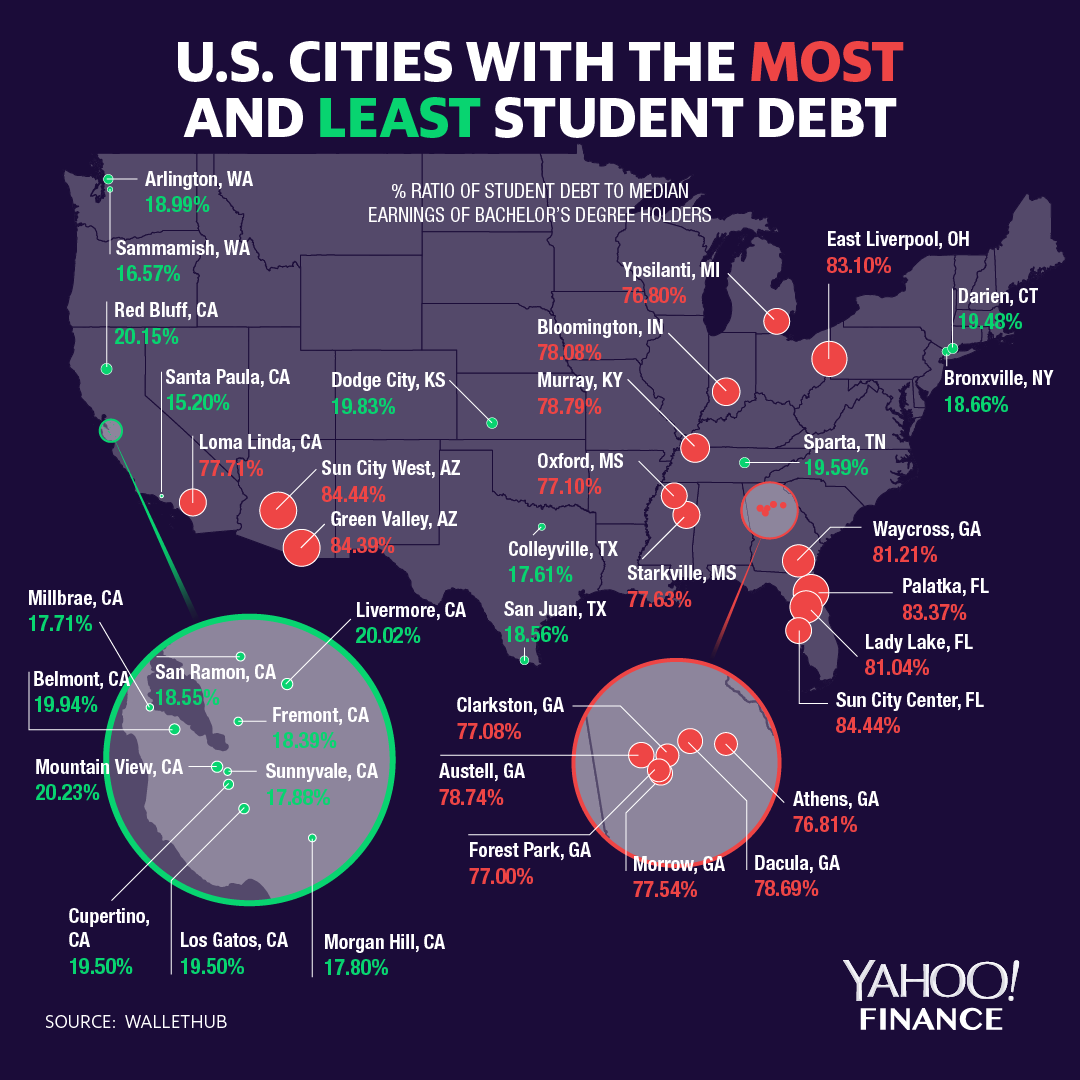

According to a study by WalletHub, borrowers in the South are feeling the pain more than most. Thirteen of the 20 cities with the worst debt-to-earnings ratio were in the South (i.e., south of the Mason-Dixon line and east of the Mississippi River). On the other end of the spectrum, 10 of the top 20 cities with the best debt-to-earnings ratio were in California.

Responding to the student debt crisis, states like California and Maine have taken legislative action to protect borrowers and hold student loan servicers accountable.

—

Aarthi is a writer for Yahoo Finance. Follow her on Twitter @aarthiswami.

Read more:

Presidential candidate Pete Buttigieg: ‘I have six-figure student debt’

Bernie Sanders unveils sweeping student debt cancellation plan

Household debt hits $13.6 trillion as student loan and credit card delinquencies rise

Elizabeth Warren unveils 'broad cancellation plan' for student debt

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews,LinkedIn, YouTube, and reddit.