Warren Buffett and Charlie Munger defend Wells Fargo's disgraced CEOs

Berkshire Hathaway (BRK-A, BRK-B) Chairman and CEO Warren Buffett and Vice Chairman Charlie Munger were asked about Wells Fargo’s (WFC) fake bank account scandal at the 2019 Berkshire Hathaway Annual Shareholders Meeting on Saturday in Omaha, Nebraska.

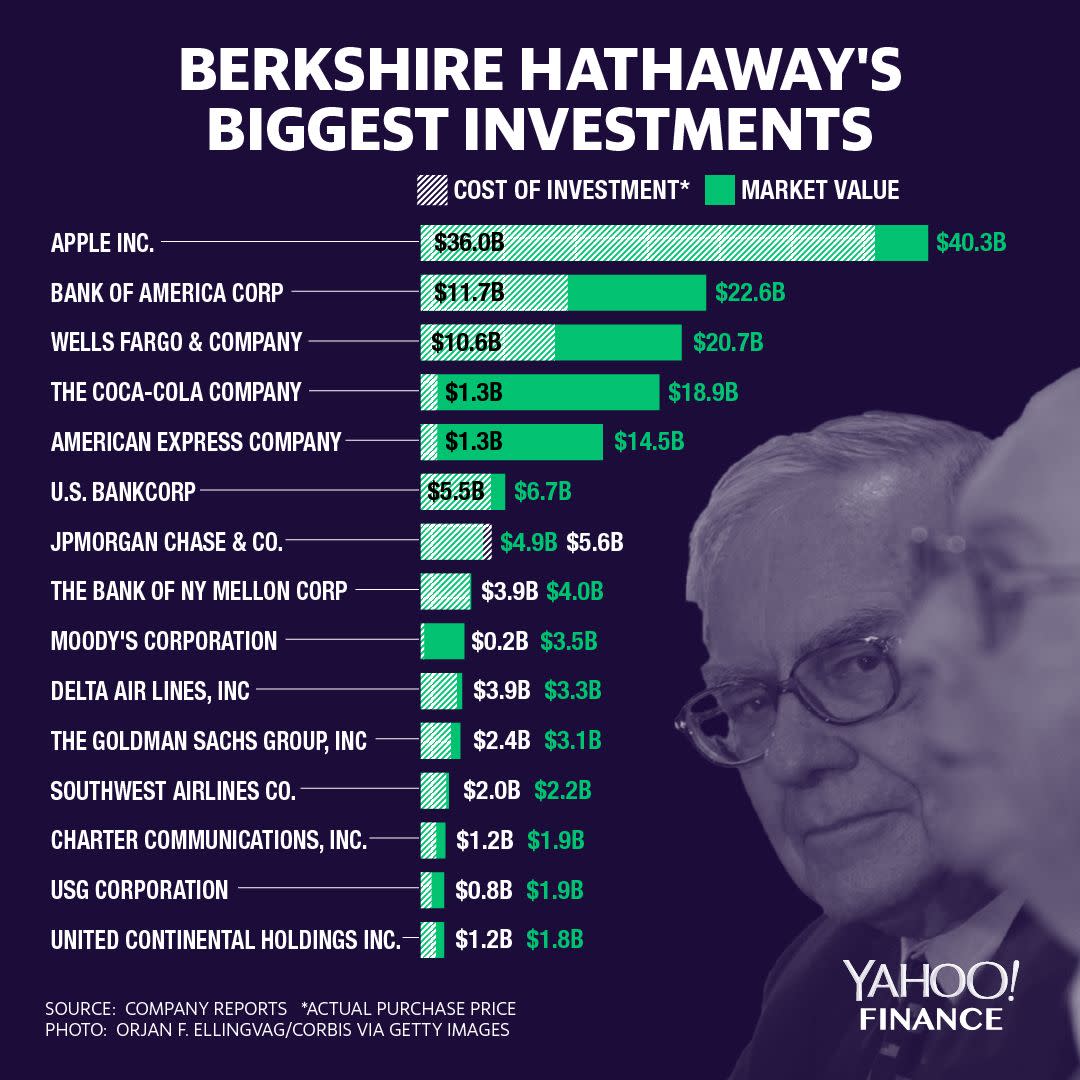

Berkshire Hathaway owns a stake in Wells Fargo of roughly 9%.

“It looks to me like Wells made some big mistakes in what they incentivized,” Buffett said. “I’ve seen that [at] a lot of places. That clearly existed at Wells. To the extent that they set up fake accounts, a couple of million of them that had no balance in them, that could not possibly have been profitable to Wells.”

[Click here for coverage of the 2019 Berkshire Hathaway Shareholders Meeting.]

The fake bank account woes led to the departure of CEO John Stumpf in 2016 and more recently Tim Sloan in 2019, who took over for Stumpf.

“I don’t think people ought to go to jail for honest errors of judgement. It’s bad enough to lose your job,” Munger said. “I wish Tim Sloan was still there.”

Buffett also pointed out that the scandal affects shareholders.

“If we own 9% of Wells, 9% of this is being borne by us,” he noted.

Wells Fargo shares are up 5.6% year-to-date, but are down 5.6% over the past 12 months. The broader financials sector is up 17.8% year-to-date and up 4.3% year-over-year.

—

Scott Gamm is a reporter at Yahoo Finance. Follow him on Twitter @ScottGamm.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

More from Scott:

Billionaire Ken Fisher: Why the stock market likely has more room to run

Warren Buffett: 'Something different' is happening in the economy right now

The market is starting to overreact to very specific economic data points

2019 may be the year of tariffs against European auto imports