The most serious tech problems taxpayers can expect with the IRS as they file

If the process of filing your taxes this year has left you in a jam, you are not alone. From shutdown delays, tax law changes, and outrage over lower expected refunds affecting millions of Americans, confusion and frustration is at a peak as we head to the April 15 deadline.

National Taxpayer Advocate Nina Olson is your ear at the IRS—the Office of the Taxpayer Advocate is a government office dedicated to helping taxpayers solve their problems with the IRS. In her Annual Report to Congress, Olson highlighted 20 major problems with the IRS plaguing taxpayers this year. At the top of the list was the taxpayers’ ability to get answers to their tax law questions.

“My staff would call in with basic questions, questions where the law hadn't changed at all,” Olson says. But “we got very few right answers.”

Adding to the confusion and frustration is people’s inability to get in touch with a human being, Olson said. While the IRS reports an 86% level of service for callers, Olson says they found only a quarter of the calls are getting through to someone on the other end of the line.

“To me it's a math problem, where you have to say to Congress, the IRS just needs more people,” Olson says. “We need more employees answering those calls.”

While the IRS is currently testing a new call-back feature, the agency’s antiquated IT systems are causing major headaches and need an overhaul, Olson says.

“The IRS has two core systems but they were designed in the 1960s [and] are the oldest databases in the federal government,” Olson says. Taxpayer information is stored on 60 different IT programs as newer systems are updated. This causes a tremendous amount of confusion for the IRS and taxpayers, Olson says.

“You’ll call the IRS and say, ‘I sent you a payment,’ and they’ll say, ‘We can see that you sent us something but the payment isn’t showing up yet,’” Olson says. “You see that confusion and it creates work for the IRS, and we can’t keep going like that.”

Because taxpayer information is stored in so many different places, there is a concern of hacking and identity theft. Olson says the IRS fields millions of hack attempts per day, and while its security systems are good, ID theft is rampant and more difficult to monitor, she says.

“Where there are risks for taxpayers is that an identity thief can appear almost identical to the taxpayer—they can prepare a return that looks identical to a legitimate return and how is [the IRS] supposed to know?” Olson says. “The IRS has tried to work very hard with preparers and payroll companies to really be careful about not falling for these scams.”

Additionally, scammers are posing as IRS agents, and calling taxpayers, saying if they don’t pay immediately, they’ll be sent to jail. If you get one of these calls, don’t fall for it, however rattling it may be.

“The IRS doesn’t call you up and say we’re going to put you in jail,” Olson says. “It’s rare we would be calling someone and it would always be preceded by letters and appointments first, so don’t fall for that.”

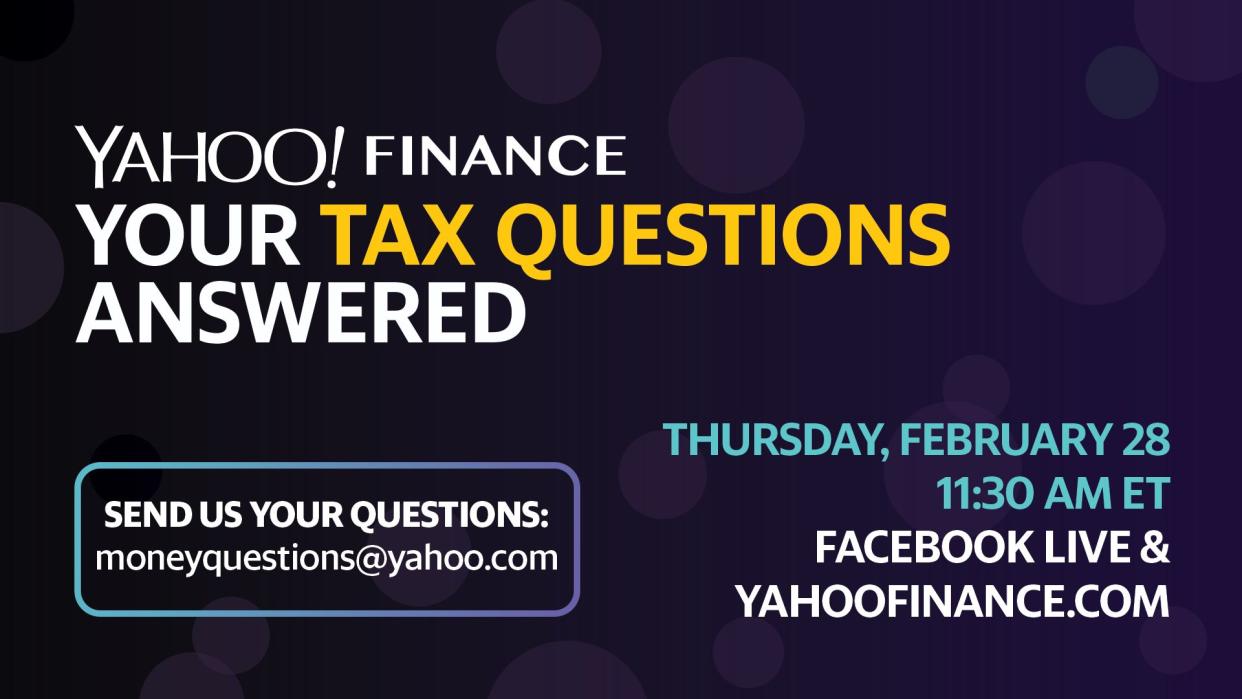

If you have a tax question, tune in Thursday for a Yahoo FInance Live Tax Q&A. A panel of experts will be answering your questions, starting at 11:30 AM ET on yahoofinance.com and Facebook.

WATCH MORE